Form 8915 Irs

What is the Form 8915 Irs

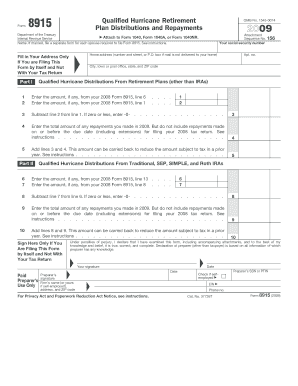

Form 8915 is a tax form issued by the IRS, specifically designed for taxpayers who have taken distributions from their retirement accounts due to the COVID-19 pandemic. This form allows individuals to report these distributions and potentially spread the tax liability over three years. The form is essential for those who want to take advantage of the special tax treatment provided under the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

How to use the Form 8915 Irs

To use Form 8915, taxpayers must first determine if they qualify for the special distribution rules. Eligible distributions include those taken from retirement accounts like IRAs and 401(k)s. Once eligibility is confirmed, the individual can fill out the form to report the amount of the distribution and the portion of the distribution they plan to include in their taxable income for the current tax year. The form also allows taxpayers to indicate how they will treat the distribution over the next two years.

Steps to complete the Form 8915 Irs

Completing Form 8915 involves several key steps:

- Gather necessary documents, including your retirement account statements and any previous tax returns.

- Determine the total amount of distributions taken from your retirement accounts during the eligible period.

- Fill out the form by entering your personal information and the distribution details.

- Calculate the taxable amount for the current year and the amounts to report for the following two years.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Form 8915 must be filed along with your annual tax return. For most taxpayers, the deadline for filing is typically April 15 of the following year. However, if you are unable to meet this deadline, you may file for an extension. It is important to check for any updates from the IRS regarding specific deadlines, especially in light of changes that may occur due to ongoing legislation.

Legal use of the Form 8915 Irs

The legal use of Form 8915 is strictly for reporting eligible distributions taken from retirement accounts under the provisions of the CARES Act. Taxpayers must ensure that they meet the eligibility criteria to avoid any potential issues with the IRS. Misreporting or using the form incorrectly can lead to penalties or additional taxes owed, so it is crucial to understand the legal implications before filing.

Eligibility Criteria

To qualify for using Form 8915, taxpayers must meet specific eligibility criteria. These include having taken a distribution from a qualified retirement plan due to the COVID-19 pandemic, with the distribution amount not exceeding $100,000. Additionally, the taxpayer must certify that they have been affected by the pandemic in a way that justifies the distribution, such as experiencing a loss of income or other financial hardships.

Required Documents

When preparing to fill out Form 8915, it is important to gather all required documents. This includes:

- Retirement account statements showing the distribution amount.

- Any documentation that supports your eligibility, such as proof of income loss or hardship.

- Previous tax returns for reference, particularly if you are spreading the tax liability over multiple years.

Quick guide on how to complete form 8915 irs

Handle [SKS] effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed papers, allowing you to easily find the appropriate template and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign [SKS] without hassle

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal value as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your revisions.

- Select how you wish to send your form—via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or mismanaged documents, tedious form searches, or errors that require printing additional copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8915 Irs

Create this form in 5 minutes!

How to create an eSignature for the form 8915 irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8915 IRS and who needs it?

Form 8915 IRS is used by individuals who have taken distributions from retirement accounts and are eligible for special tax relief due to disaster recovery efforts. If you've experienced a federally declared disaster and accessed your retirement funds, you may need to fill out this form to report your income correctly.

-

How can airSlate SignNow help with Form 8915 IRS submissions?

With airSlate SignNow, you can easily create, send, and electronically sign Form 8915 IRS. Our platform streamlines the document management process, allowing you to efficiently complete and submit your tax forms while ensuring compliance with IRS regulations.

-

What are the pricing options for using airSlate SignNow to manage Form 8915 IRS?

airSlate SignNow offers various pricing plans that cater to different business needs, starting from a free tier to more comprehensive solutions. You can choose a plan that suits your volume of Form 8915 IRS submissions, ensuring a cost-effective solution for your document management.

-

Are there any features specific to handling Form 8915 IRS in airSlate SignNow?

Yes, airSlate SignNow provides features like customizable templates, document tracking, and secure storage that are ideal for handling Form 8915 IRS. These features ensure that your documents are processed smoothly and securely, giving you peace of mind during tax season.

-

Can I integrate airSlate SignNow with other software for managing Form 8915 IRS?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as CRM systems and cloud storage solutions. This flexibility allows you to manage your Form 8915 IRS and other related documents within your existing workflow.

-

What benefits does airSlate SignNow provide for eSigning Form 8915 IRS?

airSlate SignNow offers a user-friendly interface that makes eSigning Form 8915 IRS quick and easy. This electronic signing capability not only saves time but also enhances the security and validity of your submissions, ensuring they are legally binding.

-

Is it safe to submit Form 8915 IRS through airSlate SignNow?

Yes, submitting Form 8915 IRS through airSlate SignNow is safe and secure. We utilize advanced encryption and security measures to protect your sensitive information, ensuring that your tax filings are secure during transmission and storage.

Get more for Form 8915 Irs

Find out other Form 8915 Irs

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU