Taxpayer Guide Missouri Department of Revenue MO Gov Form

Understanding the Missouri Tax Registration Application

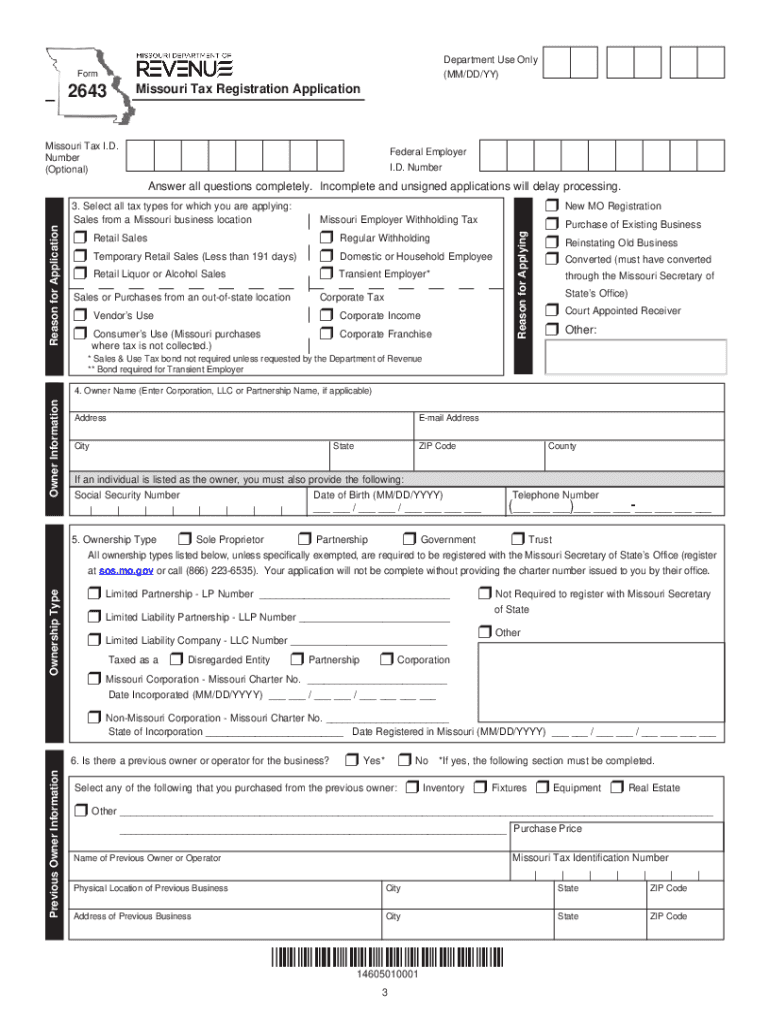

The Missouri tax registration application is a crucial document for businesses operating in the state. This application, often referred to as the Form 2643, is essential for registering for various taxes, including sales tax and withholding tax. Completing this form accurately ensures compliance with state tax laws and facilitates the proper collection and remittance of taxes owed to the Missouri Department of Revenue.

Steps to Complete the Missouri Tax Registration Application

Filling out the Missouri tax registration application online involves several key steps:

- Gather necessary information, including your business name, address, and federal Employer Identification Number (EIN).

- Determine the type of business entity you are registering (e.g., sole proprietorship, LLC, corporation).

- Access the Missouri tax registration application online through the Missouri Department of Revenue's website.

- Fill out the application form, ensuring all fields are completed accurately.

- Review your application for any errors or omissions before submitting.

- Submit the application electronically and retain a copy for your records.

Required Documents for the Application

When completing the Missouri tax registration application, certain documents may be required to support your submission. These typically include:

- Your federal Employer Identification Number (EIN) or Social Security Number (SSN) if applicable.

- Business formation documents, such as articles of incorporation or partnership agreements.

- Proof of address, which can be a utility bill or lease agreement.

Having these documents ready can streamline the application process and help ensure that your registration is processed without delays.

Eligibility Criteria for Registration

To successfully complete the Missouri tax registration application, businesses must meet specific eligibility criteria. These include:

- Operating a business within the state of Missouri.

- Having a valid business structure, such as an LLC, corporation, or partnership.

- Complying with local business licensing and zoning requirements.

Understanding these criteria can help ensure that your application is compliant and increases the likelihood of approval.

Form Submission Methods

The Missouri tax registration application can be submitted in various ways, making it accessible for different business needs. The primary submission methods include:

- Online submission through the Missouri Department of Revenue's website, which is the most efficient method.

- Mailing a paper application to the appropriate address provided on the form.

- In-person submission at designated Department of Revenue offices, if preferred.

Choosing the right submission method can impact the speed of your application processing and your overall experience.

Potential Penalties for Non-Compliance

Failing to register for taxes in Missouri can lead to significant penalties. Businesses that do not comply with tax registration requirements may face:

- Fines and interest on unpaid taxes.

- Legal action from the state for non-compliance.

- Inability to obtain necessary permits or licenses for operation.

Understanding these potential consequences emphasizes the importance of timely and accurate registration.

Quick guide on how to complete taxpayer guide missouri department of revenue mo gov

Complete Taxpayer Guide Missouri Department Of Revenue MO gov effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers a perfect environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Taxpayer Guide Missouri Department Of Revenue MO gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to edit and eSign Taxpayer Guide Missouri Department Of Revenue MO gov with ease

- Obtain Taxpayer Guide Missouri Department Of Revenue MO gov and click on Get Form to begin.

- Take advantage of the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure confidential details with functions offered by airSlate SignNow specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then hit the Done button to save your adjustments.

- Choose how you wish to send your form, whether by email, text (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Taxpayer Guide Missouri Department Of Revenue MO gov and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxpayer guide missouri department of revenue mo gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri tax registration application online process?

The Missouri tax registration application online process allows businesses to efficiently register for state taxes via a user-friendly platform. By utilizing airSlate SignNow, you can complete and submit the necessary forms quickly, ensuring compliance with state regulations. This streamlined process saves time and reduces the likelihood of errors.

-

How much does it cost to use the Missouri tax registration application online with airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to different business needs when using the Missouri tax registration application online. You can select a plan that best fits your budget and requirements, thus ensuring a cost-effective solution for document eSigning and management. Visit the pricing page on our website for detailed information.

-

What features does the Missouri tax registration application online offer?

The Missouri tax registration application online through airSlate SignNow includes a range of features designed to enhance user experience. Key features include eSignature capabilities, document templates, and an intuitive interface that allows for seamless completion of registration forms. These features ensure a smooth and efficient workflow for businesses.

-

Are there any benefits of using airSlate SignNow for the Missouri tax registration application online?

Using airSlate SignNow for the Missouri tax registration application online comes with numerous benefits. It simplifies the registration process, ensures quick document turnaround, and enhances compliance with state laws. Additionally, businesses can track the status of their applications, providing peace of mind and reducing administrative burdens.

-

Can I integrate the Missouri tax registration application online with other tools?

Yes, airSlate SignNow allows for easy integration of the Missouri tax registration application online with various software tools. This interoperability can enhance your workflow by connecting to CRM systems, accounting software, and other essential applications. Such integrations help streamline processes and maintain organized records efficiently.

-

Is the Missouri tax registration application online process secure?

Absolutely! The Missouri tax registration application online through airSlate SignNow is designed with security in mind. The platform employs robust encryption and security protocols to protect your sensitive information, ensuring that your documents and data remain confidential throughout the registration process.

-

How can I get support while using the Missouri tax registration application online?

airSlate SignNow provides comprehensive support resources for users of the Missouri tax registration application online. Customers can access tutorials, FAQs, and dedicated support teams to assist with any questions or technical issues. Our commitment is to help you navigate the process smoothly and efficiently.

Get more for Taxpayer Guide Missouri Department Of Revenue MO gov

Find out other Taxpayer Guide Missouri Department Of Revenue MO gov

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document