Form it 201

What is the Form IT-201

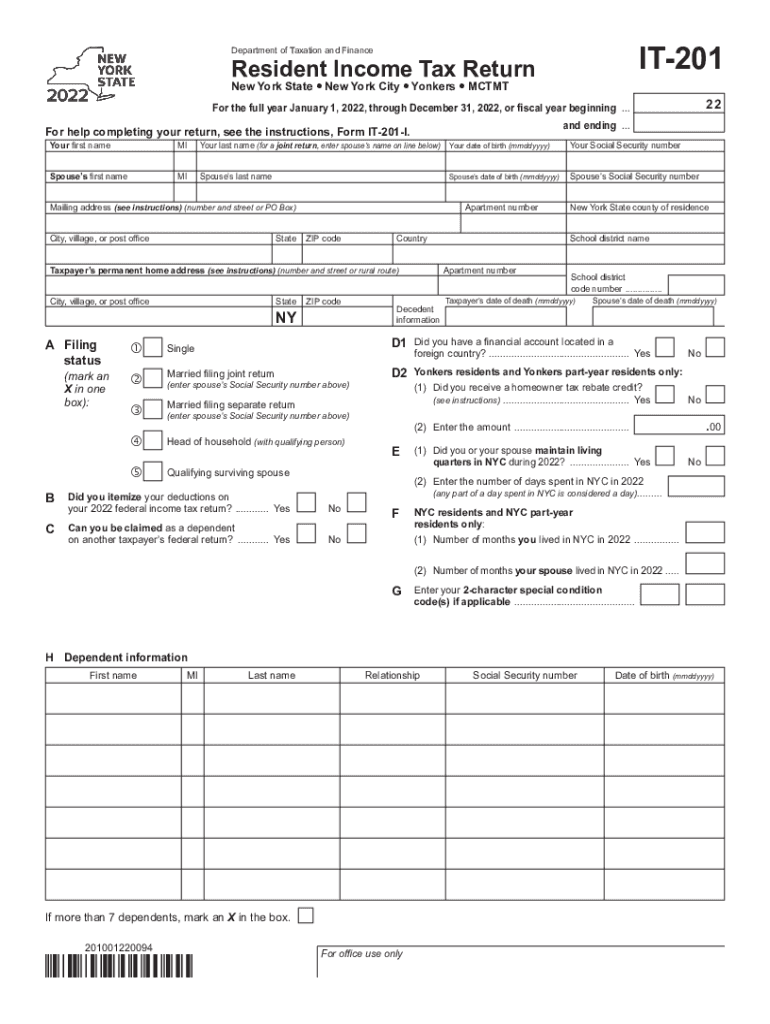

The New York State IT-201 form is the resident income tax return for individuals. It is specifically designed for residents of New York who need to report their income, claim deductions, and calculate their tax liability. The form is essential for individuals to ensure compliance with state tax regulations and to facilitate the accurate assessment of tax obligations. The IT-201 form is used to report various types of income, including wages, interest, dividends, and capital gains.

How to Obtain the Form IT-201

Individuals can obtain the New York State IT-201 form through several methods. The form is available for download in PDF format from the New York State Department of Taxation and Finance website. Additionally, taxpayers can request a paper copy to be mailed to them by contacting the department directly. Many tax preparation offices and libraries also provide printed copies of the IT-201 form for convenience.

Steps to Complete the Form IT-201

Completing the IT-201 form involves several key steps:

- Gather all necessary documentation, including W-2s, 1099s, and other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income in the appropriate sections of the form.

- Claim any applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability based on the provided tax tables.

- Sign and date the form before submission.

Key Elements of the Form IT-201

The IT-201 form includes several important sections that taxpayers must complete:

- Personal Information: This section requires basic identification details.

- Income Reporting: Taxpayers must list all income sources, including wages and investment income.

- Deductions and Credits: This section allows taxpayers to claim various deductions, such as the standard deduction or itemized deductions.

- Tax Calculation: Taxpayers must compute their tax liability using the information provided.

Filing Deadlines / Important Dates

For the 2022 tax year, the deadline to file the IT-201 form is typically April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of any changes to the filing deadline and ensure that they submit their forms on time to avoid penalties.

Form Submission Methods

Taxpayers have several options for submitting the IT-201 form:

- Online Filing: The form can be submitted electronically through approved e-filing services.

- Mail: Taxpayers can print the completed form and mail it to the appropriate address provided in the instructions.

- In-Person: Some individuals may choose to file their forms in person at designated tax offices.

Quick guide on how to complete form it 201 701659061

Effortlessly prepare Form It 201 on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can access the required form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form It 201 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven operation today.

How to adjust and eSign Form It 201 without hassle

- Obtain Form It 201 and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight essential sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to preserve your modifications.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your desktop.

Eliminate the worries of lost or misplaced documents, burdensome form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign Form It 201 and ensure exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 201 701659061

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ny tax form it 201 2022 used for?

The NY tax form IT-201 for 2022 is the personal income tax return that New York residents need to file. It helps in reporting your income, calculating taxes owed, and claiming credits or refunds. Properly completing this form is crucial for compliance and to avoid penalties.

-

How can airSlate SignNow assist with the ny tax form IT-201 2022?

AirSlate SignNow provides an easy-to-use platform for electronically signing and sending your NY tax form IT-201 2022 and other important documents. With user-friendly features, you can ensure that your forms are completed and submitted securely and efficiently. This saves you time and effort during tax season.

-

What are the pricing options for using airSlate SignNow?

AirSlate SignNow offers flexible pricing plans to accommodate various business needs. You can choose from a basic plan for individuals needing to manage documents or opt for advanced plans that include additional features and integrations. Regardless of the plan, handling documents like the NY tax form IT-201 2022 becomes seamless and cost-effective.

-

Can I integrate airSlate SignNow with other applications to manage the ny tax form IT-201 2022?

Yes, airSlate SignNow integrates with numerous applications, allowing you to manage your documents efficiently. Whether you use accounting software or your email suite, you can streamline the process of handling the NY tax form IT-201 2022 and other essential documents. This integration enhances productivity and reduces manual work.

-

Are there benefits to using airSlate SignNow for the ny tax form IT-201 2022?

Using airSlate SignNow for the NY tax form IT-201 2022 offers several benefits, including increased efficiency, reduced errors, and enhanced security. You'll be able to send and receive signed documents quickly, ensuring timely submission of your tax forms. Plus, eSignature technology simplifies the entire process, making tax filing less stressful.

-

Is airSlate SignNow compliant with tax regulations for the ny tax form IT-201 2022?

Yes, airSlate SignNow complies with various regulations, including those pertaining to electronic signatures and document management for tax forms like the NY tax form IT-201 2022. This compliance ensures that your digitally signed documents are legally valid and accepted by tax authorities, offering peace of mind during tax season.

-

How secure is airSlate SignNow when handling the ny tax form IT-201 2022?

AirSlate SignNow prioritizes security, utilizing advanced encryption and secure data transmission methods. When you handle sensitive documents like the NY tax form IT-201 2022 on our platform, your information is safeguarded against unauthorized access. You can trust airSlate SignNow to keep your tax documents confidential and secure.

Get more for Form It 201

- Quitclaim husband wife 497298316 form

- California life estate 497298317 form

- Ca husband wife 497298318 form

- Deed of rescission individual to individual california form

- Quitclaim deed four individuals to three individuals california form

- California warranty deed form

- California quitclaim deed 497298322 form

- Grant deed 497298323 form

Find out other Form It 201

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online