ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes 2021

What is the ST389 INSTRUCTIONSST389 I RevThes

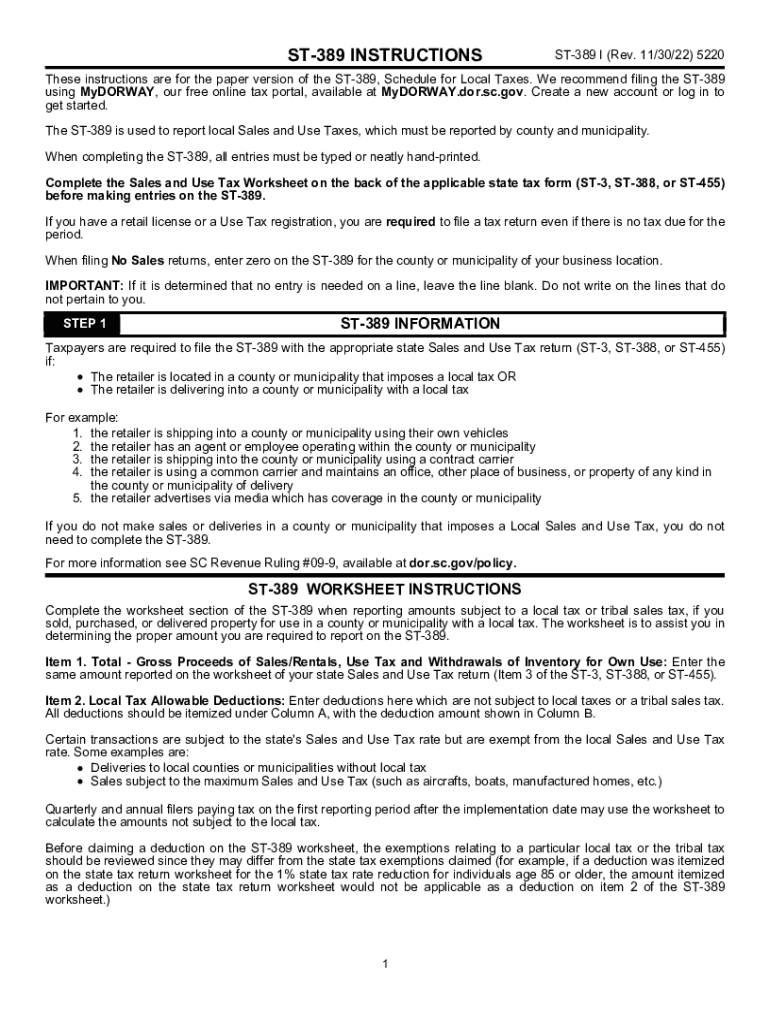

The ST389 INSTRUCTIONSST389 I RevThes is a specific form utilized for various administrative purposes. This form is primarily designed to provide detailed instructions on how to fill out and submit related documentation accurately. It serves as a guide for individuals and businesses to ensure compliance with regulatory requirements. Understanding this form is crucial for effective documentation and adherence to legal standards.

How to use the ST389 INSTRUCTIONSST389 I RevThes

Using the ST389 INSTRUCTIONSST389 I RevThes involves several steps to ensure proper completion. First, review the instructions thoroughly to understand each section's requirements. Gather all necessary information and documents that will be needed for filling out the form. Follow the guidelines closely, ensuring that all fields are completed accurately to avoid delays or complications in processing.

Steps to complete the ST389 INSTRUCTIONSST389 I RevThes

Completing the ST389 INSTRUCTIONSST389 I RevThes requires careful attention to detail. Start by downloading the form from the appropriate source. Next, fill in your personal or business information as required. Ensure that you provide accurate data in each section, including any relevant dates and signatures. After completing the form, review it for any errors before submission. Finally, submit the form through the designated method, whether online, by mail, or in person.

Key elements of the ST389 INSTRUCTIONSST389 I RevThes

The key elements of the ST389 INSTRUCTIONSST389 I RevThes include the identification of the applicant, the purpose of the form, and detailed instructions for each section. It also outlines any supporting documents required for submission. Understanding these elements is essential for ensuring that the form is filled out correctly and meets all necessary legal requirements.

Legal use of the ST389 INSTRUCTIONSST389 I RevThes

The legal use of the ST389 INSTRUCTIONSST389 I RevThes is critical for compliance with applicable laws and regulations. This form must be completed accurately to avoid legal repercussions. It is important to ensure that all information provided is truthful and verifiable, as inaccuracies can lead to penalties or delays in processing. Familiarity with the legal implications of this form can help users navigate the requirements effectively.

Required Documents

When completing the ST389 INSTRUCTIONSST389 I RevThes, certain documents may be required to support your application. These typically include identification documents, proof of residency, and any additional paperwork specified in the form instructions. Having these documents ready can streamline the process and ensure that your submission is complete and compliant with all necessary regulations.

Form Submission Methods

The ST389 INSTRUCTIONSST389 I RevThes can be submitted through various methods, depending on the specific requirements outlined in the instructions. Common submission methods include online submission through a designated portal, mailing the completed form to the appropriate address, or delivering it in person to a designated office. Each method may have different processing times and requirements, so it is essential to choose the one that best suits your needs.

Quick guide on how to complete st389 instructionsst389 i rev 113022 5220thes

Complete ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the right form and safely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Manage ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to edit and electronically sign ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes effortlessly

- Find ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form – via email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st389 instructionsst389 i rev 113022 5220thes

Create this form in 5 minutes!

How to create an eSignature for the st389 instructionsst389 i rev 113022 5220thes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes?

The ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes provides users with a comprehensive set of features such as easy document signing, real-time collaboration, and secure storage. It streamlines the eSignature process with customizable templates and automatic reminders, ensuring that you can manage your documents efficiently and effectively.

-

How much does the ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes cost?

The pricing for the ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes is competitively structured to accommodate various business sizes. You can choose from monthly or annual plans that offer flexibility depending on your usage needs, with no hidden fees, making it a cost-effective eSignature solution.

-

Can I integrate the ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes with other applications?

Absolutely! The ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes is designed to integrate seamlessly with a wide range of applications including CRMs, cloud storage services, and productivity tools. This connectivity enhances your workflow and ensures that document management fits seamlessly into your existing systems.

-

What are the benefits of using the ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes for my business?

Using the ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes can signNowly improve your business processes by simplifying document management and reducing turnaround time. The ease of creating, sending, and signing documents not only increases efficiency but also enhances customer satisfaction with faster service delivery.

-

How secure is the ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes?

The ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes prioritizes security by utilizing advanced encryption and compliance with industry norms such as GDPR and HIPAA. All document transactions are securely logged, ensuring that your sensitive information is protected at all times for peace of mind.

-

What types of documents can I manage with the ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes?

With the ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes, you can manage various types of documents including contracts, agreements, and forms. The platform supports numerous formats, allowing you to upload and eSign virtually any document type, making it versatile for different business scenarios.

-

Is customer support available for the ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes?

Yes, customer support for the ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes is readily available through multiple channels including live chat, email, and phone. Our dedicated support team is equipped to assist you with any questions or issues, ensuring you get the most out of your eSignature experience.

Get more for ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes

- Dodea form 08 shsm h 3 9 student retention of medication

- The document you are trying to load requires adobe form

- Mentor prot g agreement med navy form

- Navedtra 43704 form

- Sample appendix for report form

- Frg sign in printable form

- Sof 91 form 36 landandmaritime dla

- Chronological record of hiv testing usa federal forms com

Find out other ST389 INSTRUCTIONSST389 I Rev 113022 5220Thes

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe