Form it 59 Tax Forgiveness for Victims of the Tax NY Gov

Understanding the IT-59 Tax Forgiveness Form

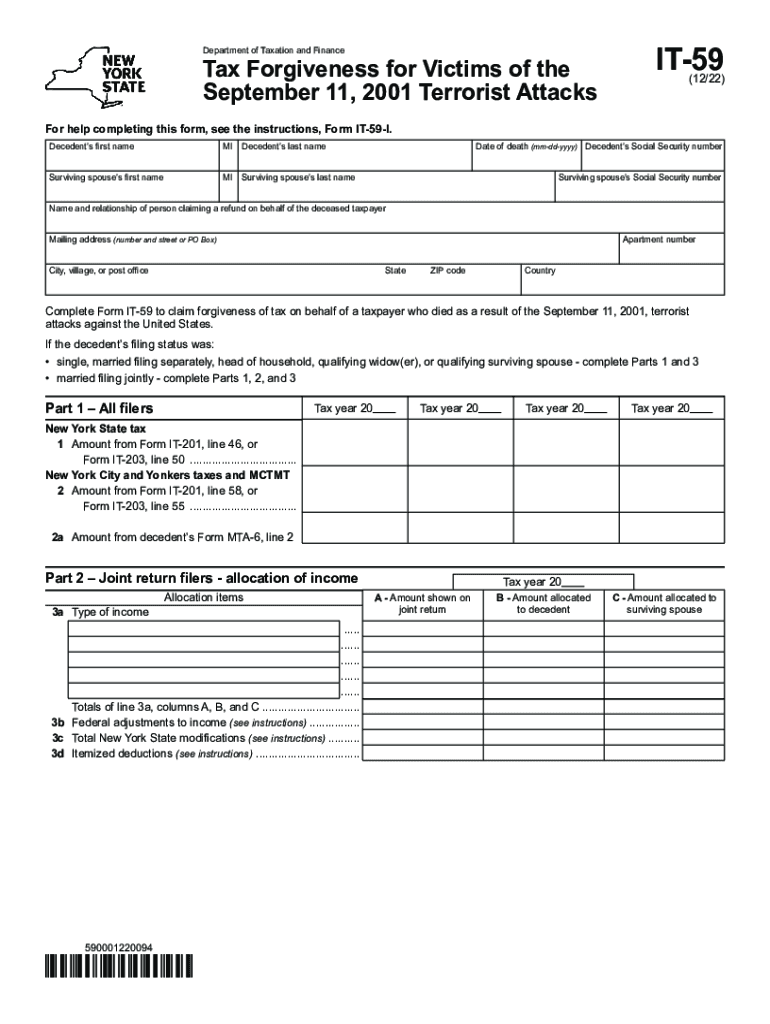

The IT-59 tax form is a specific document used in New York for tax forgiveness aimed at victims of certain circumstances, such as natural disasters or other qualifying events. This form allows eligible taxpayers to request relief from specific tax liabilities, providing a means to alleviate financial burdens caused by unforeseen circumstances. Understanding the purpose and eligibility requirements of the IT-59 is crucial for those seeking assistance.

Steps to Complete the IT-59 Tax Forgiveness Form

Filling out the IT-59 tax form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including personal identification details and specific circumstances that warrant the request for forgiveness. Follow these steps:

- Download the IT-59 form from the official New York State website.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide detailed information regarding the circumstances that led to your request for tax forgiveness.

- Attach any required documentation that supports your claim, such as proof of loss or damage.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the IT-59 Tax Forgiveness Form

To qualify for the IT-59 tax forgiveness, taxpayers must meet specific eligibility criteria set forth by the New York State Department of Taxation and Finance. Generally, eligibility includes:

- Being a resident of New York State at the time of the event.

- Experiencing a qualifying event that resulted in financial hardship.

- Submitting the form within the designated timeframe following the event.

It is important to review the detailed criteria to ensure that your situation aligns with the requirements for tax forgiveness.

Required Documents for the IT-59 Tax Forgiveness Form

When submitting the IT-59 form, certain documents are required to support your request for tax forgiveness. These documents typically include:

- Proof of residence in New York State.

- Documentation of the event that caused the financial hardship, such as insurance claims or repair estimates.

- Any previous tax documents relevant to the tax year in question.

Having these documents ready will facilitate a smoother application process and help substantiate your claim.

Form Submission Methods for the IT-59 Tax Forgiveness Form

The IT-59 form can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices.

Choosing the right submission method can depend on personal preference and urgency.

Key Elements of the IT-59 Tax Forgiveness Form

Understanding the key elements of the IT-59 form is essential for accurate completion. Important components include:

- Personal information section for taxpayer identification.

- Details regarding the qualifying event and its impact on finances.

- Signature and date to certify the accuracy of the information provided.

Familiarity with these elements can help ensure that all necessary information is included and correctly presented.

Quick guide on how to complete form it 59 tax forgiveness for victims of the tax ny gov

Complete Form IT 59 Tax Forgiveness For Victims Of The Tax NY gov effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Form IT 59 Tax Forgiveness For Victims Of The Tax NY gov on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Form IT 59 Tax Forgiveness For Victims Of The Tax NY gov with ease

- Find Form IT 59 Tax Forgiveness For Victims Of The Tax NY gov and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements with just a few clicks from any device you choose. Edit and eSign Form IT 59 Tax Forgiveness For Victims Of The Tax NY gov and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 59 tax forgiveness for victims of the tax ny gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to it59?

airSlate SignNow is an intuitive platform designed for businesses to send and eSign documents easily. Our solution, often associated with the keyword 'it59', enables users to streamline their document workflows and enhance productivity through electronic signatures.

-

What pricing plans are available for airSlate SignNow users interested in it59?

airSlate SignNow offers various pricing tiers tailored to different business needs. The plans cater to individuals, small teams, and large organizations, ensuring you can find the right fit while utilizing the it59 features efficiently.

-

What are the key features of airSlate SignNow related to it59?

airSlate SignNow boasts numerous features that enhance document management, including customizable templates, in-person signing, and secure storage. These it59-linked features simplify the eSigning process, making it more accessible for users across various industries.

-

How can airSlate SignNow benefit businesses looking for it59 solutions?

By adopting airSlate SignNow, businesses can signNowly reduce the time spent on document processing and increase efficiency. The it59 capabilities integrate seamlessly into existing workflows, leading to faster transaction times and improved customer satisfaction.

-

Can airSlate SignNow integrate with other software when focusing on it59?

Yes, airSlate SignNow offers extensive integrations with popular applications like Salesforce, Google Drive, and Microsoft Office. This ensures that your it59 document signing can happen within the tools you already use, providing a smooth user experience.

-

Is airSlate SignNow secure enough for handling sensitive documents linked to it59?

Absolutely. airSlate SignNow prioritizes security with industry-leading encryption protocols and compliance with regulations such as GDPR and HIPAA. Users can confidently use our it59 services knowing their sensitive documents are protected.

-

How does airSlate SignNow support mobile users seeking it59?

airSlate SignNow provides a user-friendly mobile app that allows users to send and eSign documents on the go. This mobile capability ensures that your it59 needs are met wherever you are, making document management more flexible than ever.

Get more for Form IT 59 Tax Forgiveness For Victims Of The Tax NY gov

- Guaranty attachment to lease for guarantor or cosigner alaska form

- Amendment to lease or rental agreement alaska form

- Warning notice due to complaint from neighbors alaska form

- Lease subordination agreement alaska form

- Apartment rules and regulations alaska form

- Agreed cancellation of lease alaska form

- Amendment of residential lease alaska form

- Agreement for payment of unpaid rent alaska form

Find out other Form IT 59 Tax Forgiveness For Victims Of The Tax NY gov

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter