San Bernardino Fictitious Business Name Search 2018

What is the San Bernardino Fictitious Business Name Search

The San Bernardino Fictitious Business Name (FBN) Search is a process that allows individuals and businesses to verify the availability of a business name that is not their legal name. This search is crucial for ensuring that the chosen name does not conflict with existing businesses in San Bernardino County. By conducting this search, entrepreneurs can avoid potential legal issues and ensure compliance with local regulations.

How to use the San Bernardino Fictitious Business Name Search

To use the San Bernardino Fictitious Business Name Search, individuals can access the official county website where the search tool is provided. Users can input the desired business name to check for existing registrations. The search results will indicate whether the name is already in use or available for registration. It is advisable to conduct this search before filing any official documents to ensure that the name can be legally used for business purposes.

Steps to complete the San Bernardino Fictitious Business Name Search

Completing the San Bernardino Fictitious Business Name Search involves several straightforward steps:

- Visit the San Bernardino County official website.

- Locate the Fictitious Business Name Search tool.

- Enter the desired business name in the search field.

- Review the search results for existing registrations.

- If the name is available, proceed to the registration process.

Legal use of the San Bernardino Fictitious Business Name Search

The legal use of the San Bernardino Fictitious Business Name Search is essential for compliance with state regulations. By ensuring that a business name is not already in use, entrepreneurs protect themselves from potential legal disputes. Additionally, registering a fictitious business name provides legal recognition and can enhance credibility with customers and partners.

Required Documents

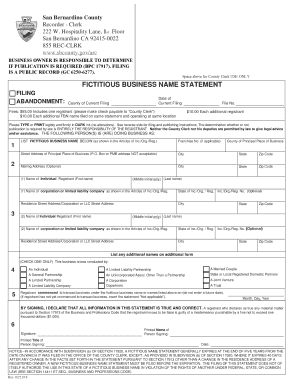

When filing for a fictitious business name in San Bernardino County, certain documents are typically required. These may include:

- A completed Fictitious Business Name Statement form.

- Payment of the required filing fee.

- Identification documents, such as a driver's license or business license.

Form Submission Methods

Individuals can submit their Fictitious Business Name Statement through various methods in San Bernardino County:

- Online submission via the county's official website.

- Mailing the completed form to the county recorder's office.

- In-person submission at designated county offices.

Penalties for Non-Compliance

Failure to comply with the fictitious business name registration requirements can result in penalties. These may include fines or legal action against the business for operating under an unregistered name. It is important for business owners to adhere to the regulations to avoid these consequences and maintain their business's legitimacy.

Quick guide on how to complete business owner is responsible to determine

Handle San Bernardino Fictitious Business Name Search anywhere, anytime

Your daily management tasks may require additional focus when managing state-specific business documents. Reclaim your office time and reduce the costs associated with paper-intensive processes with airSlate SignNow. airSlate SignNow provides you with various pre-uploaded business documents, including San Bernardino Fictitious Business Name Search, that you can utilize and share with your business associates. Handle your San Bernardino Fictitious Business Name Search seamlessly with powerful editing and eSignature features and send it directly to your recipients.

Steps to obtain San Bernardino Fictitious Business Name Search in a few clicks:

- Choose a form relevant to your region.

- Click Learn More to open the document and verify its accuracy.

- Select Get Form to begin working with it.

- San Bernardino Fictitious Business Name Search will automatically launch in the editor. No additional steps are required.

- Utilize airSlate SignNow’s advanced editing features to complete or modify the form.

- Select the Sign tool to create your personal signature and eSign your document.

- When ready, simply click Done, save changes, and access your document.

- Send the form via email or text message, or use a link-to-fill option with partners or allow them to download the document.

airSlate SignNow greatly saves your time managing San Bernardino Fictitious Business Name Search and allows you to find critical documents in one location. A large collection of forms is organized and designed to address key operational tasks required for your business. The advanced editor minimizes the risk of errors, as you can easily fix mistakes and review your documents on any device before sending them out. Start your free trial today to explore all the advantages of airSlate SignNow for your daily organization workflows.

Create this form in 5 minutes or less

Find and fill out the correct business owner is responsible to determine

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

What forms should I fill out to start a business?

From a legal business entity standpoint, one does not normally have to file any forms with the state the business is located in to be considered a sole proprietor (SP). However, this highly unadvisable since a SP provides no liability protection.The most popular, and most advisable business entities are a Limited Liability Company (LLC) and a Corporation. These entities are state created entities meaning that you must file the necessary paperwork in the state where you will have the business headquarters. The state’s secretary of state’s office will have all the necessary documents, forms, and rules needed to create the entity of your choice. You will also have to pay a filing fee.It is important that you further discuss the issue with experienced counsel as they will be able to help you decide which entity is best for you, and help you with the filing.

-

Why not treat guns like cars, i.e., why not license gun owners, register the guns and require gun owners to carry insurance?

Why not indeed? In that case, anyone can own a gun at any age. Anyone can legally carry a gun on private property as long as they’re physically capable. Anyone can obtain a “learner’s permit” to carry any gun in public areas, even a handgun, at 14, and get a full concealed carry permit or license to carry at age 16 by passing a course and taking an eye exam, but undergoing no background check or fingerprinting. And if the child waits until 17 to get the license, he or she doesn’t even have to take the course, just the tests. And once the license is obtained, it is recognized in every state. There also would be no waiting time to purchase a gun or obtain a license.Getting drunk and killing someone would incur maybe a five year sentence.Insurance and registration are also not required when operating a motor vehicle on private property.My son at 17 legally owns and operates his car on public roads. He can’t legally own a gun.Now if we regulated cars like guns, here’s how it would be.No one under 18 can drive any vehicle anywhere without either direct parental supervision or adult supervision and written parental permission.Nobody under 18 can purchase any car.18 is the legal age for purchasing SUV’s (the best equivalent I can think of to a long gun), but SUV’s with extra features like all terrain tires, trailer hitches, snowplows, winches, and “high capacity” fuel tanks are considered “assault SUV’s” in some states and are banned there. It is assumed by big city politicians that nobody really needs these features and that only ignorant rednecks ever want them.Of course all vehicle purchases require a background check. And some may require waiting periods.A few states offer licenses, but don’t require them of in-state residents provided they are legally qualified to possess a vehicle. One state (Vermont) doesn’t even issue licenses. Some states may allow people as young as 18 to obtain a license, but it requires a course ranging from eight hours to several days, a more thorough background check, and fingerprinting. Most, however, don’t allow anyone to get a license until age 21. Some states insist you prove to your county sheriff that you need a car, and needing to go places when public transportation is not available is not considered a good enough reason. Waiting times to obtain a license after passing the tests can last up to three months in more permissive states, longer in others.Once you get a car and a license, good luck taking a road trip. Drivers will have to plan all interstate travel around which state will recognize their licenses, because reciprocity is not guaranteed, and driving in a state that doesn’t recognize your license is a felony.Absolutely nobody from outside of California allowed to drive there. Same goes for New York, Illinois, and several other states that don’t recognize any out-of-state license. Some states require you to keep your vehicles in locked garages with the fuel tank emptied and fuel stored separately.While some states may allow 18–21 year olds to own a sedan or compact (the closest automotive equivalent to a handgun) if it’s a gift, nobody can legally purchase such a vehicle until age 21.Waiting times may be placed on all vehicle purchases, depending on the state. Some states will not allow out-of-state residents to buy cars there. Waiting times to obtain a license can take up to three months in some states, even longer than others.Committing any crime with a car could get you a minimum of five years fixed. Kill anyone with a car, and you could be facing life in prison or even the death penalty.Buying any vehicle with an automatic transmission will require a federal tax stamp, another background check, and a personal letter from your county sheriff to the ATF vouching for your character. Once you obtain said vehicle, you cannot drive it anywhere without giving the ATF prior notification. And civilian ownership of all cars with automatic transmission manufactured later than 1986 is completely illegal.Yeah. People who want guns regulated like cars really don’t know what they’re asking for.

-

As a business owner, what online/offline templates would you benefit from having (e.g. a template to fill out and send invoices, business plan templates, etc.)?

One awesome highlight of ZipBooks’ invoice templates is that you can save default settings like your notes and payment terms for your invoices once you nail down the details of what exactly should be on your invoice. Using ZipBooks for your invoice means never sending off an invoice without your own company information on it (oops!). They actually score your invoice based on what information you include and so you'll be able to leverage the data we've collected from tens of thousands of invoices on what things are important to get you paid faster.Here are a couple tips on things that you will get you paid faster and should definitely be included on your invoice:Company logo: This is part of the invoice template that we provide for you. You'll save a company logo under company settings and you'll never have to think about whether your invoice template header looks good again.Notes: Thanking a customer for their business will always make you stand out in a crowd and leverages the psychological principle of reciprocity so that you get paid faster. Lots of studies show that including a thank you note gets you paid faster. I think that would especially be true when someone is getting a big bill for legal services.Invoice payment terms: Another great free feature of ZipBooks invoice templates for legal services (and anyone else who used our invoice templates for that matter) is that when you put terms into an invoice, we automatically detected it and set a due date for you. If you don't set terms, we assume that the invoice will be due in 14 days. This is the due date that we use to drive the late payment reminder and to display the number of days that a invoice has been outstanding in the AR aging report. If you don't want to set the invoice payment terms every time, you can set it up once under Account Preferences in the ZipBooks app. Pretty neat, right?Customer information: This one might seem pretty straightforward but it should always be on the list of "must haves" when thinking about what you should put on your invoice.Detailed description of bill: ZipBooks' invoice template lends itself to the ability to show a detailed account of everything that you have charged since you last sent an invoice. You can do that by manually entering the invoice details or you can use the time tracker to automatically pull in billable activity once you are ready to send the next invoice for your legal services.

-

What are the dirty little secrets about working in the food and restaurant industry?

I use to manage a McDonalds and a Subway.1). Some places are really clean while others are not. It is a hit and miss. It all depends on management and the crew (I always made people clean because of health codes and the fact that it is disgusting to let a food handling station go uncleaned for a long time).2). If you walk in 1 minute before closing time 10/10 times you can order a meal. Most fast food owners can be greedy and want every single penny. So good for you (though the workers will hate you for it).3). Food temperature logs? Ha! They are 90% of the time false as food temps are rarely taken (this includes other places than fast food) or are faked.4). You can easily make similar meals at home alot cheaper. When you buy a meal at a fast food place or restaurant you are paying more for overhead costs (such as lot rent, wages etc). So in turn the food quality is going to be very low.5). There are states that do not require gloves to be used when handling and making food. Some states feel that handwashing is adequate (do a google search). I am sorry but that is a bunch of crap, every state should have mandatory glove laws. I cannot count the many times I saw people not washing their hands after going to the bathroom and such… also gloves are not changed often so you can have employees who will wear the same gloves for hours on end…6). Order fries without salt and technically all fast food places (such as McDonald's) are suppose to make a new fresh batch for you. You can then put salt on yourself. Though this will depend if the restaurant actually does it or throws old fries back into the grease for a minute and claim they are fresh. (My manager use to do this because she didn't want to make a new batch of fries).7). Rotation is not done so you really dont know how old (if expired) that meat really is….. dates on when product pulled is never accurate and sometimes the dates are fudged by almost another week to save money (a month old buffalo 6 inch sub for anyone?)8). If a business has alot of customers that is a good thing. It means all the old food had been used (or close to it). So if 10 people go through the drive thru I guarantee you will have fresh fries.9). Ice cream machines and fancy drink blenders are only deep cleaned once a week (if that, you can bypass the required cleaning if you know what you are doing). So you really dont know when the last time that machine was sanitized.10). If you want to know if a place is good to eat do 2 things. First use the restroom even if you just walk in and take a look. If the bathroom looks like someone had cleaned it once in a while you are good. If it looks like a trash heap leave the restuarant. YOU WILL GET SICK. Second (applies to fast food more than casual) when ordering your meal look at the floors underneath the table/counter. If it looks like it hadn't been swept in a long time, chances are you will be going home with a food borne illness.11). Turnover rate is very high in the food industry. You can easily hire and train 20 people (then they quit 2 weeks later). If you go to a place and you notice it is the same staff for over 2 months you found the holy grail. When a good team sticks together you can get a good meal that will not get you sick.12). It is all about the money. You want to add mayonnaise to that sandwich? That would be an additional 80 cents. Easily skip the special ordering and use the condiment packets.13). When ordering always go for the ala cart (good example for McDonald's) and order items separately. The franchise makes more off combo meals than single items.14). Always ask questions if you are not certain on something. 99% of orders being sent back are due to a misunderstanding.15). The food waste is ridiculous and by health code staff cannot take any of it home. Waste cannot be donated to a homeless shelter either due to health codes and a possible lawsuit due to someone getting sick.16). If you have a bad experience or your order is wrong talk to a manager. Ask them how they are going to compensate for their mess up. One time my family and myself waited almost 2 hours for a crappy meal at a village inn. I was so pissed by the time we got done I straight up asked the manager what he was going to do to rectify the situation. We were comped all our meals and drinks.17). Health code inspections (and company inspections) give almost a 3 to 4 month notice to the restuarant. So at this time everything will be made perfect (such as cleanliness and food safety practices) once the inspection is over, it goes right back to crap. (If inspections were random and not announced then I promise alot of restaurants and food establishments would be shut down instantly)Cant think of any others. Please excuse any grammatical errors as I am using my phone to type this answerUpdate 04/04/2019Wow! 53k views and over 190 upvotes!!! Thank you all considering this was my first answer on quora.

-

What are the required forms to fill out when starting a business?

It depends on where you're based: not only do different countries have different paperwork, but so do different states, counties and even cities. There are some places where you can start a new business without filling out any paperwork (although you'll likely have to deal with tax forms and the like after you've been in business for a while.There are some common forms that you should check on whether you need for your area:Business licenseProfessional license — In addition to a license for operating a business, certain professions are licensed.DBA / Doing business as — If you're doing business under a name other than your own, such as a company name, you may need to file a DBA.Incorporation or organizational documents — Depending on how you organize your business, you may need to file paperwork to incorporate.Tax registration — You will usually need to register with your local state if you're collecting sales tax. You will also probably need to complete paperwork to get a taxpayer identification number or an equivalent for your business.Employee forms — If you have employees, there can be quite a bit of paperwork, including their tax paperwork and any appropriate registration.These really are just a starting point. One of the best things you can do is find a local accountant or other professional to advise you on what you need.

Create this form in 5 minutes!

How to create an eSignature for the business owner is responsible to determine

How to make an eSignature for the Business Owner Is Responsible To Determine online

How to generate an eSignature for your Business Owner Is Responsible To Determine in Google Chrome

How to make an electronic signature for putting it on the Business Owner Is Responsible To Determine in Gmail

How to make an eSignature for the Business Owner Is Responsible To Determine straight from your mobile device

How to make an electronic signature for the Business Owner Is Responsible To Determine on iOS devices

How to create an eSignature for the Business Owner Is Responsible To Determine on Android devices

People also ask

-

What is San Bernardino County FBN and how does airSlate SignNow relate to it?

San Bernardino County FBN refers to the Filing of a Fictitious Business Name in the region. airSlate SignNow helps businesses streamline the process of submitting these documents electronically, enhancing efficiency and ensuring compliance with local regulations.

-

How much does airSlate SignNow cost for businesses in San Bernardino County?

Pricing for airSlate SignNow varies based on the features needed. For businesses in San Bernardino County FBN, the service offers affordable subscription plans that cater to all business sizes, ensuring you get the best value for your eSigning needs.

-

What features does airSlate SignNow offer for managing San Bernardino County FBN documents?

AirSlate SignNow provides robust features for managing San Bernardino County FBN documents, including customizable templates, templates sharing, secure cloud storage, and real-time tracking of document status. These features simplify the process, ensuring you can manage all aspects of your filings effectively.

-

How does airSlate SignNow help ensure compliance with San Bernardino County FBN regulations?

With airSlate SignNow, compliance with San Bernardino County FBN regulations is assured through its secure eSigning technology. The platform keeps a detailed audit trail of document interactions, providing businesses the peace of mind they need when submitting critical filings.

-

Are there integrations available with airSlate SignNow for San Bernardino County FBN processes?

Yes, airSlate SignNow integrates seamlessly with various applications, enabling a smooth workflow for San Bernardino County FBN processes. Integrating with popular tools like Google Drive, Salesforce, and more enhances productivity and ensures all your business needs are met.

-

What are the benefits of using airSlate SignNow for San Bernardino County FBN?

Using airSlate SignNow for San Bernardino County FBN offers benefits such as enhanced efficiency, cost savings, and improved accessibility. This user-friendly platform allows businesses to manage their documents on-the-go, making it easier to stay organized and compliant.

-

Is airSlate SignNow secure for filing San Bernardino County FBN documents?

Absolutely, airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect your sensitive San Bernardino County FBN documents. Your data integrity and confidentiality are our top priorities.

Get more for San Bernardino Fictitious Business Name Search

- Mental health law online forms

- Dhcr document form

- St 119 1 form

- Riverbend counselling intake form

- Ending chronic homelessness through employment and housing form

- Notice of appeal use this form to appeal a small claims decision to the court of queens bench

- Inquiries toll 1 form

- Alberta health services personal information form

Find out other San Bernardino Fictitious Business Name Search

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement