Instructions for Schedule a Form 8804 Department of the Treasury Internal Revenue Service Penalty for Underpayment of Estimated

Understanding Schedule A Form 8804

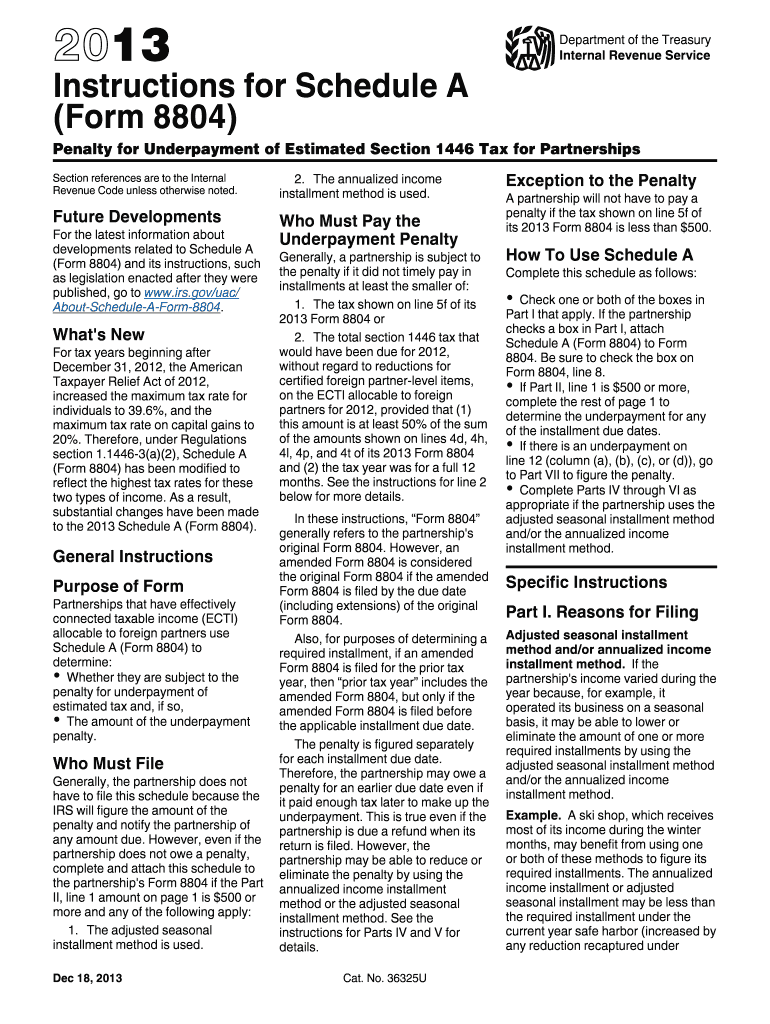

The Instructions For Schedule A Form 8804 provide essential guidance for partnerships regarding the penalty for underpayment of estimated Section 1446 tax. This form is crucial for partnerships that have foreign partners, as it helps ensure compliance with U.S. tax obligations. The penalties outlined in the instructions are designed to encourage timely and accurate tax payments, thereby minimizing the risk of additional charges or interest. Partnerships must carefully review these instructions to understand their responsibilities and avoid potential penalties.

How to Use the Instructions For Schedule A Form 8804

Using the Instructions For Schedule A Form 8804 involves several steps to ensure that partnerships accurately report their estimated tax payments. First, partnerships should read through the instructions thoroughly to familiarize themselves with the requirements. Next, they need to gather necessary financial information, including income and deductions relevant to the partnership. The instructions guide users on how to calculate the estimated tax owed and the penalties for underpayment, ensuring that all calculations are accurate and compliant with IRS regulations.

Steps to Complete Schedule A Form 8804

Completing Schedule A Form 8804 requires a systematic approach. Begin by reviewing the partnership's income and expenses to determine the taxable income. Next, calculate the estimated tax liability based on the applicable tax rates for the partnership. The instructions detail how to apply any credits or deductions that may reduce the total tax owed. Finally, partnerships must report their findings on the form, ensuring that all entries are accurate and reflect the partnership's financial situation. It is recommended to double-check all calculations to prevent errors that could lead to penalties.

Penalties for Non-Compliance

Partnerships that fail to comply with the Instructions For Schedule A Form 8804 may face significant penalties. The IRS imposes penalties for underpayment of estimated Section 1446 tax, which can accumulate over time. These penalties are designed to encourage timely payments and adherence to tax obligations. Partnerships should be aware of the potential financial impact of non-compliance and take proactive steps to meet their tax responsibilities. Understanding these penalties can help partnerships avoid costly mistakes and maintain good standing with the IRS.

Required Documents for Schedule A Form 8804

To complete Schedule A Form 8804, partnerships must gather specific documents that support their tax calculations. This includes financial statements, profit and loss reports, and any relevant tax documents that detail the partnership's income and deductions. Additionally, partnerships should have records of previous estimated tax payments made, as these will be necessary for accurate reporting. Having all required documents organized and readily available will streamline the process and help ensure compliance with the IRS requirements.

Filing Deadlines for Schedule A Form 8804

Filing deadlines for Schedule A Form 8804 are critical for partnerships to observe. Partnerships must submit their estimated tax payments on a quarterly basis, adhering to the IRS schedule. The instructions outline specific due dates for each quarter, ensuring that partnerships remain compliant and avoid penalties for late payments. It is essential for partnerships to mark these deadlines on their calendars and plan their finances accordingly to meet these obligations.

Quick guide on how to complete instructions for schedule a form 8804 department of the treasury internal revenue service penalty for underpayment of estimated

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents quickly without any delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and then click Get Form to start.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in a few clicks from any device you select. Edit and electronically sign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Schedule A Form 8804 Department Of The Treasury Internal Revenue Service Penalty For Underpayment Of Estimated

Create this form in 5 minutes!

How to create an eSignature for the instructions for schedule a form 8804 department of the treasury internal revenue service penalty for underpayment of estimated

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the instructions for Schedule A Form 8804?

The Instructions For Schedule A Form 8804 Department Of The Treasury Internal Revenue Service Penalty For Underpayment Of Estimated Section 1446 Tax For Partnerships Section References Are To The Internal Revenue Code Unless Otherwise provides detailed guidelines on how partnerships must file the Schedule A. It covers eligibility requirements, necessary information to include, and specific procedures to follow to avoid penalties.

-

What is the penalty for underpayment of estimated Section 1446 tax?

The penalty for underpayment of estimated Section 1446 tax can be signNow, impacting partnerships that fail to adhere to the provided Instructions For Schedule A Form 8804 Department Of The Treasury Internal Revenue Service Penalty For Underpayment Of Estimated Section 1446 Tax For Partnerships Section References Are To The Internal Revenue Code Unless Otherwise. Understanding these penalties ensures compliance and minimizes potential financial repercussions.

-

How can airSlate SignNow assist with tax-related documents?

airSlate SignNow simplifies the process of signing and sending tax-related documents by providing a user-friendly platform. You can easily eSign and send Instructions For Schedule A Form 8804 Department Of The Treasury Internal Revenue Service Penalty For Underpayment Of Estimated Section 1446 Tax For Partnerships Section References Are To The Internal Revenue Code Unless Otherwise and other needed documents efficiently and securely.

-

What features does airSlate SignNow offer for managing documents?

airSlate SignNow offers robust features including customizable templates, real-time status tracking, and cloud storage. These tools enhance your ability to manage documents like the Instructions For Schedule A Form 8804 Department Of The Treasury Internal Revenue Service Penalty For Underpayment Of Estimated Section 1446 Tax For Partnerships Section References Are To The Internal Revenue Code Unless Otherwise, ensuring that you are always prepared and compliant.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow provides potential customers with a free trial option. This allows users to explore the platform's capabilities, including how to handle Instructions For Schedule A Form 8804 Department Of The Treasury Internal Revenue Service Penalty For Underpayment Of Estimated Section 1446 Tax For Partnerships Section References Are To The Internal Revenue Code Unless Otherwise, without any financial commitment.

-

Can airSlate SignNow integrate with other software?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your document management workflow. This means that you can seamlessly work with Instructions For Schedule A Form 8804 Department Of The Treasury Internal Revenue Service Penalty For Underpayment Of Estimated Section 1446 Tax For Partnerships Section References Are To The Internal Revenue Code Unless Otherwise across different platforms.

-

What are the benefits of using airSlate SignNow for partnerships?

Using airSlate SignNow for partnerships streamlines document workflows, reduces turnaround time, and lowers the risk of errors in tax filings. The solution is designed to support the accurate handling of documents such as the Instructions For Schedule A Form 8804 Department Of The Treasury Internal Revenue Service Penalty For Underpayment Of Estimated Section 1446 Tax For Partnerships Section References Are To The Internal Revenue Code Unless Otherwise, maximizing efficiency and compliance.

Get more for Instructions For Schedule A Form 8804 Department Of The Treasury Internal Revenue Service Penalty For Underpayment Of Estimated

- Foreign national tax setup change form

- Constructive and destructive forces worksheet pdf form

- Naming acids and bases worksheet chemistry 2 points answer key form

- Npdcl name change application form

- Sales tax form durangogovorg

- Identify and calculate the area and perimeter for each polygon worksheet answers form

- Adventurer induction ceremony program pdf form

- Adeverinta de venit model form

Find out other Instructions For Schedule A Form 8804 Department Of The Treasury Internal Revenue Service Penalty For Underpayment Of Estimated

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney