St 389 Instructions SC Gov 2020

Understanding the St 389 Instructions

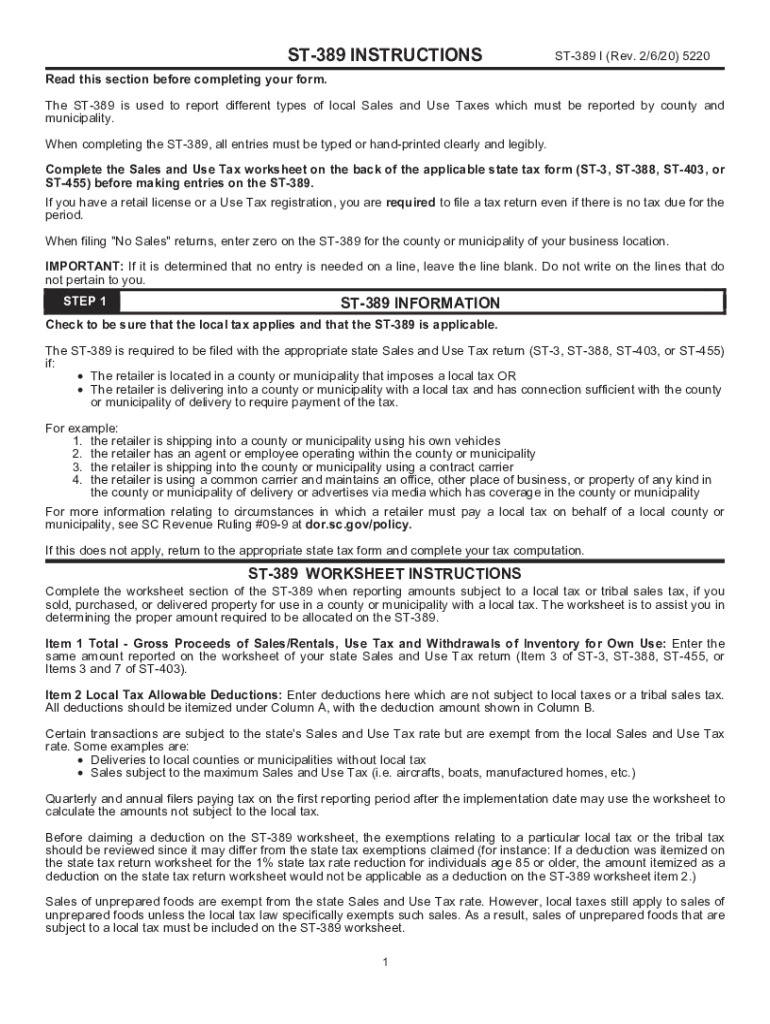

The St 389 form is essential for South Carolina taxpayers, particularly for those involved in sales tax reporting. The instructions for the St 389 provide detailed guidance on how to accurately complete and submit the form. This document outlines the necessary steps, required information, and specific guidelines that ensure compliance with state tax regulations. Familiarizing yourself with these instructions is crucial for avoiding errors that could lead to penalties or delays in processing.

Steps to Complete the St 389 Instructions

Completing the St 389 form involves several key steps that taxpayers should follow to ensure accuracy and compliance. First, gather all necessary documentation, including sales records and tax identification numbers. Next, carefully read through the St 389 instructions to understand the specific requirements for each section of the form. Fill out the form completely, ensuring that all figures are accurate and match your supporting documents. Finally, review the completed form for any errors before submission.

Legal Use of the St 389 Instructions

The St 389 form must be completed in accordance with South Carolina tax law. The legal use of the St 389 instructions ensures that taxpayers fulfill their obligations while maintaining compliance with state regulations. This includes adhering to deadlines, providing accurate information, and understanding the implications of any errors made on the form. Utilizing the St 389 instructions properly helps to avoid legal issues and ensures that all tax responsibilities are met.

Required Documents for the St 389 Form

When preparing to complete the St 389 form, it is essential to have all required documents on hand. These typically include sales records, tax identification numbers, and any previous tax filings that may be relevant. Having these documents readily available streamlines the process of filling out the form and ensures that all information is accurate and complete. This preparation can significantly reduce the likelihood of errors and the need for resubmission.

Form Submission Methods for the St 389

Taxpayers have several options for submitting the St 389 form. The form can be submitted online through the South Carolina Department of Revenue’s website, providing a quick and efficient method for filing. Alternatively, taxpayers may choose to mail the completed form or submit it in person at designated locations. Understanding these submission methods allows taxpayers to select the option that best fits their needs and ensures timely processing of their tax documents.

Filing Deadlines for the St 389 Form

Staying informed about filing deadlines is crucial for compliance with South Carolina tax law. The St 389 form has specific due dates that taxpayers must adhere to in order to avoid penalties. These deadlines may vary based on the taxpayer's filing frequency—monthly, quarterly, or annually. It is important to consult the St 389 instructions or the South Carolina Department of Revenue for the most current deadlines to ensure timely submission.

Quick guide on how to complete st 389 instructions scgov

Effortlessly Prepare St 389 Instructions SC gov on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal sustainable alternative to conventional printed and signed papers, allowing you to locate the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any hurdles. Manage St 389 Instructions SC gov across any platform using the airSlate SignNow applications for Android or iOS and streamline any document-related workflow today.

How to Modify and eSign St 389 Instructions SC gov with Ease

- Locate St 389 Instructions SC gov and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive details using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form navigation, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign St 389 Instructions SC gov and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st 389 instructions scgov

Create this form in 5 minutes!

How to create an eSignature for the st 389 instructions scgov

How to generate an eSignature for a PDF online

How to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is sc st 389 2019?

SC ST 389 2019 refers to a specific standard in document management and electronic signatures. It provides guidelines that ensure the legality and security of electronic signatures, making it easier for businesses to comply with legal requirements. Understanding this standard is crucial for any organization looking to implement effective document workflows.

-

How does airSlate SignNow comply with sc st 389 2019?

AirSlate SignNow complies with SC ST 389 2019 by incorporating robust security measures and adhering to best practices in electronic signature technology. This ensures that all documents signed through our platform meet the requirements of trust and authenticity dictated by the standard. Our commitment to compliance protects businesses and enhances their document management processes.

-

What are the benefits of using airSlate SignNow for SC ST 389 2019 compliance?

Using airSlate SignNow helps businesses achieve SC ST 389 2019 compliance efficiently and cost-effectively. Our platform simplifies the document signing process, reduces turnaround time, and minimizes the risk of manual errors. By streamlining compliance efforts, organizations can focus on their core operations while ensuring legal adherence.

-

What features does airSlate SignNow offer to facilitate adherence to sc st 389 2019?

AirSlate SignNow offers various features that align with SC ST 389 2019, including secure electronic signature capture, audit trails, and customizable templates. These tools make it easy to manage document workflows while maintaining compliance with the standard's requirements. Users can trust that their documents are handled securely and efficiently.

-

Is airSlate SignNow cost-effective for organizations needing SC ST 389 2019 compliance?

Yes, airSlate SignNow is a cost-effective solution for organizations aiming for SC ST 389 2019 compliance. Our competitive pricing plans are designed to fit businesses of all sizes, offering necessary features without breaking the bank. This affordability ensures that even small businesses can maintain compliance without financial strain.

-

Can airSlate SignNow integrate with other platforms for sc st 389 2019 compliance?

Absolutely! AirSlate SignNow can seamlessly integrate with various platforms and applications, enhancing your ability to meet SC ST 389 2019 compliance. Whether it's CRM systems, document management software, or your existing workflows, our integrations enable a smooth transition and improved efficiency across different tools.

-

How does airSlate SignNow enhance user experience while ensuring sc st 389 2019 compliance?

AirSlate SignNow is designed with user experience in mind, providing an intuitive interface that simplifies the signing process while ensuring SC ST 389 2019 compliance. This ease of use encourages higher adoption rates among employees and clients alike, leading to more efficient document management and workflow automation.

Get more for St 389 Instructions SC gov

- Letter from landlord to tenant about time of intent to enter premises virginia form

- Virginia landlord notice form

- Letter from tenant to landlord about sexual harassment virginia form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children virginia form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure virginia form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497428096 form

- Non compliance letter to tenant virginia form

- Letter from tenant to landlord for failure of landlord to comply with building codes affecting health and safety or resulting 497428098 form

Find out other St 389 Instructions SC gov

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy