CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda Form

Understanding the CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda

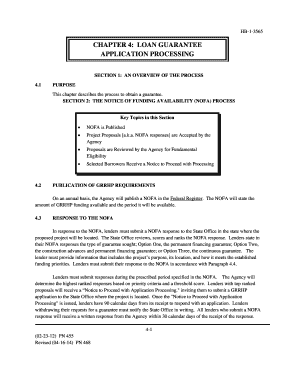

The CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda is a crucial document for individuals and businesses seeking financial assistance through the USDA Rural Development program. This application process is designed to facilitate access to loans for rural development projects, ensuring that applicants meet specific eligibility criteria and compliance requirements. The program aims to promote economic growth in rural areas by providing loan guarantees that reduce the risk for lenders. Understanding this application is essential for anyone looking to leverage USDA resources for development purposes.

Steps to Complete the CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda

Completing the CHAPTER 4 LOAN GUARANTEE APPLICATION involves several key steps. First, applicants must gather necessary documentation, including proof of income, credit history, and project details. Next, they should fill out the application form accurately, ensuring all required sections are completed. After submitting the application, it is essential to monitor its status and respond promptly to any requests for additional information from the USDA. This proactive approach can significantly influence the approval timeline and outcome.

Eligibility Criteria for the CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda

To qualify for the CHAPTER 4 LOAN GUARANTEE, applicants must meet specific eligibility criteria established by the USDA. These criteria typically include being a U.S. citizen or legal resident, demonstrating the ability to repay the loan, and having a viable project plan that aligns with USDA objectives. Additionally, applicants must show that their project will benefit rural communities, contributing to economic development and sustainability. Meeting these criteria is essential for a successful application process.

Required Documents for the CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda

Applicants must prepare a comprehensive set of documents to support their CHAPTER 4 LOAN GUARANTEE application. Essential documents include:

- Proof of identity and citizenship

- Financial statements, including income and credit history

- Detailed project proposal outlining the intended use of funds

- Business plan, if applicable, demonstrating project viability

- Any relevant permits or licenses required for the project

Having these documents ready will streamline the application process and enhance the chances of approval.

Application Process & Approval Time for the CHAPTER 4 LOAN GUARANTEE

The application process for the CHAPTER 4 LOAN GUARANTEE involves several stages, starting with the submission of the completed application form and supporting documents. Once submitted, the USDA will review the application for completeness and compliance with eligibility criteria. The approval time can vary based on the complexity of the application and the volume of submissions being processed. Generally, applicants can expect a response within a few weeks, but it is advisable to stay in contact with the USDA for updates during this period.

Legal Use of the CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda

The CHAPTER 4 LOAN GUARANTEE is governed by federal regulations that dictate its legal use. Applicants must adhere to these regulations to ensure compliance and avoid penalties. This includes using the loan funds solely for the intended purpose as outlined in the application. Misuse of funds or failure to comply with the terms of the loan can result in legal repercussions, including the possibility of loan repayment demands or disqualification from future funding opportunities.

Quick guide on how to complete chapter 4 loan guarantee application processing rurdev usda

Effortlessly Create [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow offers all the resources necessary to generate, modify, and electronically sign your documents swiftly without interruptions. Handle [SKS] on any device using the airSlate SignNow applications for Android or iOS, and streamline any document-related process today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and select Get Form to begin.

- Utilize the tools available to complete your document.

- Select important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and has the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Decide how you would like to share your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] to ensure effective communication throughout every phase of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda

Create this form in 5 minutes!

How to create an eSignature for the chapter 4 loan guarantee application processing rurdev usda

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda?

The CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda refers to the process established by the USDA to facilitate loan guarantees for eligible rural development projects. This process ensures that applicants meet the necessary criteria for funding, allowing them to enhance their communities through various initiatives.

-

How does airSlate SignNow simplify the CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda?

airSlate SignNow streamlines the CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda by providing businesses with a platform to easily create, send, and eSign documents needed for the loan application. This reduces paperwork, speeds up the process, and ensures compliance with USDA requirements.

-

What are the costs associated with using airSlate SignNow for CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda?

airSlate SignNow offers competitive pricing tailored for businesses looking to expedite the CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda. Subscription plans vary, allowing users to choose one that fits their budget while gaining access to features that enhance their document workflows.

-

What features does airSlate SignNow provide for the CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda?

Key features of airSlate SignNow include customizable templates, automated workflows, and secure eSigning capabilities, all designed to facilitate the CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda. These tools help users efficiently manage documents and track application progress.

-

Can airSlate SignNow integrate with other applications for the CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda?

Yes, airSlate SignNow seamlessly integrates with various applications and systems to enhance the CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda. These integrations allow for better data management and improved communication between teams working on loan applications.

-

What are the benefits of using airSlate SignNow for my CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda?

Using airSlate SignNow for the CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda provides signNow benefits such as time savings, enhanced accuracy, and improved customer experience. These advantages allow your organization to focus more on project implementation instead of getting bogged down by paperwork.

-

How secure is airSlate SignNow when handling CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda documents?

airSlate SignNow takes security seriously by employing advanced encryption and compliance standards to protect documents related to the CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda. Users can confidently store and sign sensitive information without fear of data bsignNowes.

Get more for CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda

- Report form minnesota department of natural resources files dnr state mn

- Minnesota forest stewardship plan preparer application form

- My applications application main menu cpl conservation partners legacy grant application applications total to date 129 form

- Cpl applications total to date 129 files dnr state mn form

- State of rhode island and providence plantations d form

- Safety emission control form

- Request for classroom premises check form

- Become a classroom pre licensing course provider ny dmv form

Find out other CHAPTER 4 LOAN GUARANTEE APPLICATION PROCESSING Rurdev Usda

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later

- eSign Iowa Revocation of Power of Attorney Online

- How Do I eSign Maine Revocation of Power of Attorney

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement