How to Missouri Form Sales Tax

Understanding the Missouri Sales Tax Form

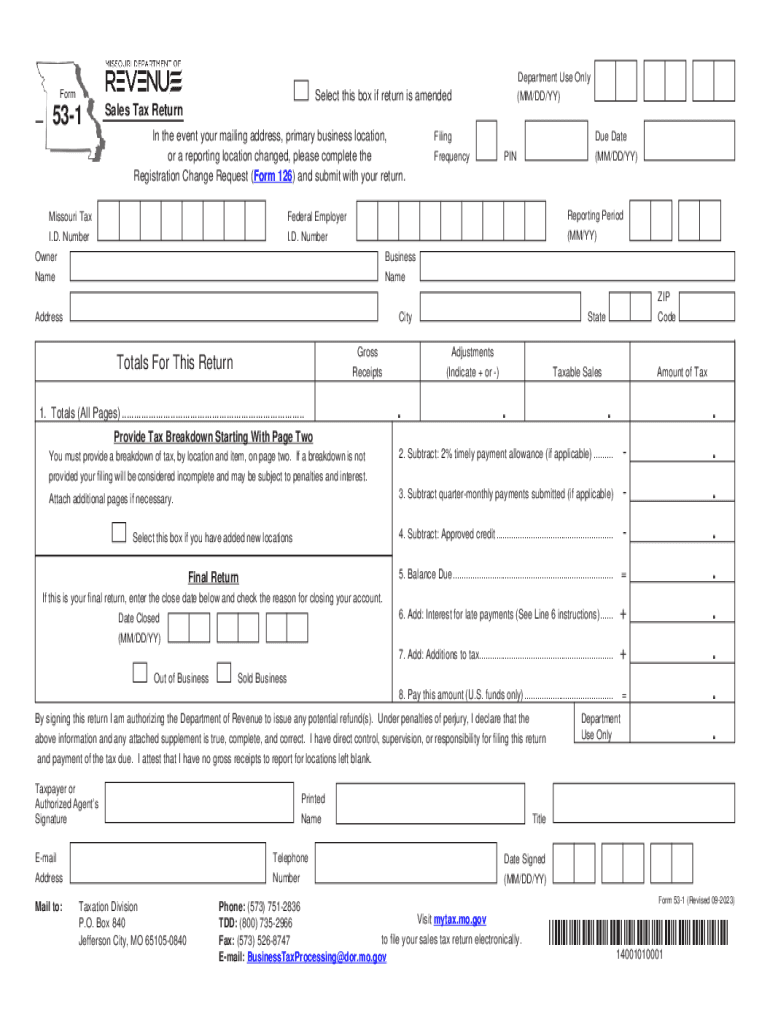

The Missouri sales tax form, specifically the Form 53-1, is essential for businesses operating within the state. This form is used to report and remit sales tax collected from customers. It is crucial for compliance with state tax regulations and helps ensure that businesses fulfill their tax obligations accurately.

Steps to Complete the Missouri Sales Tax Form

Filling out the Missouri sales tax form involves several key steps:

- Gather necessary information, including your business name, address, and sales tax identification number.

- Calculate the total sales made during the reporting period.

- Determine the amount of sales tax collected based on applicable rates.

- Complete all sections of the Form 53-1, ensuring accuracy in reporting sales and tax amounts.

- Review the completed form for errors before submission.

Filing Deadlines and Important Dates

It is vital to be aware of the filing deadlines for the Missouri sales tax form. Typically, the due date for filing is the 20th of the month following the end of the reporting period. Businesses should mark their calendars to avoid late submissions, which can incur penalties and interest.

Form Submission Methods

The Missouri sales tax form can be submitted through various methods:

- Online: Businesses can file electronically through the Missouri Department of Revenue's online portal.

- By Mail: Completed forms can be mailed to the appropriate address provided by the Missouri Department of Revenue.

- In-Person: Businesses may also deliver the form directly to local Department of Revenue offices.

Legal Use of the Missouri Sales Tax Form

Using the Missouri sales tax form is legally required for businesses that collect sales tax in the state. Failure to file or remit the correct amount of sales tax can result in penalties, interest, and potential legal action. It is essential to maintain accurate records and ensure compliance with state tax laws.

Key Elements of the Missouri Sales Tax Form

The Form 53-1 includes several important sections that must be completed:

- Business Information: Name, address, and tax identification number.

- Sales Information: Total sales and taxable sales during the reporting period.

- Tax Calculation: Total sales tax collected and any adjustments.

- Signature: An authorized representative must sign the form to certify its accuracy.

Quick guide on how to complete how to missouri form sales tax

Complete How To Missouri Form Sales Tax effortlessly on any device

Web-based document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your files quickly without delays. Manage How To Missouri Form Sales Tax on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest method to modify and eSign How To Missouri Form Sales Tax without hassle

- Obtain How To Missouri Form Sales Tax and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign How To Missouri Form Sales Tax and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to missouri form sales tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can airSlate SignNow help with sales tax documentation?

airSlate SignNow simplifies the process of managing sales tax documentation by allowing businesses to create, send, and eSign necessary documents quickly. The platform's intuitive interface ensures that all required forms related to sales tax are accurately completed and stored securely. This helps businesses maintain compliance with local tax regulations and avoid costly errors.

-

What features does airSlate SignNow offer for sales tax compliance?

airSlate SignNow comes with features like customizable templates, automated reminders, and real-time tracking that facilitate sales tax compliance. Users can easily modify templates based on their specific sales tax requirements, ensuring that they stay up-to-date with any changes in tax laws. This improves efficiency and minimizes the risk of forgetting important deadlines.

-

Is airSlate SignNow affordable for small businesses handling sales tax?

Yes, airSlate SignNow offers a cost-effective solution for small businesses managing sales tax. The pricing plans are designed to cater to various budgets without sacrificing essential features. Businesses can choose a plan that meets their needs while enjoying the benefits of streamlined sales tax documentation and management.

-

Can I integrate airSlate SignNow with my accounting software for sales tax purposes?

airSlate SignNow integrates seamlessly with popular accounting software, allowing businesses to synchronize sales tax data effortlessly. This integration helps in maintaining accurate financial records, enabling smoother processing of sales tax payments. By connecting your accounting system with airSlate SignNow, you can enhance your overall financial workflow.

-

How does airSlate SignNow ensure the security of sales tax documents?

Security is a top priority at airSlate SignNow, especially for sensitive sales tax documents. The platform employs industry-standard encryption protocols and offers secure storage options to protect your data. Users can rest assured that their sales tax filings and related documents are kept secure and confidential.

-

What benefits does eSigning sales tax documents offer?

eSigning sales tax documents with airSlate SignNow offers numerous benefits, including faster turnaround times and enhanced convenience. This reduces the time spent on manual signature collection and accelerates the filing process for sales tax returns. Additionally, eSigned documents are legally binding, ensuring compliance and authenticity.

-

Can I track the status of my sales tax documents with airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of their sales tax documents in real time. Users can easily see who has viewed or signed their documents, ensuring that nothing falls through the cracks. This tracking feature enhances accountability and provides peace of mind when handling important sales tax forms.

Get more for How To Missouri Form Sales Tax

- Colorado quitclaim deed from a trust to two individuals form

- Co beneficiary deed form

- Colorado quitclaim deed form

- Colorado quitclaim deed individual to husband and wife form

- Colorado general warranty deed from husband and wife and husband and wife to husband and wife husband and wife and an individual form

- Durable power attorney co form

- Tenancy common joint form

- Colorado warranty deed for separate or joint property to joint tenancy form

Find out other How To Missouri Form Sales Tax

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later