Income Tax Fact Sheet 8, K 12 Education Subtraction and Form

Understanding the K-12 Education Subtraction

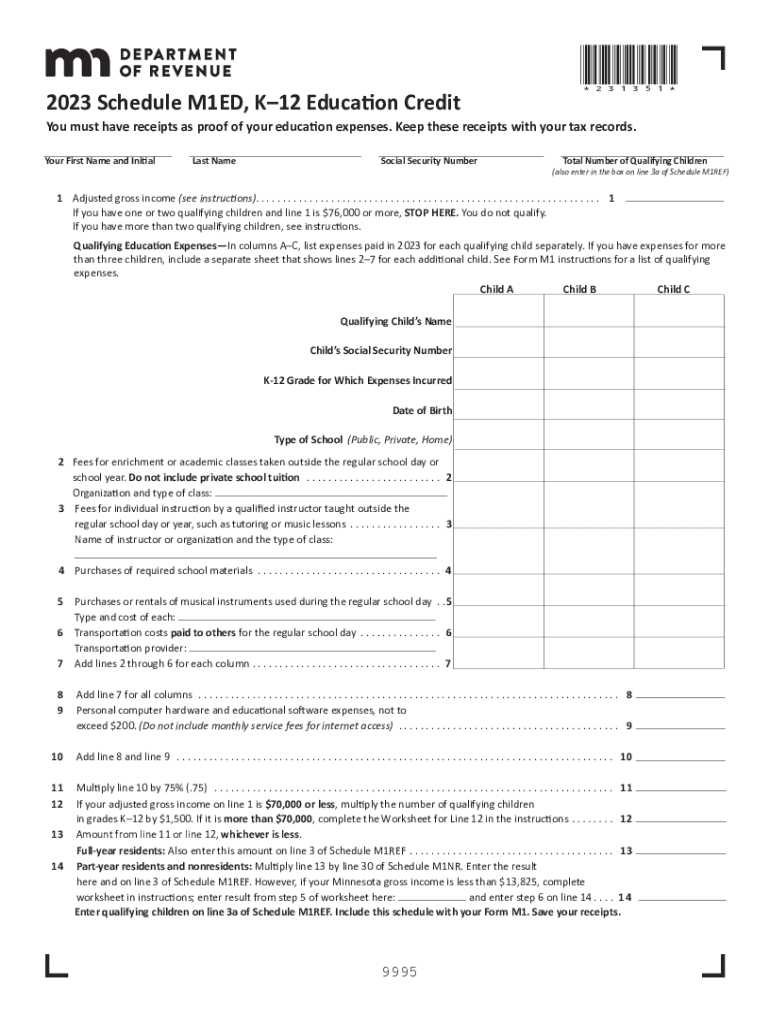

The K-12 education subtraction allows eligible taxpayers in Minnesota to subtract certain education-related expenses from their taxable income. This deduction is designed to alleviate some of the financial burdens associated with K-12 education costs. Eligible expenses may include tuition, textbooks, and other necessary educational materials. Understanding the specifics of this subtraction is crucial for maximizing potential tax benefits.

Eligibility Criteria for the K-12 Education Subtraction

To qualify for the K-12 education subtraction, taxpayers must meet specific criteria. The eligible expenses must be incurred for students enrolled in K-12 education within Minnesota. Additionally, the expenses must be for items that are not covered by other forms of financial aid or assistance. It is important to keep detailed records of all expenses to ensure compliance with eligibility requirements.

Steps to Complete the K-12 Education Subtraction

Completing the K-12 education subtraction involves several key steps:

- Gather all relevant documentation, including receipts for tuition and educational materials.

- Determine the total amount of eligible expenses incurred during the tax year.

- Fill out the appropriate section on your Minnesota tax return, ensuring accuracy in reporting the subtraction.

- Submit your tax return by the designated deadline to ensure you receive the benefits of the subtraction.

Important Dates and Filing Deadlines

Taxpayers should be aware of important dates related to the K-12 education subtraction. Typically, the tax filing deadline for individual taxpayers is April 15. However, it is advisable to check for any updates or changes to deadlines each tax year. Filing early can help avoid potential delays in processing and ensure you receive any applicable refunds promptly.

Required Documents for the K-12 Education Subtraction

When claiming the K-12 education subtraction, taxpayers must provide specific documentation to support their claims. Required documents include:

- Receipts for tuition payments made to educational institutions.

- Invoices for educational materials such as textbooks and supplies.

- Any additional documentation that verifies the eligibility of the expenses claimed.

Examples of Eligible Expenses for the K-12 Education Subtraction

Eligible expenses under the K-12 education subtraction can vary. Common examples include:

- Tuition fees paid to private or charter schools.

- Costs associated with purchasing textbooks and other educational materials.

- Fees for extracurricular activities that are necessary for the student's education.

Understanding what qualifies as an eligible expense can help taxpayers maximize their deductions and reduce their overall tax liability.

Quick guide on how to complete income tax fact sheet 8 k 12 education subtraction and

Effortlessly Set Up Income Tax Fact Sheet 8, K 12 Education Subtraction And on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents rapidly without any delays. Handle Income Tax Fact Sheet 8, K 12 Education Subtraction And on any device using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The simplest method to edit and eSign Income Tax Fact Sheet 8, K 12 Education Subtraction And effortlessly

- Locate Income Tax Fact Sheet 8, K 12 Education Subtraction And and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your updates.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Income Tax Fact Sheet 8, K 12 Education Subtraction And and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax fact sheet 8 k 12 education subtraction and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it support k 12 education?

airSlate SignNow is a digital signature and document management platform that streamlines the process of sending and signing documents. In the realm of k 12 education, it enhances administrative efficiency by enabling schools to handle permission slips, enrollment forms, and other essential documents quickly and securely.

-

How much does airSlate SignNow cost for k 12 education institutions?

airSlate SignNow offers competitive pricing tailored for k 12 education institutions, ensuring budget-friendly options. Schools can choose from various plans that fit their size and needs, often resulting in signNow cost savings compared to traditional paper-based processes.

-

What features does airSlate SignNow offer that benefit k 12 education?

The platform offers a range of features beneficial for k 12 education, including custom workflows, secure document storage, and real-time tracking of signatures. These features help educators and administrators manage documents more efficiently, allowing them to focus on student engagement and learning.

-

Can airSlate SignNow integrate with other tools used in k 12 education?

Yes, airSlate SignNow seamlessly integrates with many tools commonly used in k 12 education, such as Google Drive, Microsoft Office, and various learning management systems. This integration ensures that schools can incorporate electronic signatures into their existing workflows without disruption.

-

How does airSlate SignNow enhance security for k 12 education documents?

Security is a top priority for airSlate SignNow, especially in the context of k 12 education. The platform features advanced encryption, secure cloud storage, and compliance with various educational data regulations, ensuring that sensitive documents are protected throughout their lifecycle.

-

Is airSlate SignNow easy to use for staff in k 12 education?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for educators and administrators in k 12 education to adopt the technology without extensive training. This ease of use helps ensure quick implementation and efficient document handling.

-

What benefits can k 12 education institutions expect from using airSlate SignNow?

By adopting airSlate SignNow, k 12 education institutions can expect improved efficiency, reduced paperwork, and quicker turnaround times for approvals. This translates into more time for educators to focus on teaching and less time managing administrative tasks.

Get more for Income Tax Fact Sheet 8, K 12 Education Subtraction And

- Quitclaim deed by two individuals to husband and wife michigan form

- Warranty deed from two individuals to husband and wife michigan form

- Michigan lady bird deed pdf form

- Michigan quitclaim deed form

- Quitclaim deed from limited liability company as grantor and husband and wife as grantees michigan form

- Quitclaim deed from grantor trust to five individual grantees michigan form

- Quitclaim deed husband and wife to three individuals michigan form

- Quitclaim deed husband wife 497311324 form

Find out other Income Tax Fact Sheet 8, K 12 Education Subtraction And

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed