Form CT 200 V Payment Voucher for E Filed Corporation Tax 2016

Understanding the Form CT 200 V Payment Voucher for E-filed Corporation Tax

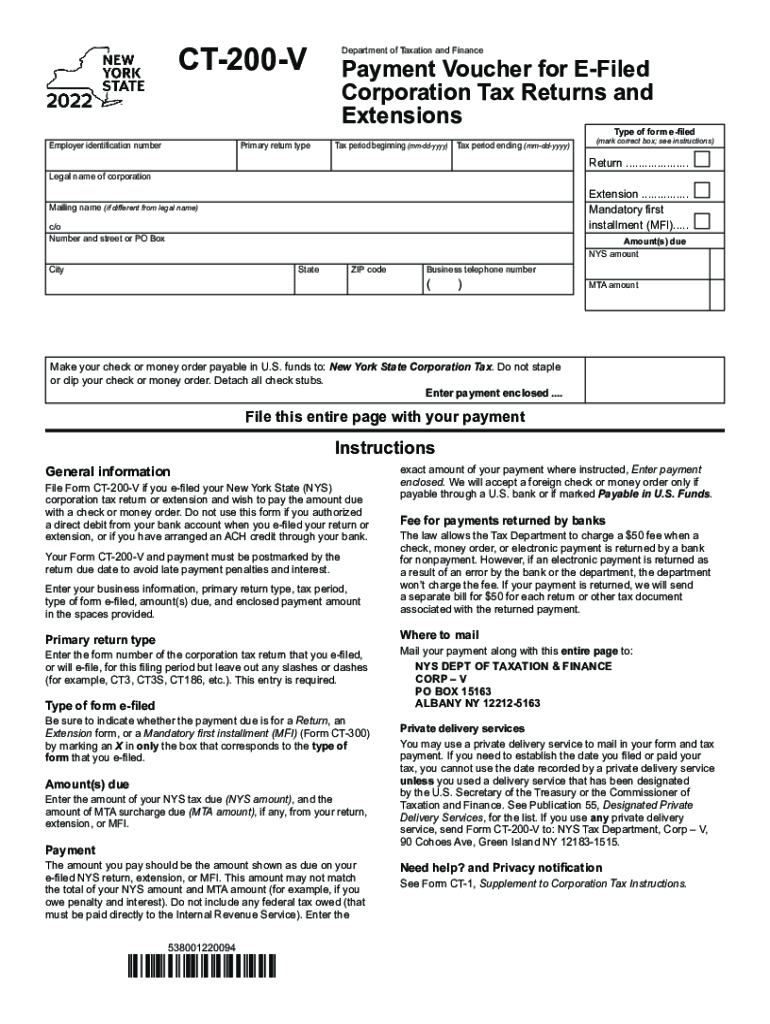

The Form CT 200 V is a payment voucher specifically designed for corporations that are e-filing their tax returns in New York State. This form is essential for businesses that need to submit payments related to their corporation tax obligations. By using this voucher, corporations can ensure that their payments are properly credited to their account, which helps in maintaining accurate tax records. The CT 200 V is particularly useful for those who prefer to manage their tax payments electronically, streamlining the process and reducing the risk of errors associated with paper submissions.

Steps to Complete the Form CT 200 V Payment Voucher

Completing the Form CT 200 V is a straightforward process. Here are the key steps to follow:

- Begin by entering your corporation's name and address at the top of the form.

- Provide your Employer Identification Number (EIN) to ensure proper identification of your business.

- Indicate the total amount of tax being paid. This amount should match the tax liability calculated on your e-filed return.

- Check the appropriate box to indicate the type of payment you are making, whether it is for estimated tax or a balance due.

- Sign and date the form to certify that the information provided is accurate and complete.

Once completed, the CT 200 V should be submitted according to the filing instructions provided by the New York State Department of Taxation and Finance.

Obtaining the Form CT 200 V Payment Voucher

The Form CT 200 V can be easily obtained from the New York State Department of Taxation and Finance website. It is available as a downloadable PDF, which allows businesses to print and fill out the form as needed. Additionally, many tax preparation software programs include the CT 200 V as part of their filing packages, making it accessible for those who prefer digital solutions. Ensure that you have the most recent version of the form to comply with current tax regulations.

Key Elements of the Form CT 200 V Payment Voucher

The CT 200 V includes several key elements that are crucial for accurate tax payment processing. These elements include:

- Corporation Information: Name, address, and EIN are required for identification.

- Payment Amount: The total amount due must be clearly indicated to ensure proper crediting.

- Payment Type: Indicating whether the payment is for estimated tax or a balance due helps the tax authority categorize the payment correctly.

- Signature: The form must be signed to validate the information provided.

These elements work together to facilitate a smooth payment process and ensure compliance with New York tax laws.

Filing Deadlines and Important Dates for the CT 200 V

Adhering to filing deadlines is critical for avoiding penalties. The Form CT 200 V must be submitted along with your e-filed corporation tax return. Typically, the deadline for filing corporation tax returns in New York is the fifteenth day of the fourth month following the end of your tax year. For most corporations operating on a calendar year, this means that the due date is April 15. It is advisable to check for any changes in deadlines or specific requirements that may apply to your business.

Legal Use of the Form CT 200 V Payment Voucher

The Form CT 200 V serves a legal purpose in the tax filing process. It acts as an official record of payment made towards corporation taxes. By using this form, corporations can ensure that their payments are documented and recognized by the New York State Department of Taxation and Finance. This legal acknowledgment is important for maintaining compliance and can be beneficial in case of audits or disputes regarding tax liabilities.

Quick guide on how to complete form ct 200 v payment voucher for e filed corporation tax

Complete Form CT 200 V Payment Voucher For E filed Corporation Tax effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents swiftly without delays. Manage Form CT 200 V Payment Voucher For E filed Corporation Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to edit and eSign Form CT 200 V Payment Voucher For E filed Corporation Tax with ease

- Obtain Form CT 200 V Payment Voucher For E filed Corporation Tax and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you want to distribute your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form CT 200 V Payment Voucher For E filed Corporation Tax and guarantee outstanding communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 200 v payment voucher for e filed corporation tax

Create this form in 5 minutes!

How to create an eSignature for the form ct 200 v payment voucher for e filed corporation tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ct 200v and how does it work with airSlate SignNow?

The ct 200v is a cutting-edge solution designed to streamline the document signing process. With airSlate SignNow, users can send and eSign documents efficiently, leveraging the features of ct 200v to enhance productivity and ensure security.

-

How much does airSlate SignNow with ct 200v cost?

AirSlate SignNow offers competitive pricing for businesses looking to utilize the ct 200v solution. Our pricing plans are designed to fit various budgets, allowing you to choose the best option that meets your company’s needs while still enjoying the benefits of ct 200v.

-

What are the key features of ct 200v in airSlate SignNow?

The ct 200v includes features like customizable templates, advanced security protocols, and real-time tracking. These capabilities ensure that users can manage document workflows effectively while utilizing the robust functionalities of airSlate SignNow.

-

What benefits can I expect from using the ct 200v with airSlate SignNow?

By integrating the ct 200v with airSlate SignNow, you can expect increased efficiency and streamlined workflows. The solution not only reduces turnaround times but also enhances document security, making it a smart choice for businesses looking to improve their signing processes.

-

Can I integrate ct 200v with other applications?

Yes, airSlate SignNow provides easy integration capabilities with a variety of applications. When using ct 200v, you can connect with your favorite apps, such as CRM systems and cloud storage services, to optimize your document management processes.

-

Is it easy to set up ct 200v with airSlate SignNow?

Absolutely! Setting up ct 200v with airSlate SignNow is user-friendly and straightforward. Our intuitive interface guides you through the initial setup, ensuring that you can start sending and eSigning documents in no time.

-

Does airSlate SignNow with ct 200v comply with legal standards?

Yes, airSlate SignNow with ct 200v complies with all relevant legal and regulatory standards for eSigning. We prioritize security and legal compliance to ensure that your documents are protected and valid in any jurisdiction.

Get more for Form CT 200 V Payment Voucher For E filed Corporation Tax

- Mychart authorization proxy access form ohiohealth

- Access honorhealth com form

- State of california audit renewal paramedic license application form

- Sports management contract template form

- Sports player contract template form

- Sports sponsorship contract template form

- Sports team contract template form

- Spreadsheet management contract template form

Find out other Form CT 200 V Payment Voucher For E filed Corporation Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors