IA W 4 Employee Withholding Allowance Certificate Tax Iowa Form

Understanding the IA W-4 Employee Withholding Allowance Certificate

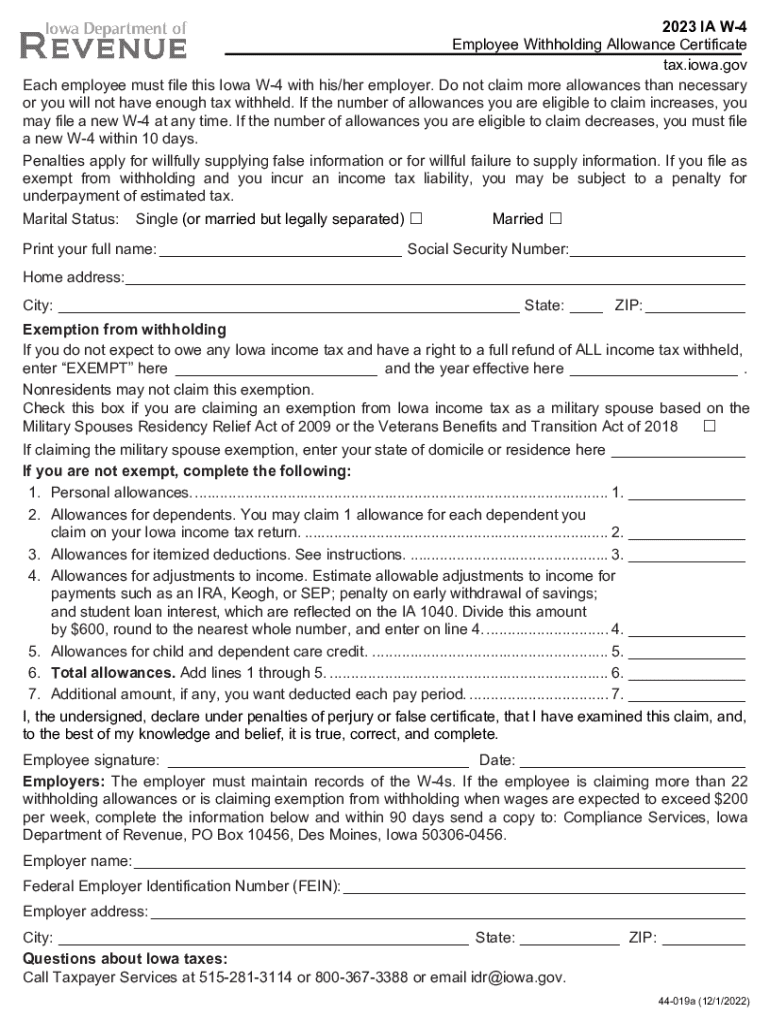

The IA W-4 Employee Withholding Allowance Certificate is a crucial form for employees in Iowa. It is used to determine the amount of state income tax that should be withheld from an employee's paycheck. By accurately completing this form, employees can ensure that the right amount of tax is deducted, helping them avoid underpayment or overpayment when filing their state tax returns.

Steps to Complete the IA W-4 Employee Withholding Allowance Certificate

Filling out the IA W-4 form involves several key steps:

- Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, which can be single, married, or head of household.

- Allowances: Calculate the number of allowances you are claiming based on your personal and financial situation. More allowances typically result in less tax withheld.

- Additional Withholding: If you want additional amounts withheld, specify that in the designated section.

- Signature: Sign and date the form to validate your submission.

How to Obtain the IA W-4 Employee Withholding Allowance Certificate

Employees can obtain the IA W-4 form from various sources. It is available on the Iowa Department of Revenue’s website, where you can download and print it. Additionally, many employers provide this form during the onboarding process or upon request. It is essential to ensure you are using the most current version for the year 2023.

Legal Use of the IA W-4 Employee Withholding Allowance Certificate

The IA W-4 form is legally required for all employees in Iowa to ensure compliance with state tax laws. Employers must keep this form on file for each employee to accurately withhold state income taxes. Failure to submit a completed IA W-4 may result in the employer withholding taxes at the highest rate, which could lead to unnecessary tax burdens for employees.

Filing Deadlines and Important Dates for Iowa Tax Forms 2023

It is important to be aware of key deadlines when dealing with Iowa tax forms. For the 2023 tax year, the deadline for submitting the IA W-4 form is typically aligned with your first paycheck of the year or when you start a new job. Additionally, ensure that your tax returns are filed by April 30, 2024, to avoid penalties.

Examples of Using the IA W-4 Employee Withholding Allowance Certificate

Consider a scenario where an employee is married with two children. They may choose to claim four allowances on their IA W-4 to reduce their withholding amount. Conversely, a single employee without dependents may claim only one allowance, resulting in higher withholding. Each individual's situation will dictate the appropriate number of allowances to claim.

Quick guide on how to complete ia w 4 employee withholding allowance certificate tax iowa

Complete IA W 4 Employee Withholding Allowance Certificate Tax iowa seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed files, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage IA W 4 Employee Withholding Allowance Certificate Tax iowa on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign IA W 4 Employee Withholding Allowance Certificate Tax iowa effortlessly

- Obtain IA W 4 Employee Withholding Allowance Certificate Tax iowa and select Get Form to begin.

- Use the tools provided to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with the tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign IA W 4 Employee Withholding Allowance Certificate Tax iowa to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ia w 4 employee withholding allowance certificate tax iowa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for Iowa tax forms 2023?

airSlate SignNow offers a user-friendly platform that simplifies the signing of Iowa tax forms 2023. With features like templates, in-app notifications, and customization options, businesses can streamline their tax document workflow efficiently.

-

How does airSlate SignNow ensure security for Iowa tax forms 2023?

Security is a top priority for airSlate SignNow. All signed Iowa tax forms 2023 are protected with bank-level encryption, ensuring that sensitive information remains confidential and secure throughout the signing process.

-

What are the pricing options for using airSlate SignNow for Iowa tax forms 2023?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Depending on your requirements for Iowa tax forms 2023, you can choose from various subscription tiers, ensuring an affordable solution.

-

Can I integrate airSlate SignNow with my existing software to manage Iowa tax forms 2023?

Yes, airSlate SignNow integrates seamlessly with numerous applications to manage Iowa tax forms 2023. This capability allows you to streamline document management by syncing with popular tools like Google Drive, Dropbox, and others.

-

Is there a mobile app available for signing Iowa tax forms 2023?

Absolutely! airSlate SignNow provides a mobile app that enables users to sign Iowa tax forms 2023 on-the-go. This convenient feature ensures you can manage your documents anytime, anywhere, enhancing flexibility.

-

What benefits can I expect from using airSlate SignNow for Iowa tax forms 2023?

Using airSlate SignNow for Iowa tax forms 2023 provides signNow benefits including increased efficiency, reduced turnaround time, and enhanced accuracy. These advantages help businesses save time and minimize errors when processing tax documents.

-

Are there any templates available for Iowa tax forms 2023 in airSlate SignNow?

Yes, airSlate SignNow offers customizable templates specifically designed for Iowa tax forms 2023. These templates allow users to quickly prepare and send documents, saving time and ensuring compliance.

Get more for IA W 4 Employee Withholding Allowance Certificate Tax iowa

- Indoor soccer lineup sheet pdf philadelphia parks amp recreation form

- Facility request form

- Bakery special order form

- Form 818b post tensioned slab on grade

- Standard sale contract template form

- Standard service contract template form

- Standard vendor contract template form

- Standard work contract template form

Find out other IA W 4 Employee Withholding Allowance Certificate Tax iowa

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement