Tax Filing Form

What is the IT-214 Form?

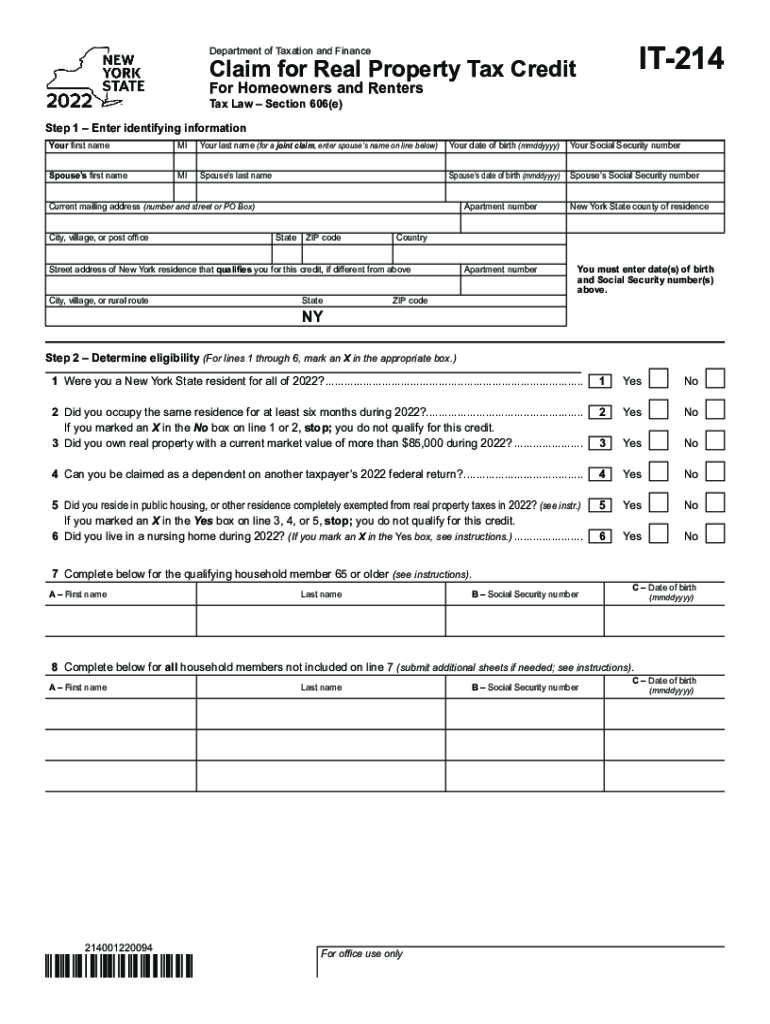

The IT-214 form, also known as the New York State Claim for the School Tax Relief (STAR) Credit, is a tax document used by residents of New York to claim a credit for property taxes paid on their primary residence. This form is essential for homeowners looking to reduce their tax burden and is specifically designed to provide financial relief for eligible taxpayers. The IT-214 form can be completed for the current tax year, such as the IT-214 form 2023, and it may also reference previous years, like the IT-214 form 2022.

Steps to Complete the IT-214 Form

Completing the IT-214 form involves several key steps to ensure accuracy and compliance with New York State tax regulations. Here is a straightforward process to follow:

- Gather necessary documents, including your property tax bill and proof of residency.

- Download the IT-214 form PDF from the New York State Department of Taxation and Finance website or access it through a reliable source.

- Fill out the form with accurate information, including your name, address, and details about your property taxes.

- Calculate the credit amount based on the guidelines provided in the form instructions.

- Review the completed form for any errors or omissions.

- Submit the form either online or via mail, following the submission guidelines.

Eligibility Criteria for the IT-214 Form

To qualify for the IT-214 tax credit, applicants must meet specific eligibility criteria set by New York State. These include:

- Being a resident of New York State and owning a primary residence.

- Meeting income limits as defined by the state for the applicable tax year.

- Having paid property taxes on the residence for which the claim is being made.

It is important to review these criteria carefully to ensure that you qualify for the credit before submitting the IT-214 form.

Key Elements of the IT-214 Form

The IT-214 form includes several key elements that are crucial for proper completion and submission. These elements consist of:

- Personal Information: This section requires your name, address, and social security number.

- Property Information: Details about the property for which the credit is being claimed, including the tax identification number.

- Tax Payment Information: Information regarding the amount of property taxes paid during the tax year.

- Signature: Your signature certifying that the information provided is accurate and complete.

Filing Deadlines for the IT-214 Form

Filing deadlines for the IT-214 form are crucial to ensure that taxpayers receive their credits on time. Generally, the form must be submitted by the due date of your state income tax return. For the 2023 tax year, this typically aligns with the federal tax filing deadline, which is usually April 15. It is advisable to check for any updates or changes to deadlines each tax year.

Form Submission Methods

The IT-214 form can be submitted using various methods, providing flexibility for taxpayers. These methods include:

- Online Submission: Many taxpayers prefer to file electronically through the New York State Department of Taxation and Finance website.

- Mail Submission: Taxpayers can also print the completed form and mail it to the appropriate address as indicated in the form instructions.

- In-Person Submission: Some may choose to deliver the form in person at designated tax offices, although this option may vary by location.

Quick guide on how to complete tax filing

Effortlessly Prepare Tax Filing on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the right format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without any holdups. Handle Tax Filing on any device using the airSlate SignNow applications for Android or iOS, and simplify any document-related process today.

The Simplest Method to Alter and Electronically Sign Tax Filing Effortlessly

- Find Tax Filing and click on Obtain Form to commence.

- Utilize the tools we provide to fill in your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Signature tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Complete button to save your modifications.

- Choose your preferred method of sharing your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Alter and electronically sign Tax Filing, ensuring seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax filing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 214 form PDF and why do I need it?

The IT 214 form PDF is a tax document used for claiming certain credits and deductions. It is essential for individuals and businesses looking to maximize their tax benefits. Using the IT 214 form PDF can help streamline your tax filing process and ensure you claim all eligible credits.

-

How can I easily access the IT 214 form PDF?

You can easily access the IT 214 form PDF through various government tax websites or directly via airSlate SignNow. Our platform allows you to download, view, and eSign this document quickly. This ensures that you always have the latest version of the form.

-

What features does airSlate SignNow offer for managing the IT 214 form PDF?

airSlate SignNow offers features such as document eSigning, template creation, and secure cloud storage for your IT 214 form PDF. These tools enhance your workflow efficiency, making it easy to send and receive signed documents. You can also track the status of your documents in real-time.

-

Is there a cost associated with using airSlate SignNow for the IT 214 form PDF?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including options that cater to frequent users of documents like the IT 214 form PDF. Our pricing is competitive and offers excellent value for the features provided. You can choose a plan that aligns with your usage requirements.

-

Can I integrate airSlate SignNow with other software for handling the IT 214 form PDF?

Absolutely! airSlate SignNow integrates seamlessly with popular applications like Google Drive, Salesforce, and Microsoft Office. This integration enhances your ability to manage the IT 214 form PDF alongside other business documents, streamlining your operations.

-

What are the benefits of using airSlate SignNow for the IT 214 form PDF?

Using airSlate SignNow for the IT 214 form PDF offers signNow benefits, including time savings, increased security, and improved accuracy. Our eSigning feature reduces the time spent on manual signatures, while automatic reminders help ensure timely submission. Plus, your documents are securely stored and easily accessible.

-

Is it safe to sign the IT 214 form PDF online with airSlate SignNow?

Yes, signing the IT 214 form PDF online with airSlate SignNow is very secure. We implement advanced encryption and comply with industry standards to protect your sensitive information. You can confidently eSign knowing that your documents are protected.

Get more for Tax Filing

Find out other Tax Filing

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself