In Kind Donation Sheet Form

What is the In Kind Donation Sheet

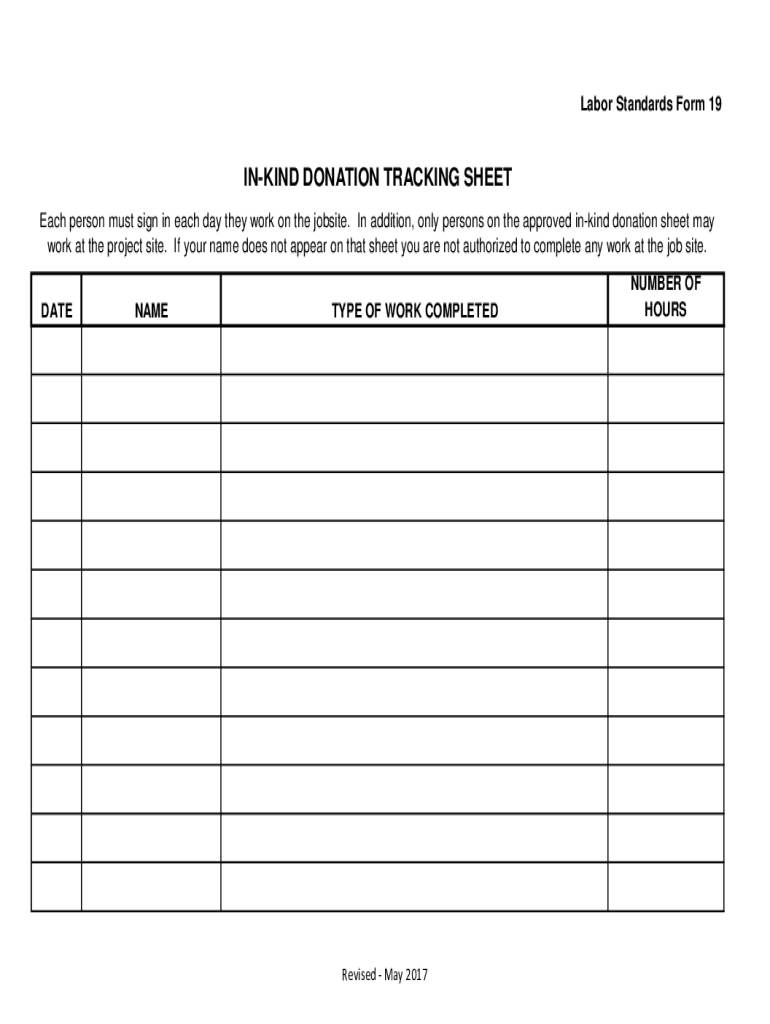

The in kind donation sheet is a document used to record non-cash contributions made to a nonprofit organization. These contributions can include goods, services, or other forms of support that hold value but do not involve cash transactions. This sheet is essential for both donors and organizations, as it helps track donations for accounting and tax purposes. It ensures that donors can claim appropriate deductions while providing organizations with a clear record of the resources received.

How to use the In Kind Donation Sheet

Using the in kind donation sheet involves several straightforward steps. First, gather all necessary information about the donation, including the donor's name, contact details, and the description of the items or services provided. Next, detail the estimated value of each contribution, ensuring that it reflects fair market value. Finally, both the donor and an authorized representative from the organization should sign and date the sheet to validate the transaction. This completed document serves as a formal acknowledgment of the donation.

Steps to complete the In Kind Donation Sheet

Completing the in kind donation sheet requires careful attention to detail. Follow these steps:

- Begin by entering the donor's full name and contact information.

- List each item or service donated, providing a brief description for clarity.

- Assign a fair market value to each item or service, using reliable sources if necessary.

- Include the date of the donation to establish a timeline.

- Have both the donor and a representative from the organization sign and date the sheet.

Legal use of the In Kind Donation Sheet

The in kind donation sheet is legally recognized as a valid record of non-cash contributions. For tax purposes, it is crucial that the sheet is filled out accurately and completely. The IRS requires documentation for donations exceeding a certain value, making this sheet an important tool for compliance. Organizations should retain these records for their files, as they may be needed for audits or financial reviews.

IRS Guidelines

The IRS provides specific guidelines regarding in kind donations. Donors can typically deduct the fair market value of the donated items on their tax returns. However, the IRS mandates that donations of certain items, such as vehicles or property, require additional documentation. It is advisable for donors to consult IRS publications or a tax professional to ensure compliance with all requirements and to maximize their tax benefits.

Examples of using the In Kind Donation Sheet

Examples of using the in kind donation sheet can vary widely based on the nature of the contributions. For instance, a local business may donate office supplies to a nonprofit, which would be recorded on the sheet with details about the items and their estimated values. Similarly, a volunteer may offer professional services, such as legal advice or graphic design, which should also be documented. Each example emphasizes the importance of accurately reflecting the value and nature of the contributions for both parties involved.

Quick guide on how to complete in kind donation sheet

Prepare In Kind Donation Sheet effortlessly on any device

Web-based document handling has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without holdups. Manage In Kind Donation Sheet on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign In Kind Donation Sheet with ease

- Obtain In Kind Donation Sheet and press Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign In Kind Donation Sheet and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the in kind donation sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an in kind donation sheet?

An in kind donation sheet is a document that outlines the details of non-monetary contributions made to an organization. It helps in recording the type, value, and donor information related to donated goods or services. This sheet is crucial for maintaining transparency and ensuring proper acknowledgment of donations.

-

How can I create an in kind donation sheet using airSlate SignNow?

Creating an in kind donation sheet with airSlate SignNow is simple and efficient. You can utilize our intuitive document editor to customize the sheet according to your organization's needs, add necessary fields, and send it for electronic signatures. This streamlines the process and ensures that all parties have access to signed documentation.

-

Is there a cost associated with using the in kind donation sheet feature?

Using airSlate SignNow to manage your in kind donation sheet is cost-effective, with various pricing plans available to cater to different organizational needs. Our plans include essential features for creating, sending, and signing documents electronically, which can be a budget-friendly option for nonprofits and businesses alike.

-

What are the benefits of using airSlate SignNow for my in kind donation sheet?

Using airSlate SignNow for your in kind donation sheet provides numerous benefits, including enhanced efficiency, improved tracking of donations, and secure electronic signatures. Additionally, our platform helps ensure compliance with regulatory requirements and enhances the donor's experience through seamless interactions.

-

Can I integrate airSlate SignNow with my existing donation management system?

Yes, airSlate SignNow can be easily integrated with various donation management systems and CRM tools. This integration allows you to automate the process of tracking in kind donations, ensuring that all relevant information is seamlessly transferred between systems for better management and reporting.

-

How does airSlate SignNow ensure the security of my in kind donation sheet?

airSlate SignNow prioritizes the security of your documents and data. Our platform uses advanced encryption methods, secure cloud storage, and compliance with industry regulations to protect the information within your in kind donation sheet. This ensures that both your organization and your donors' information is kept safe.

-

Is it easy to share the in kind donation sheet with my team?

Absolutely! airSlate SignNow makes it easy to share your in kind donation sheet with team members and stakeholders. You can send documents via email, generate shareable links, or invite collaborators directly through the platform to streamline communication and collaboration.

Get more for In Kind Donation Sheet

Find out other In Kind Donation Sheet

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form