W 9 Revised January Form

What is the W-9 Revised January Form

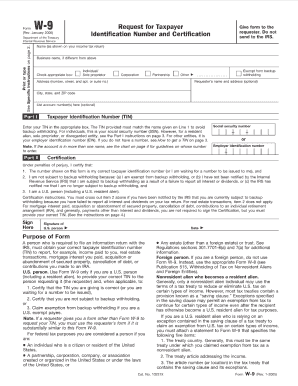

The W-9 Revised January Form is a tax document used in the United States by individuals and entities to provide their taxpayer identification information to another party. This form is essential for various financial transactions, including payments made to independent contractors, freelancers, and other service providers. By completing the W-9, the requester can accurately report income to the Internal Revenue Service (IRS). The form captures critical details such as the name, business name (if applicable), address, and taxpayer identification number (TIN), which can be a Social Security number or an Employer Identification Number.

How to use the W-9 Revised January Form

Using the W-9 Revised January Form involves a straightforward process. First, the requester must provide the form to the individual or entity from whom they need taxpayer information. The recipient fills out the required fields, ensuring accuracy in their details. Once completed, the form is returned to the requester, who retains it for their records. This form is not submitted directly to the IRS but is crucial for the requester to fulfill their tax reporting obligations. It is advisable to keep the form secure and confidential, as it contains sensitive information.

Steps to complete the W-9 Revised January Form

Completing the W-9 Revised January Form involves several key steps:

- Begin by entering your name as it appears on your tax return.

- If applicable, provide your business name in the designated field.

- Select the appropriate federal tax classification that applies to you, such as individual, corporation, or partnership.

- Fill in your address, including street, city, state, and ZIP code.

- Enter your taxpayer identification number (TIN) in the appropriate box.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the W-9 Revised January Form

The W-9 Revised January Form serves a legal purpose by ensuring that the requester has the necessary information to report payments to the IRS accurately. This form is particularly important for compliance with tax regulations, as it helps prevent issues related to underreporting income. The information provided on the W-9 is protected under privacy laws, and both parties must handle it with care to avoid unauthorized disclosure. Proper completion of the form can also mitigate potential penalties for non-compliance with tax reporting requirements.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the W-9 Revised January Form. According to IRS regulations, the form should be completed whenever a business or individual is required to report payments made to another party. The IRS emphasizes the importance of accuracy in the information provided to avoid discrepancies during tax filing. Additionally, the form must be updated if there are any changes to the taxpayer's information, such as a change in name or TIN. It is essential to refer to the latest IRS instructions for any updates or changes related to the form's use.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the W-9 Revised January Form can lead to significant penalties. If a requester does not obtain a completed W-9 from a payee, they may face backup withholding on payments made, which is typically at a rate of twenty-four percent. Additionally, inaccuracies in the information reported to the IRS can result in fines and interest charges. It is crucial for both parties to ensure the form is correctly completed and maintained to avoid these potential penalties.

Quick guide on how to complete w 9 revised january form

Effectively Manage W 9 Revised January Form on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers a superb environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the appropriate template and securely save it online. airSlate SignNow equips you with all the tools necessary to produce, modify, and electronically sign your documents rapidly without delays. Manage W 9 Revised January Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest way to modify and electronically sign W 9 Revised January Form effortlessly

- Locate W 9 Revised January Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign W 9 Revised January Form and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 9 revised january form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the W 9 Revised January Form used for?

The W 9 Revised January Form is used by individuals and businesses to provide their taxpayer identification information to entities that will report income paid to them to the IRS. This form is essential for ensuring correct tax reporting and avoiding penalties due to incorrect information.

-

How can I fill out the W 9 Revised January Form using airSlate SignNow?

With airSlate SignNow, you can easily fill out the W 9 Revised January Form online. Simply upload the form to our platform, and utilize our user-friendly editing tools to complete the fields accurately before sending it for eSignature.

-

Is there a cost associated with using airSlate SignNow for the W 9 Revised January Form?

Yes, airSlate SignNow offers various pricing plans to fit your business needs. Our plans provide unlimited access to features like eSigning, document storage, and form templates, including the W 9 Revised January Form, at a cost-effective rate.

-

What are the benefits of using airSlate SignNow for the W 9 Revised January Form?

Using airSlate SignNow for the W 9 Revised January Form streamlines the document signing process and enhances efficiency. You'll benefit from secure document storage, automated reminders for signatories, and the ability to track submission status, which simplifies tax compliance.

-

Can I integrate airSlate SignNow with other applications when using the W 9 Revised January Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems. This flexibility allows you to manage your documents, including the W 9 Revised January Form, directly from your preferred platforms.

-

What security measures does airSlate SignNow have in place for the W 9 Revised January Form?

airSlate SignNow places top priority on document security with features like data encryption and secure servers. When you fill out and send the W 9 Revised January Form using our platform, you can trust that your information is protected against unauthorized access.

-

Is it easy to send the W 9 Revised January Form for eSignature with airSlate SignNow?

Yes, sending the W 9 Revised January Form for eSignature is simple with airSlate SignNow. Just select your recipients, add any necessary instructions, and hit send—your recipients will receive an email notification to sign electronically.

Get more for W 9 Revised January Form

- Joint tenancy deed form

- History department gsrstaff appointment ucla chavez form

- Job shadow informational interview questions

- Financial contribution verification huntsville housing authority huntsvillehousing form

- Power of attorney alaska department of labor and labor alaska form

- Power of attorney alaska department of labor form

- Calista direct deposit form

- Arrl radiogram software form

Find out other W 9 Revised January Form

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple