Minnesota Tax Form M1M

What is the Minnesota Tax Form M1M

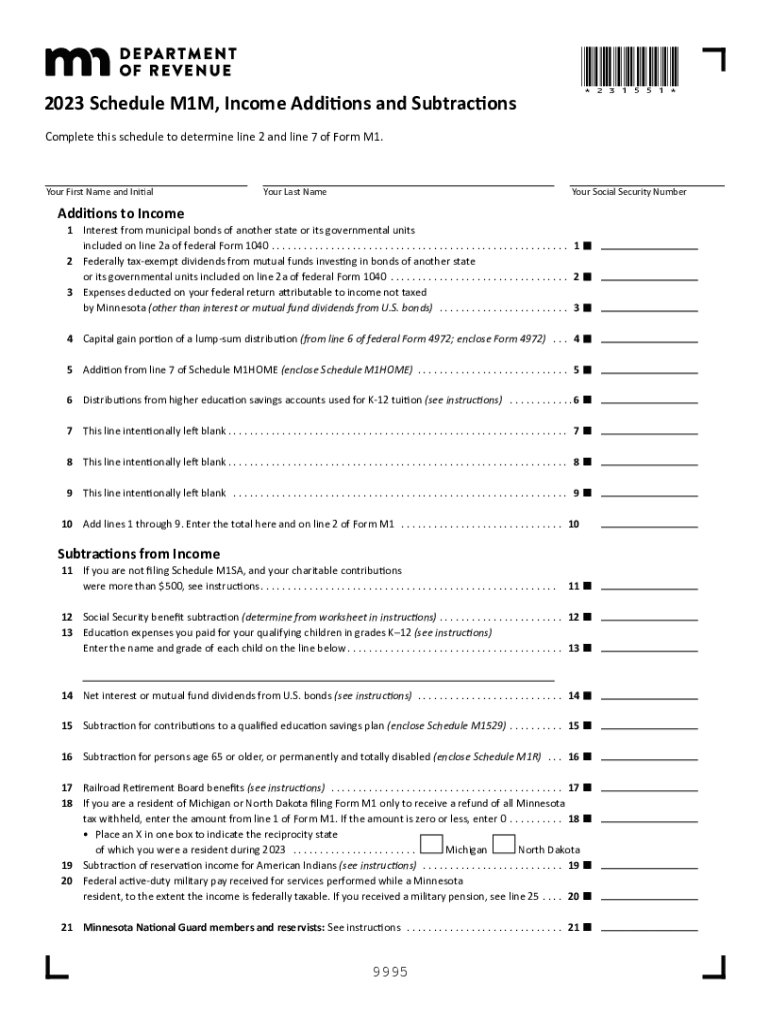

The Minnesota Schedule M1M is a tax form used by residents of Minnesota to report modifications to their federal taxable income. This form is essential for individuals who need to adjust their income due to specific state tax laws. The M1M form allows taxpayers to account for various additions and subtractions that impact their overall state tax liability. Understanding this form is crucial for accurate tax reporting and compliance with Minnesota tax regulations.

How to use the Minnesota Tax Form M1M

Using the Minnesota Schedule M1M involves several steps to ensure accurate reporting. Taxpayers should begin by gathering their federal tax return, as this will serve as the basis for adjustments. The form requires individuals to list any additions or subtractions to their federal taxable income, such as state tax refunds or certain deductions that are not applicable for state tax purposes. It is important to carefully follow the instructions provided with the form to ensure all necessary information is included.

Steps to complete the Minnesota Tax Form M1M

Completing the Minnesota Schedule M1M requires a systematic approach:

- Start with your federal tax return to determine your federal taxable income.

- Identify any necessary adjustments that apply to your situation, such as state tax refunds or specific deductions.

- Fill out the M1M form by entering your federal taxable income and then applying the identified adjustments.

- Double-check all entries for accuracy and ensure that all required fields are completed.

- Submit the completed form alongside your Minnesota tax return.

Filing Deadlines / Important Dates

For the Minnesota Schedule M1M, it is crucial to adhere to specific filing deadlines. Typically, the deadline for filing state tax returns, including the M1M form, aligns with the federal tax deadline, which is usually April 15. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any potential extensions that may apply to their situation, ensuring timely submission to avoid penalties.

Required Documents

To accurately complete the Minnesota Schedule M1M, taxpayers should prepare several documents:

- Your federal tax return, which provides the basis for the M1M adjustments.

- Any supporting documentation for deductions or additions, such as W-2s, 1099s, or records of state tax refunds.

- Previous year’s tax returns, if applicable, to reference past adjustments and ensure consistency.

Key elements of the Minnesota Tax Form M1M

The Minnesota Schedule M1M includes several key elements that taxpayers must understand:

- Additions: These are items that increase your taxable income, such as certain business income or tax-exempt interest.

- Subtractions: These reduce your taxable income and may include items like state tax refunds or specific deductions.

- Instructions: Detailed guidelines are provided to help taxpayers navigate the form and ensure compliance with state tax laws.

Quick guide on how to complete minnesota tax form m1m

Complete Minnesota Tax Form M1M effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without issues. Manage Minnesota Tax Form M1M on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The easiest way to edit and eSign Minnesota Tax Form M1M without hassle

- Find Minnesota Tax Form M1M and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Edit and eSign Minnesota Tax Form M1M and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minnesota tax form m1m

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Minnesota Schedule M1M, and why is it important?

The Minnesota Schedule M1M is a critical document for residents of Minnesota, used to report adjustments to income on your state tax return. Understanding this schedule is essential for accurate tax filing, ensuring you don't miss deductions or credits you may qualify for.

-

How does airSlate SignNow streamline the process for completing the Minnesota Schedule M1M?

With airSlate SignNow, you can easily create, send, and eSign your Minnesota Schedule M1M documents online. Our user-friendly platform simplifies the document workflow, allowing you to focus on your financial calculations instead of paperwork.

-

Is there a cost associated with using airSlate SignNow for the Minnesota Schedule M1M?

airSlate SignNow offers various pricing plans to cater to different budget needs, ensuring affordability for individuals and businesses looking to manage their Minnesota Schedule M1M forms. You can choose a plan that offers the best features suited to your requirements.

-

What features does airSlate SignNow offer specifically for Minnesota Schedule M1M users?

airSlate SignNow provides features like document templates, automated workflows, and secure eSigning, making it easier for users to manage their Minnesota Schedule M1M. These features enhance efficiency, reduce errors, and save time in document management.

-

Can airSlate SignNow integrate with accounting software for handling the Minnesota Schedule M1M?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, ensuring your Minnesota Schedule M1M aligns with your financial records. This integration allows for efficient data transfer and helps eliminate reconciliation issues.

-

How secure is the eSigning process for the Minnesota Schedule M1M with airSlate SignNow?

The eSigning process for the Minnesota Schedule M1M through airSlate SignNow is highly secure. We utilize industry-standard encryption and authentication protocols, ensuring that your sensitive tax documents are safely signed and stored.

-

What are the benefits of using airSlate SignNow for my Minnesota Schedule M1M compared to traditional methods?

Using airSlate SignNow to handle your Minnesota Schedule M1M offers signNow benefits over traditional methods, such as reduced turnaround time, improved organization, and easier access to documents. You can also collaborate in real-time with your accountant or tax preparer.

Get more for Minnesota Tax Form M1M

- March of dimes donation form 62338795

- Classifying chemical reactions worksheet form

- Personal assessment wheel alycia hall form

- Belmont personal supplement form

- Annual report form for guardian filing individually dallas county dallascounty

- Pool party booking form pdf

- Over the counter otc benefit catalog keystone first vip form

- Private pay laboratory requisition panorama nipt form

Find out other Minnesota Tax Form M1M

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online