Form M1PR, Homestead Credit Refund Fill Out & Sign Online

What is the M1PR Form and Its Purpose?

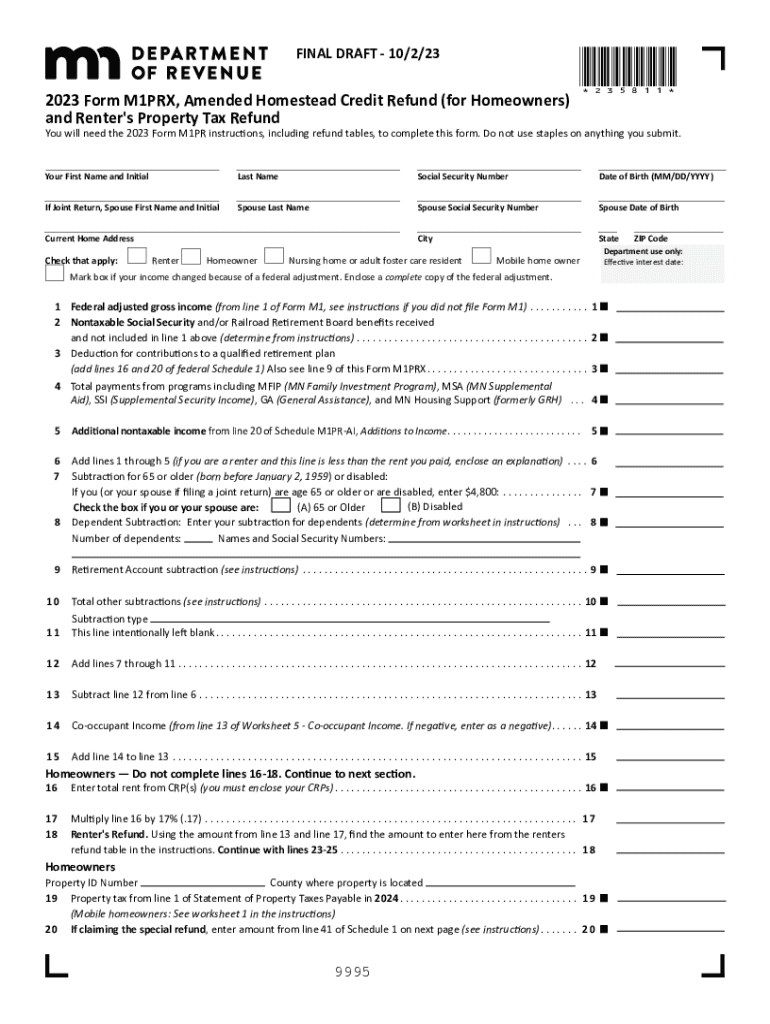

The M1PR form, officially known as the Minnesota Homestead Credit Refund, is designed to provide property tax relief to eligible homeowners in Minnesota. This form allows residents to apply for a refund based on their property taxes and income. It is particularly beneficial for those who may struggle to meet their property tax obligations, ensuring that homeownership remains accessible and affordable.

Eligibility Criteria for the M1PR Form

To qualify for the M1PR refund, applicants must meet specific criteria, including:

- Being a Minnesota resident for at least half of the year.

- Owning and occupying the property as their primary residence.

- Meeting income limits set by the state, which vary depending on household size.

- Having paid property taxes on the homestead during the tax year.

Steps to Complete the M1PR Form

Completing the M1PR form involves several key steps:

- Gather necessary documents, including your property tax statement and income information.

- Fill out the M1PR form, ensuring all sections are completed accurately.

- Double-check your calculations, particularly regarding income and property taxes paid.

- Submit the form by the deadline, either online or via mail, to the Minnesota Department of Revenue.

Form Submission Methods for the M1PR

There are several ways to submit the M1PR form:

- Online: Use the Minnesota Department of Revenue's online filing system for a quick and efficient submission.

- By Mail: Print the completed form and send it to the appropriate address provided in the instructions.

- In-Person: Visit your local county assessor's office to submit the form directly.

Required Documents for M1PR Filing

When filing the M1PR form, applicants must provide certain documents to support their claim:

- Your most recent property tax statement.

- Proof of income, such as W-2 forms or tax returns.

- Any additional documentation that verifies eligibility, such as proof of residency.

Key Elements of the M1PR Form

The M1PR form includes several essential sections that need to be completed:

- Personal Information: Name, address, and Social Security number of the applicant.

- Property Information: Details about the property, including its address and tax identification number.

- Income Information: Total household income, including all sources of revenue.

- Property Taxes Paid: Amount of property taxes paid during the year for which the refund is being claimed.

Quick guide on how to complete form m1pr homestead credit refund fill out amp sign online

Prepare Form M1PR, Homestead Credit Refund Fill Out & Sign Online seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly and without delays. Manage Form M1PR, Homestead Credit Refund Fill Out & Sign Online on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Form M1PR, Homestead Credit Refund Fill Out & Sign Online effortlessly

- Locate Form M1PR, Homestead Credit Refund Fill Out & Sign Online and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form M1PR, Homestead Credit Refund Fill Out & Sign Online and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form m1pr homestead credit refund fill out amp sign online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Minnesota M1PRX?

Minnesota M1PRX is a robust digital solution offered by airSlate SignNow, designed to streamline the e-signature process for businesses. This tool enables users to send, sign, and manage documents securely and efficiently. Ideal for companies in Minnesota, M1PRX ensures compliance with local regulations and offers a seamless user experience.

-

How much does Minnesota M1PRX cost?

Pricing for Minnesota M1PRX varies based on the specific features and the number of users. airSlate SignNow offers flexible subscription plans that cater to different business needs. By investing in Minnesota M1PRX, businesses can reduce overhead costs associated with traditional document handling.

-

What features are included with Minnesota M1PRX?

Minnesota M1PRX includes a variety of features such as customizable templates, automated workflows, and real-time tracking of document status. Users can also benefit from advanced security measures, ensuring that all signed documents are protected. These features enhance productivity and facilitate a paperless environment.

-

Can Minnesota M1PRX integrate with other software?

Yes, Minnesota M1PRX seamlessly integrates with popular business applications such as Salesforce, Google Drive, and Microsoft Office. This integration capability allows users to manage their documents without switching between platforms. Consequently, businesses can improve efficiency and maintain a streamlined workflow.

-

What are the benefits of using Minnesota M1PRX?

Using Minnesota M1PRX provides numerous benefits including increased efficiency, cost savings, and enhanced security for document management. The e-signature solution allows for quicker turnaround times on contracts and agreements, improving overall business operations. Additionally, businesses can enjoy a more environmentally friendly approach to document handling.

-

Is Minnesota M1PRX suitable for all types of businesses?

Absolutely! Minnesota M1PRX is versatile and can cater to businesses of all sizes, from startups to large enterprises. Its user-friendly interface and flexible features make it an ideal solution for various industries seeking to optimize their document workflow. Regardless of the sector, any business can benefit from the capabilities of Minnesota M1PRX.

-

How secure is Minnesota M1PRX for document signing?

Security is a top priority for Minnesota M1PRX, which employs advanced encryption and authentication measures to protect sensitive information. Signers can be assured that their data is secure against unauthorized access. With airSlate SignNow's compliance with industry standards, users can confidently manage their electronic documents.

Get more for Form M1PR, Homestead Credit Refund Fill Out & Sign Online

- Concrete mason contractor package maine form

- Demolition contractor package maine form

- Security contractor package maine form

- Insulation contractor package maine form

- Paving contractor package maine form

- Site work contractor package maine form

- Siding contractor package maine form

- Refrigeration contractor package maine form

Find out other Form M1PR, Homestead Credit Refund Fill Out & Sign Online

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF