M1R Taxes State Mn Us Form

Understanding the Minnesota Schedule M1R

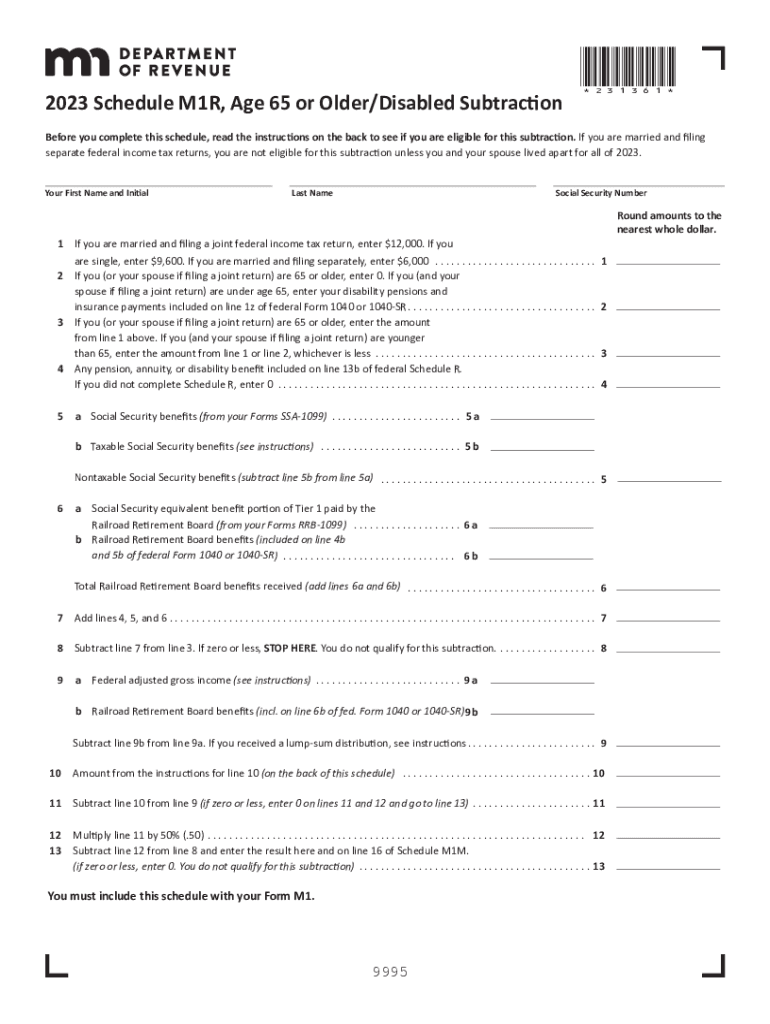

The Minnesota Schedule M1R is a tax form used by individuals to claim certain subtractions from their income on their Minnesota state tax return. This form is specifically designed for taxpayers who qualify for various deductions, including those related to disability, age, and other specific situations. The Schedule M1R helps taxpayers reduce their taxable income, ultimately lowering their overall tax liability.

Eligibility Criteria for the Minnesota Schedule M1R

To qualify for the Minnesota Schedule M1R, taxpayers must meet specific eligibility requirements. These include:

- Being a resident of Minnesota for the entire tax year.

- Having income that includes wages, salaries, or other taxable income.

- Meeting the criteria for specific subtractions, such as the disabled subtraction or the older adult subtraction for those aged sixty-five and older.

Taxpayers should review the detailed eligibility requirements in the Minnesota Department of Revenue guidelines to ensure they qualify for the deductions available on this form.

Steps to Complete the Minnesota Schedule M1R

Completing the Minnesota Schedule M1R involves several key steps:

- Gather necessary documentation, including your federal tax return and any relevant income statements.

- Identify which subtractions you qualify for, such as the disabled subtraction or the subtraction for older adults.

- Fill out the Schedule M1R form, providing accurate information regarding your income and the subtractions you are claiming.

- Double-check your entries for accuracy before submitting the form.

Following these steps carefully will help ensure that your Schedule M1R is completed correctly, maximizing your potential tax benefits.

Required Documents for Filing the Minnesota Schedule M1R

When filing the Minnesota Schedule M1R, certain documents are essential to support your claims. These include:

- Your federal tax return (Form 1040 or 1040-SR).

- W-2 forms or 1099 forms that report your income.

- Documentation supporting any subtractions claimed, such as proof of disability or age verification.

Having these documents organized will facilitate a smoother filing process and help avoid delays or issues with your tax return.

Filing Deadlines for the Minnesota Schedule M1R

The filing deadline for the Minnesota Schedule M1R typically aligns with the federal tax return deadline. For most taxpayers, this is April fifteen of the following year. However, if you need additional time, you may file for an extension, which allows you to submit your tax return by October fifteen. It is important to adhere to these deadlines to avoid penalties and interest on any unpaid taxes.

Form Submission Methods for the Minnesota Schedule M1R

Taxpayers can submit the Minnesota Schedule M1R through various methods:

- Online filing through the Minnesota Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate address specified by the Minnesota Department of Revenue.

- In-person submission at designated state tax offices, if available.

Choosing the right submission method can enhance the efficiency of your filing process and ensure timely processing of your tax return.

Quick guide on how to complete m1r taxes state mn us

Manage M1R Taxes state mn us easily on any device

Digital document management has gained traction among businesses and individuals alike. It offers a fantastic environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle M1R Taxes state mn us on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The simplest way to modify and electronically sign M1R Taxes state mn us with ease

- Find M1R Taxes state mn us and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign M1R Taxes state mn us and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m1r taxes state mn us

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mn schedule m1r?

The mn schedule m1r refers to a specific scheduling feature in airSlate SignNow that allows users to manage their document signing processes efficiently. This feature streamlines the workflow, ensuring that all parties involved can sign documents at the appropriate times without delays.

-

How does pricing work for mn schedule m1r?

Pricing for the mn schedule m1r feature is designed to be flexible and cost-effective. Depending on your business needs, various subscription plans are available, each offering different levels of access to features like scheduling and document management.

-

What are the main benefits of using mn schedule m1r?

Using mn schedule m1r offers numerous benefits, including increased efficiency, reduced turnaround times for document signing, and enhanced tracking capabilities. This feature ensures that you never miss a signing deadline, making your business more reliable.

-

Can I integrate mn schedule m1r with other applications?

Yes, mn schedule m1r can be easily integrated with various third-party applications. This functionality allows users to connect their existing software with airSlate SignNow, creating a seamless document management experience across different platforms.

-

Is there a mobile app available for mn schedule m1r?

Absolutely! airSlate SignNow offers a mobile app that includes the mn schedule m1r feature. This allows users to manage document signing and scheduling on-the-go, making it convenient to access important documents anytime, anywhere.

-

How does mn schedule m1r improve my business's workflow?

mn schedule m1r is designed to optimize your business's workflow by automating repetitive tasks associated with document signing. This solution reduces the manual effort involved, allowing your team to focus on more strategic activities and increase overall productivity.

-

What types of documents can I manage with mn schedule m1r?

With mn schedule m1r, you can manage a wide variety of documents such as contracts, agreements, and compliance forms. This versatility ensures that you can handle all your signing needs effectively within a single platform.

Get more for M1R Taxes state mn us

- Leaving permit certificate form

- Fillable form 4719 fire drill report

- Pmap communication form care providers careproviders

- Early childhood care and development checklist pdf form

- Corrective deed georgia form

- Printablecreditcardcancellation form

- Alabama blue prior authorization form

- Adoption support worksheet form

Find out other M1R Taxes state mn us

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors