Co Beneficiary Deed Form

What is the Colorado Beneficiary Deed?

The Colorado beneficiary deed is a legal document that allows property owners to transfer their real estate to designated beneficiaries upon their death, without the need for probate. This type of deed is particularly useful for estate planning, as it simplifies the transfer process and can help avoid delays and costs associated with probate court. The beneficiary deed remains revocable during the owner's lifetime, meaning they can change or revoke it at any time. This flexibility makes it an attractive option for many property owners in Colorado.

How to Use the Colorado Beneficiary Deed

To effectively use the Colorado beneficiary deed, property owners should first identify the beneficiaries they wish to designate. This can include family members, friends, or organizations. Once the beneficiaries are chosen, the property owner must complete the beneficiary deed form, ensuring all required information is accurately filled out. After completing the form, it must be signed in front of a notary public and then filed with the county clerk and recorder's office where the property is located. This filing is crucial for the deed to be legally recognized and enforceable.

Steps to Complete the Colorado Beneficiary Deed

Completing a Colorado beneficiary deed involves several key steps:

- Obtain the Colorado beneficiary deed form from a reliable source.

- Fill out the form with the necessary information, including the property description and beneficiary details.

- Sign the form in the presence of a notary public to ensure its validity.

- File the signed deed with the county clerk and recorder's office where the property is located.

- Keep a copy of the filed deed for personal records.

Legal Use of the Colorado Beneficiary Deed

The legal use of the Colorado beneficiary deed is governed by state laws that outline its requirements and limitations. It is essential for property owners to understand these regulations to ensure that their beneficiary deed is valid. For instance, the deed must be properly executed and recorded to be effective. Additionally, the beneficiaries must be clearly identified, and the property must be accurately described. Failure to comply with these legal requirements may result in the deed being deemed invalid, which could complicate the transfer of property upon the owner's death.

Key Elements of the Colorado Beneficiary Deed

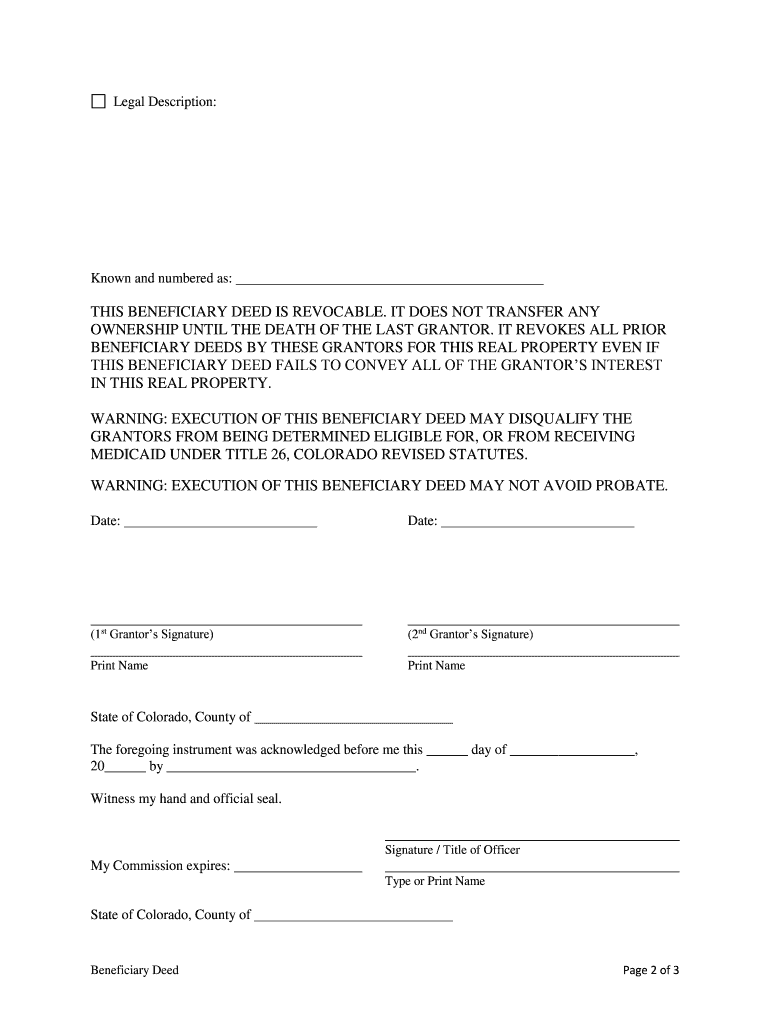

Several key elements must be included in a Colorado beneficiary deed to ensure its validity:

- Property Description: A detailed description of the property being transferred, including address and legal description.

- Beneficiary Information: Full names and addresses of the designated beneficiaries.

- Signature: The property owner's signature, along with the date of signing.

- Notary Acknowledgment: A notary public must acknowledge the signature to validate the deed.

State-Specific Rules for the Colorado Beneficiary Deed

Colorado has specific rules governing the use of beneficiary deeds that differ from other states. For example, the deed can only transfer real property and must be recorded within a specific timeframe to be effective. Additionally, Colorado law allows for multiple beneficiaries, but property owners should be aware of how this may affect future ownership and management of the property. Understanding these state-specific rules can help property owners navigate the process more effectively and ensure their intentions are honored.

Quick guide on how to complete co beneficiary deed

Manage Co Beneficiary Deed with ease on any device

Digital document management has become increasingly favored by companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can locate the correct form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Process Co Beneficiary Deed on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven operation today.

How to modify and electronically sign Co Beneficiary Deed effortlessly

- Locate Co Beneficiary Deed and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow makes available specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from your preferred device. Modify and electronically sign Co Beneficiary Deed and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a beneficiary deed form in Colorado?

A beneficiary deed form in Colorado is a legal document that allows property owners to transfer their real estate to a beneficiary upon their death, avoiding probate. This form ensures that property can be passed on seamlessly, making it a useful tool in estate planning.

-

How can I obtain a beneficiary deed form in Colorado?

You can easily obtain a beneficiary deed form in Colorado through various online platforms, legal service websites, or by consulting with a local attorney. Using airSlate SignNow, you can fill out and eSign your beneficiary deed form conveniently and securely.

-

What are the benefits of using a beneficiary deed form in Colorado?

The main benefits of using a beneficiary deed form in Colorado include the ability to avoid probate, maintain control over your property during your lifetime, and ease the transfer process to your beneficiaries. This ensures that your wishes are honored without a lengthy legal process.

-

Are there any costs associated with the beneficiary deed form in Colorado?

The costs associated with the beneficiary deed form in Colorado typically include filing fees, which can vary by county, and potentially attorney fees if you seek legal assistance. Utilizing airSlate SignNow provides a cost-effective solution for creating and eSigning your documents without excessive fees.

-

Can I modify my beneficiary deed form in Colorado after it is signed?

Yes, you can modify your beneficiary deed form in Colorado after it has been signed. However, it’s essential to follow the proper legal process to ensure that any changes are valid and recognized by the court, so consulting a legal professional might be advisable.

-

Is the beneficiary deed form in Colorado valid if signed digitally?

Yes, a beneficiary deed form in Colorado can be valid if signed digitally, as long as the eSignature complies with state laws. airSlate SignNow provides a secure platform for creating valid digital signatures that meet legal requirements.

-

What integrations does airSlate SignNow offer for managing beneficiary deed forms in Colorado?

airSlate SignNow offers integrations with various applications such as Google Drive, Dropbox, and more, making it easy to manage your beneficiary deed forms in Colorado alongside other documents. These integrations enhance workflow efficiency, allowing for seamless document management.

Get more for Co Beneficiary Deed

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase alaska form

- Alaska letter form

- Letter from tenant to landlord containing notice to landlord to withdraw retaliatory rent increase alaska form

- Ak tenant landlord agreement form

- Temporary lease agreement to prospective buyer of residence prior to closing alaska form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction form

- Letter from landlord to tenant returning security deposit less deductions alaska form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return alaska form

Find out other Co Beneficiary Deed

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online