M11L, Insurance Premium Tax Return for Life and Health Companies Form

What is the M11L, Insurance Premium Tax Return For Life And Health Companies

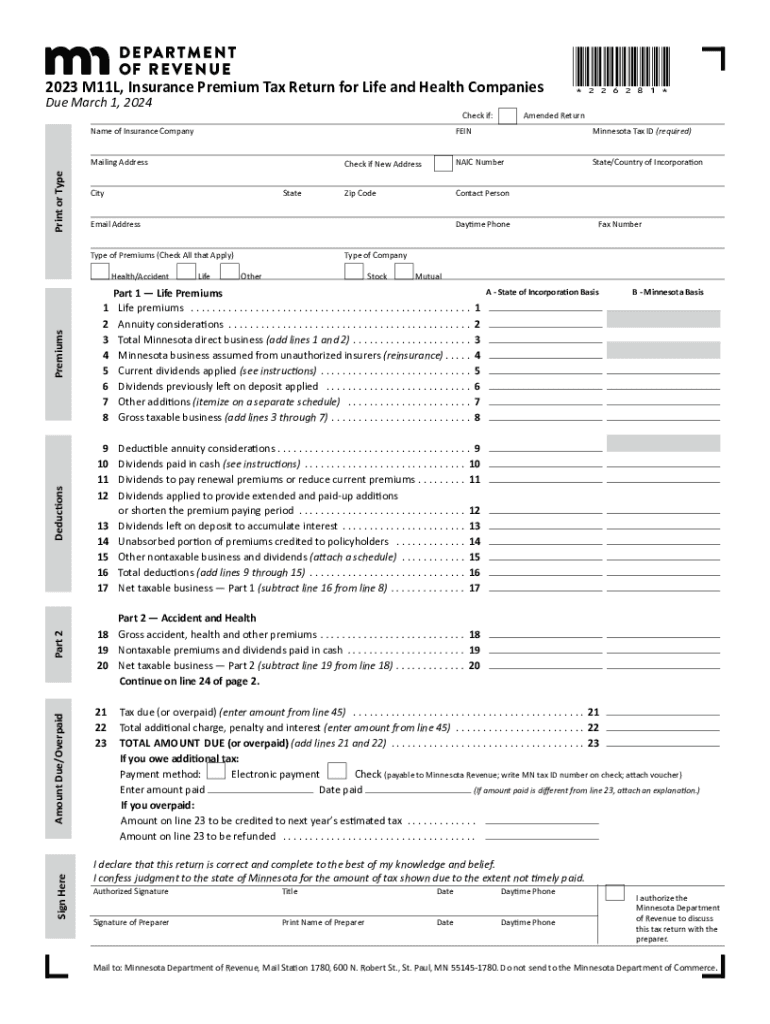

The M11L, Insurance Premium Tax Return for Life and Health Companies, is a specific tax form used by life and health insurance providers in the United States. This form is essential for reporting premium taxes owed to the state. It ensures that insurance companies comply with state regulations regarding premium taxation. The M11L form captures vital financial information, including total premiums collected and applicable deductions, which ultimately determine the tax liability of the company.

How to use the M11L, Insurance Premium Tax Return For Life And Health Companies

Using the M11L form requires careful attention to detail and an understanding of the specific requirements set by state authorities. Insurance companies must first gather all necessary financial data related to premiums collected during the reporting period. Once the data is compiled, the form can be filled out, ensuring that all sections are completed accurately. After completing the form, companies must submit it according to the state’s guidelines, which may include electronic filing or mailing a physical copy.

Steps to complete the M11L, Insurance Premium Tax Return For Life And Health Companies

Completing the M11L involves several key steps:

- Gather relevant financial documents, including premium income statements and any applicable deductions.

- Fill out the M11L form, ensuring all sections are completed accurately, including company information and financial data.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the deadline specified by the state, either electronically or via mail, depending on the state’s requirements.

Required Documents

To complete the M11L form, certain documents are essential. These typically include:

- Detailed records of premiums collected during the reporting period.

- Documentation of any deductions or exemptions applicable to the company.

- Prior year’s tax returns, if available, for reference and consistency.

Filing Deadlines / Important Dates

Filing deadlines for the M11L form can vary by state, but it is crucial for insurance companies to be aware of these dates to avoid penalties. Generally, the form must be submitted annually, and many states require it to be filed by a specific date, often aligned with the end of the fiscal year. Companies should check their state’s tax authority for the exact deadline to ensure timely compliance.

Penalties for Non-Compliance

Failure to file the M11L form on time or inaccuracies in reporting can result in significant penalties for insurance companies. These penalties may include fines, interest on unpaid taxes, and potential legal action from state authorities. It is essential for companies to understand the consequences of non-compliance and to take all necessary steps to ensure accurate and timely submissions.

Quick guide on how to complete m11l insurance premium tax return for life and health companies

Accomplish M11L, Insurance Premium Tax Return For Life And Health Companies effortlessly on any gadget

Digital document management has become increasingly popular among companies and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and eSign your documents quickly without waiting. Manage M11L, Insurance Premium Tax Return For Life And Health Companies on any device with airSlate SignNow Android or iOS applications and simplify any document-oriented process today.

The easiest way to modify and eSign M11L, Insurance Premium Tax Return For Life And Health Companies with ease

- Find M11L, Insurance Premium Tax Return For Life And Health Companies and click Get Form to begin.

- Utilize the resources we provide to fill out your form.

- Emphasize key sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal authority as a standard wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries over lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document versions. airSlate SignNow addresses your needs in document management in just a few clicks from a device of your preference. Edit and eSign M11L, Insurance Premium Tax Return For Life And Health Companies and assure excellent communication at any point of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m11l insurance premium tax return for life and health companies

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M11L, Insurance Premium Tax Return For Life And Health Companies?

The M11L, Insurance Premium Tax Return For Life And Health Companies, is a specific tax return form designed for reporting insurance premiums collected by life and health insurance companies. It helps ensure compliance with tax regulations and provides important financial insights for your business.

-

How can airSlate SignNow assist with the M11L, Insurance Premium Tax Return For Life And Health Companies?

airSlate SignNow streamlines the document signing process needed for the M11L, Insurance Premium Tax Return For Life And Health Companies. Our platform allows you to easily prepare, send, and eSign your tax return documents, ensuring quick compliance and efficient workflow.

-

What are the pricing options available for using airSlate SignNow for M11L, Insurance Premium Tax Return For Life And Health Companies?

airSlate SignNow offers several pricing plans tailored to meet the needs of different businesses, regardless of size. With our cost-effective solutions, you can access essential features for managing the M11L, Insurance Premium Tax Return For Life And Health Companies without straining your budget.

-

What features should I expect from airSlate SignNow when handling the M11L, Insurance Premium Tax Return For Life And Health Companies?

With airSlate SignNow, you can expect features like secure eSigning, document templates, and real-time tracking for the M11L, Insurance Premium Tax Return For Life And Health Companies. These tools can enhance your efficiency, minimize errors, and keep your data secure throughout the process.

-

Are there any benefits of using airSlate SignNow for insurance companies filing the M11L, Insurance Premium Tax Return?

Using airSlate SignNow provides signNow benefits for insurance companies filing the M11L, Insurance Premium Tax Return For Life And Health Companies, such as improved turnaround times and reduced paperwork. Our platform also offers audit trails to ensure compliance and validate submissions.

-

Can I integrate airSlate SignNow with other software for the M11L, Insurance Premium Tax Return For Life And Health Companies?

Yes, airSlate SignNow offers integrations with various software to enhance your workflow when preparing the M11L, Insurance Premium Tax Return For Life And Health Companies. Seamless connectivity with CRM and accounting software ensures that all relevant data is easily accessible.

-

Is airSlate SignNow secure for managing the M11L, Insurance Premium Tax Return For Life And Health Companies?

Absolutely! airSlate SignNow implements top-notch security measures to protect your data when handling the M11L, Insurance Premium Tax Return For Life And Health Companies. Our platform complies with industry standards, ensuring that your documents and personal information remain confidential.

Get more for M11L, Insurance Premium Tax Return For Life And Health Companies

- Michigan order pdf form

- Unlawful detainer forms

- Michigan verified statement form

- Michigan tenants rights form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497311609 form

- Notices resolutions simple stock ledger and certificate michigan form

- Minutes for organizational meeting michigan michigan form

- Michigan file form

Find out other M11L, Insurance Premium Tax Return For Life And Health Companies

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy