Can Landlord Refuse Sending Certificate of Rent Paid If They Form

Understanding the Certificate of Rent Paid in Minnesota

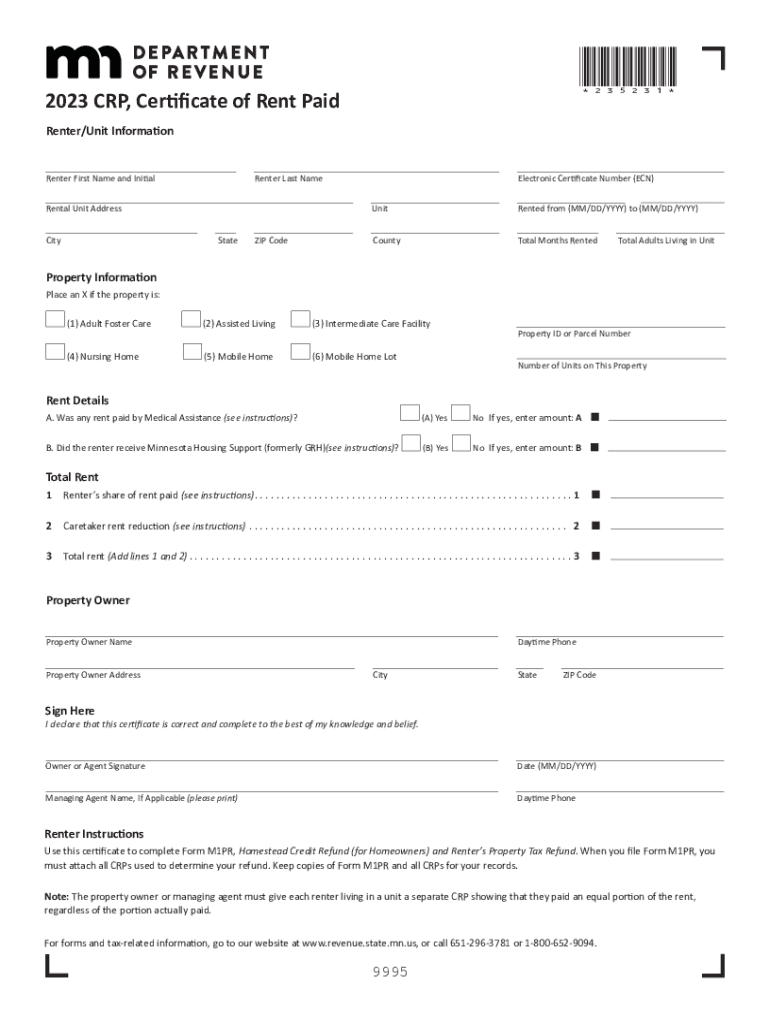

The Minnesota Certificate of Rent Paid (CRP) is a crucial document for renters. It serves as proof of rent payments made during the year and is essential for filing state income tax returns. This certificate helps eligible renters claim the Renters' Property Tax Refund, which can provide significant financial relief. Landlords are required by law to provide this certificate to tenants by January 31 of each year, detailing the total rent paid in the previous year.

Steps to Obtain the Certificate of Rent Paid

To obtain the Certificate of Rent Paid, renters should follow these steps:

- Contact your landlord or property manager to request the CRP.

- Ensure that your landlord has your current mailing address to send the certificate.

- Verify that the certificate includes accurate information regarding the total rent paid.

- If not received by the end of January, follow up with your landlord to ensure compliance.

Legal Use of the Certificate of Rent Paid

The Certificate of Rent Paid is legally recognized for tax purposes in Minnesota. Renters use this certificate to apply for the Renters' Property Tax Refund, which is available to those who meet specific income criteria. It is essential to keep this document safe, as it may be required for tax filing and potential audits by the Minnesota Department of Revenue.

Filing Deadlines for the Certificate of Rent Paid

Renters should be aware of important deadlines related to the Certificate of Rent Paid:

- The certificate must be provided by landlords by January 31 of the following year.

- Renters must file for the Renters' Property Tax Refund by August 15 of the current year.

Required Documents for Filing

When filing for the Renters' Property Tax Refund, renters need to gather the following documents:

- The Certificate of Rent Paid from the landlord.

- A completed Minnesota income tax return.

- Any additional documentation that supports income claims or residency status.

Penalties for Non-Compliance

Landlords who fail to provide the Certificate of Rent Paid by the deadline may face penalties. Renters may also encounter challenges when filing for tax refunds without this certificate. It is important for both parties to understand their responsibilities to avoid potential issues with compliance and financial repercussions.

Quick guide on how to complete can landlord refuse sending certificate of rent paid if they

Complete Can Landlord Refuse Sending Certificate Of Rent Paid If They seamlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct template and safely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Can Landlord Refuse Sending Certificate Of Rent Paid If They on any platform with the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

The easiest method to modify and electronically sign Can Landlord Refuse Sending Certificate Of Rent Paid If They with ease

- Find Can Landlord Refuse Sending Certificate Of Rent Paid If They and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important parts of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal standing as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Can Landlord Refuse Sending Certificate Of Rent Paid If They and ensure effective communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the can landlord refuse sending certificate of rent paid if they

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Minnesota certificate of rent paid 2023?

The Minnesota certificate of rent paid 2023 is a document that provides verification of the rent payments made by tenants in the state of Minnesota during the tax year. This certificate is crucial for tenants as it helps them claim any eligible rent refund taxes through the state's property tax refund program.

-

How can airSlate SignNow help with the Minnesota certificate of rent paid 2023?

airSlate SignNow simplifies the process of requesting and sending the Minnesota certificate of rent paid 2023. Our platform allows landlords and property management companies to easily generate and eSign this certificate, ensuring tenants receive their documentation quickly and efficiently.

-

Is there a cost associated with obtaining the Minnesota certificate of rent paid 2023 through airSlate SignNow?

Using airSlate SignNow is a cost-effective solution for managing documents like the Minnesota certificate of rent paid 2023. While there may be a subscription fee for access to our services, we aim to reduce overall costs related to paper handling and administrative tasks, providing signNow savings.

-

What features does airSlate SignNow offer for handling the Minnesota certificate of rent paid 2023?

airSlate SignNow boasts features such as seamless eSigning, document templates specifically for the Minnesota certificate of rent paid 2023, and secure cloud storage. These functionalities enhance the efficiency and security of document management for landlords and tenants alike.

-

What are the benefits of using airSlate SignNow for the Minnesota certificate of rent paid 2023?

Using airSlate SignNow for the Minnesota certificate of rent paid 2023 offers numerous benefits, including faster processing times and reduced paperwork. This platform improves the communication between landlords and tenants, ensuring that certificates are exchanged in real-time.

-

Can I integrate airSlate SignNow with other tools for managing the Minnesota certificate of rent paid 2023?

Yes, airSlate SignNow allows for seamless integration with various applications and software, making it easier to manage the Minnesota certificate of rent paid 2023. Whether you use property management solutions or accounting software, our platform can work alongside these tools for a more streamlined process.

-

Is technical support available for using airSlate SignNow with the Minnesota certificate of rent paid 2023?

Absolutely! airSlate SignNow provides comprehensive technical support for users, ensuring that any issues related to the Minnesota certificate of rent paid 2023 are swiftly addressed. Our support team is here to assist with questions or assistance needed to navigate the platform effectively.

Get more for Can Landlord Refuse Sending Certificate Of Rent Paid If They

- Addressamp39 title oregon form

- W oregon gov oregon form

- Form it 635 new york youth jobs program tax credit tax year

- Collections enforcement section150 e gay st 21 form

- Early admission request form eugene school district 4j 4j lane

- Software intellectual property contract template form

- Software outsourc contract template form

- Software maintenance contract template form

Find out other Can Landlord Refuse Sending Certificate Of Rent Paid If They

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free