What Credit is Available for Taxes Paid to Another State? Form

What credit is available for taxes paid to another state?

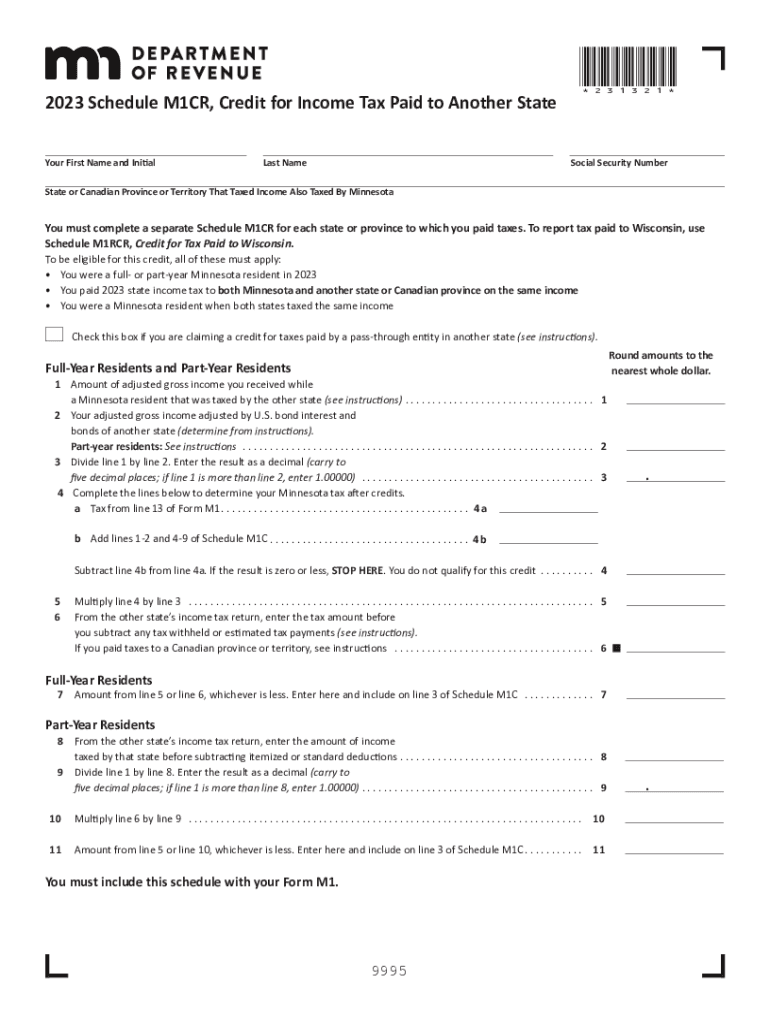

The Minnesota credit state form provides taxpayers with the opportunity to claim a credit for income taxes paid to another state. This credit helps to alleviate the burden of double taxation for residents who earn income in multiple states. It is essential for individuals to understand the specific criteria that qualify them for this credit, as well as the limitations that may apply.

Eligible taxpayers can receive a credit for the lesser of the income tax paid to the other state or the amount of Minnesota tax attributable to that income. This ensures that taxpayers are not unfairly taxed on the same income in both states.

Steps to complete the Minnesota credit state form

Completing the Minnesota credit state form involves several straightforward steps. First, gather all relevant documents, including tax returns from the other state and any supporting documentation of taxes paid. Next, accurately fill out the form, ensuring that all income earned in the other state is reported correctly.

Once the form is completed, double-check for accuracy before submitting it. It is crucial to provide any required attachments, such as copies of the other state's tax return, to support your claim. Finally, submit the form by the appropriate deadline to ensure that you receive your credit without delay.

Eligibility criteria for the Minnesota credit state form

To qualify for the Minnesota credit state form, taxpayers must meet specific eligibility criteria. Primarily, the taxpayer must be a resident of Minnesota and have paid income tax to another state on income earned outside Minnesota. Additionally, the income must be taxable in both states to qualify for the credit.

Taxpayers should also ensure that they have filed a tax return in the other state for the income they are claiming. Understanding these criteria is vital for successfully claiming the credit and avoiding potential issues with tax compliance.

Required documents for the Minnesota credit state form

When preparing to submit the Minnesota credit state form, taxpayers must gather several important documents. These typically include:

- A copy of the tax return from the other state where income tax was paid.

- Proof of payment for the taxes owed to the other state, such as payment receipts or bank statements.

- The completed Minnesota credit state form itself, which details the income and taxes paid.

Having these documents ready will facilitate a smoother filing process and help ensure that all necessary information is provided to support your claim.

Form submission methods for the Minnesota credit state form

Taxpayers have several options for submitting the Minnesota credit state form. The form can be filed online through the Minnesota Department of Revenue's website, which offers a convenient way to complete and submit the form electronically. Alternatively, taxpayers may choose to print the form and submit it by mail.

For those who prefer in-person submission, visiting a local Department of Revenue office is also an option. Regardless of the submission method chosen, it is important to keep copies of all documents for personal records.

Penalties for non-compliance with the Minnesota credit state form

Failing to comply with the requirements of the Minnesota credit state form can lead to significant penalties. Taxpayers who do not file the form or provide inaccurate information may face fines or additional tax assessments. In some cases, the Minnesota Department of Revenue may also impose interest on any unpaid taxes resulting from non-compliance.

To avoid these penalties, it is crucial for taxpayers to ensure that they accurately complete the form and adhere to all filing deadlines. Understanding the importance of compliance will help taxpayers navigate their obligations effectively.

Quick guide on how to complete what credit is available for taxes paid to another state

Effortlessly Create What Credit Is Available For Taxes Paid To Another State? on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage What Credit Is Available For Taxes Paid To Another State? on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Method to Modify and Electronically Sign What Credit Is Available For Taxes Paid To Another State? with Ease

- Locate What Credit Is Available For Taxes Paid To Another State? and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review all information and click on the Done button to save your updates.

- Select how you want to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign What Credit Is Available For Taxes Paid To Another State? and maintain excellent communication at any stage of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the what credit is available for taxes paid to another state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Minnesota credit state form get and why is it important?

The Minnesota credit state form get is a crucial document for individuals and businesses seeking tax credits in Minnesota. It simplifies the process of applying for credits, ensuring that you can maximize your tax benefits efficiently. Completing this form accurately can lead to signNow savings or refunds, making it essential for eligible residents and businesses.

-

How do I obtain the Minnesota credit state form get?

You can obtain the Minnesota credit state form get directly from the Minnesota Department of Revenue's website. Alternatively, our airSlate SignNow platform allows for easy access and management of this form to streamline your application process. Our solution ensures that you have the latest version of the form and can fill it out efficiently.

-

Is there a cost associated with using airSlate SignNow for the Minnesota credit state form get?

Using airSlate SignNow provides a cost-effective solution for managing your Minnesota credit state form get. While there is a subscription fee for our services, it often pays for itself through time savings and enhanced efficiency. Our pricing plans are designed to accommodate businesses of all sizes without breaking the bank.

-

Can I eSign the Minnesota credit state form get using airSlate SignNow?

Yes, you can easily eSign the Minnesota credit state form get using airSlate SignNow. Our platform simplifies the process of electronically signing documents, ensuring quick and secure submissions. This feature is particularly beneficial for busy professionals who need to manage documents efficiently.

-

What features does airSlate SignNow offer for the Minnesota credit state form get?

AirSlate SignNow provides a variety of features for managing the Minnesota credit state form get, including document templates, customizable workflows, and real-time collaboration. These tools enhance your ability to complete and submit forms accurately and quickly. Additionally, our secure storage ensures your documents are safe and easily accessible.

-

Can I integrate airSlate SignNow with other software for the Minnesota credit state form get?

Absolutely! AirSlate SignNow integrates seamlessly with various software applications, allowing you to manage the Minnesota credit state form get alongside your existing tools. This integration capability enhances your workflow efficiency and streamlines the data entry process, minimizing manual work.

-

What are the benefits of using airSlate SignNow for the Minnesota credit state form get?

Using airSlate SignNow for the Minnesota credit state form get provides numerous benefits, including increased efficiency, enhanced security, and improved accuracy. Our user-friendly platform reduces the time spent on paperwork and minimizes errors, allowing you to focus on what truly matters—growing your business.

Get more for What Credit Is Available For Taxes Paid To Another State?

- Roofing contract for contractor delaware form

- Electrical contract for contractor delaware form

- Sheetrock drywall contract for contractor delaware form

- Flooring contract for contractor delaware form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract delaware form

- Notice of intent to enforce forfeiture provisions of contact for deed delaware form

- Final notice of forfeiture and request to vacate property under contract for deed delaware form

- Buyers request for accounting from seller under contract for deed delaware form

Find out other What Credit Is Available For Taxes Paid To Another State?

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free