Sc Property Tax Exemption Form Fill Out & Sign Online

Understanding the South Carolina Property Tax Exemption Form

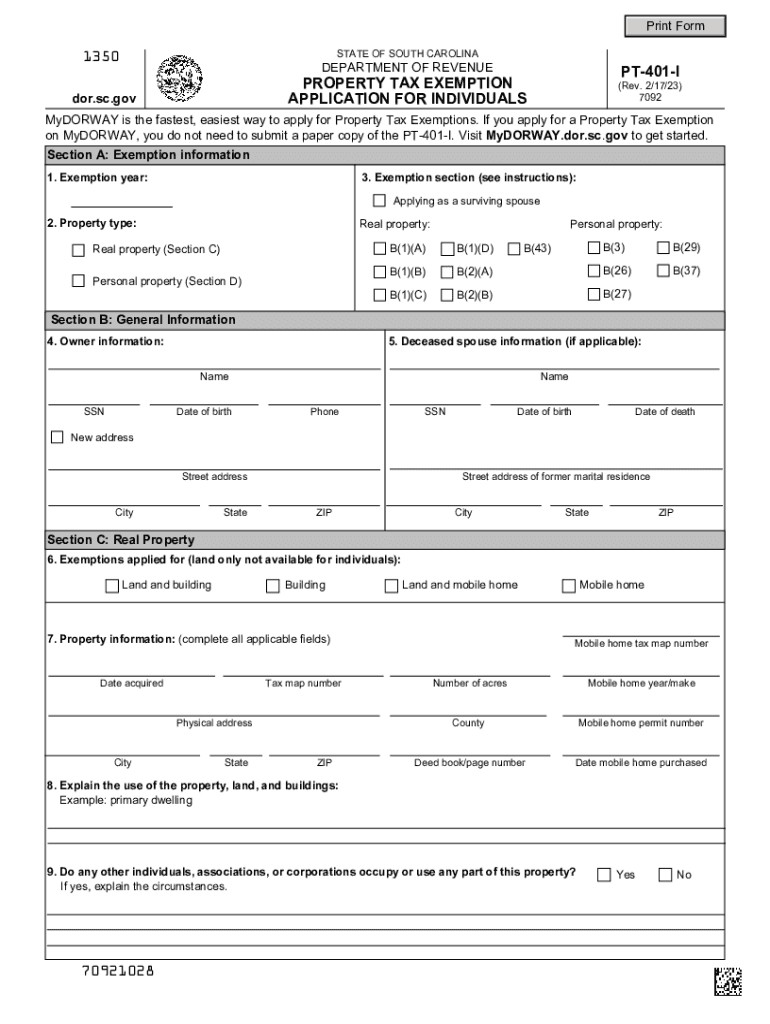

The South Carolina property tax exemption form, often referred to as the SC homestead exemption form, is designed to provide tax relief for qualifying homeowners. This exemption can significantly reduce the amount of property tax owed, making homeownership more affordable for eligible individuals, particularly seniors, disabled persons, and legally blind residents. The exemption applies to the first one hundred thousand dollars of the fair market value of a primary residence, offering substantial savings on property taxes.

Eligibility Criteria for the South Carolina Property Tax Exemption

To qualify for the SC homestead exemption, applicants must meet specific criteria. Generally, applicants must be at least sixty-five years old, or be permanently and totally disabled, or be legally blind. Additionally, the property must be the applicant's primary residence, and the applicant must have owned the property for at least one year prior to applying. It is essential to provide proof of age or disability status when submitting the application.

Steps to Complete the South Carolina Property Tax Exemption Form

Filling out the SC homestead exemption form involves several straightforward steps:

- Gather necessary documents, including proof of age or disability.

- Obtain the SC property tax exemption form from your local county assessor's office or download it from the official state website.

- Carefully fill out the form, ensuring all information is accurate and complete.

- Submit the completed form to your local county assessor's office by the specified deadline, which is typically April first of each year.

Required Documents for the Application

When applying for the SC homestead exemption, certain documents are necessary to support your application. These may include:

- A copy of your driver's license or state-issued ID.

- Proof of age, such as a birth certificate or Social Security card.

- Documentation of disability, if applicable, such as a letter from a medical professional.

- Ownership documents for the property, such as a deed or mortgage statement.

Form Submission Methods

The SC homestead exemption form can be submitted in various ways, depending on your preference and local county regulations. Options typically include:

- Submitting the form in person at your local county assessor's office.

- Mailing the completed form to the appropriate county office.

- Some counties may offer online submission options through their official websites.

Legal Use of the South Carolina Property Tax Exemption Form

The SC property tax exemption form must be used in accordance with South Carolina state laws. Misuse of the form, such as providing false information or failing to meet eligibility requirements, can result in penalties, including the loss of the exemption and potential fines. It is crucial to ensure that all information provided is truthful and accurate to maintain compliance with state regulations.

Quick guide on how to complete sc property tax exemption form fill out ampamp sign online

Easily Prepare Sc Property Tax Exemption Form Fill Out & Sign Online on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents swiftly and without any delays. Manage Sc Property Tax Exemption Form Fill Out & Sign Online on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

The Easiest Way to Alter and Electronically Sign Sc Property Tax Exemption Form Fill Out & Sign Online Effortlessly

- Locate Sc Property Tax Exemption Form Fill Out & Sign Online and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet-ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Alter and electronically sign Sc Property Tax Exemption Form Fill Out & Sign Online to guarantee outstanding communication throughout every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc property tax exemption form fill out ampamp sign online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sc homestead exemption form?

The SC homestead exemption form is a legal document that allows qualified South Carolina residents to exempt a portion of their property taxes, reducing their financial obligation. This exemption is primarily aimed at senior citizens, disabled individuals, and certain veterans. Completing the form correctly ensures eligibility for the tax benefits.

-

How can I complete the sc homestead exemption form using airSlate SignNow?

You can easily complete the SC homestead exemption form using airSlate SignNow by uploading the document and utilizing our intuitive editing tools. Our platform allows you to fill out the form digitally, ensuring that all information is accurate and legible. Once completed, you can eSign the form and send it to the appropriate tax office.

-

Is there a cost associated with using airSlate SignNow for the sc homestead exemption form?

airSlate SignNow offers various pricing plans, including options that may suit your needs whether you're a single user or a business. While creating and signing the SC homestead exemption form may have nominal fees, the overall savings from the efficient process provide great value. Our platform is designed to be cost-effective while streamlining your document management.

-

What features does airSlate SignNow offer for the sc homestead exemption form?

airSlate SignNow provides features such as document uploading, easy collaboration, and electronic signatures that enhance your experience with the SC homestead exemption form. Additionally, our solution includes tracking capabilities, reminders, and secure storage for your completed forms. These features ensure that you manage your documents effectively and stay organized.

-

Can I use airSlate SignNow on mobile devices for the sc homestead exemption form?

Yes, airSlate SignNow is fully compatible with mobile devices, allowing you to complete the SC homestead exemption form anytime and anywhere. The mobile app provides an intuitive interface for filling out and signing documents on the go. This flexibility ensures you can manage your exemptions without being tied to a computer.

-

What are the benefits of completing the sc homestead exemption form online?

Completing the SC homestead exemption form online through airSlate SignNow offers several benefits, including increased efficiency, ease of access, and automated reminders. Online submission minimizes paperwork and reduces the risk of error while ensuring a secure process. Furthermore, you can track the status of your document in real-time.

-

Does airSlate SignNow integrate with other applications for handling the sc homestead exemption form?

Yes, airSlate SignNow seamlessly integrates with various applications to facilitate the handling of the SC homestead exemption form. Our platform can connect with popular cloud storage services and productivity tools, enhancing your document workflow. These integrations make it easier to access and manage all your important files in one place.

Get more for Sc Property Tax Exemption Form Fill Out & Sign Online

- Gift deed 481377349 form

- Maine warranty deed form

- Maine marital domestic separation and property settlement agreement adult children form

- Small estate maine form

- Maine general durable power of attorney for property and finances or financial effective upon disability form

- Maine quitclaim deed form

- Michigan quitclaim deed from individual to husband and wife form

- Michigan warranty deed from husband and wife to an individual form

Find out other Sc Property Tax Exemption Form Fill Out & Sign Online

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself