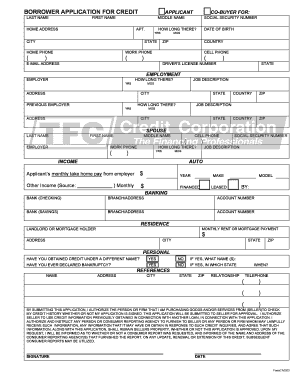

BORROWER APPLICATION for CREDIT Form

What is the Borrower Application for Credit

The Borrower Application for Credit is a formal document used by individuals or businesses seeking to obtain credit from lenders. This application collects essential information about the borrower, including personal identification details, financial history, and the purpose of the loan. It serves as a crucial tool for lenders to assess the creditworthiness of applicants and make informed lending decisions.

Key Elements of the Borrower Application for Credit

Understanding the key elements of the Borrower Application for Credit is essential for a successful application process. Typically, the form includes:

- Personal Information: Name, address, social security number, and contact details.

- Employment Details: Current employer, job title, and income information.

- Financial History: Current debts, assets, and credit history.

- Loan Details: Amount requested, loan purpose, and repayment terms.

Providing accurate and complete information in these sections can significantly enhance the chances of approval.

Steps to Complete the Borrower Application for Credit

Completing the Borrower Application for Credit involves several important steps:

- Gather Required Information: Collect all necessary documents, such as proof of income and identification.

- Fill Out the Application: Enter accurate information in each section of the application form.

- Review the Application: Double-check all details to ensure accuracy and completeness.

- Submit the Application: Follow the specified submission method, whether online, by mail, or in person.

Taking these steps carefully can help streamline the application process and reduce the likelihood of errors.

Eligibility Criteria

Eligibility for the Borrower Application for Credit varies by lender but generally includes certain common criteria:

- Age: Applicants must be at least eighteen years old.

- Residency: Must be a legal resident of the United States.

- Credit History: A satisfactory credit history may be required.

- Income: Proof of stable income to support loan repayment.

Understanding these criteria can help applicants prepare adequately before submitting their applications.

Required Documents

When applying for credit, certain documents are typically required to support the Borrower Application for Credit. These may include:

- Identification: Government-issued ID or driver's license.

- Proof of Income: Recent pay stubs, tax returns, or bank statements.

- Credit Report: A copy of the applicant's credit report may be requested.

- Financial Statements: Documentation of assets and liabilities.

Having these documents ready can facilitate a smoother application process and help lenders evaluate the application effectively.

Application Process & Approval Time

The application process for the Borrower Application for Credit typically involves several stages:

- Submission: Submit the completed application along with required documents.

- Review: The lender reviews the application and supporting documentation.

- Decision: The lender makes a decision based on the applicant's creditworthiness.

- Notification: The applicant is notified of the approval or denial.

Approval times can vary widely depending on the lender, ranging from a few hours to several days. Understanding this timeline can help applicants manage their expectations during the process.

Quick guide on how to complete borrower application for credit

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and eSign your documents quickly without any delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Effortlessly Edit and eSign [SKS]

- Locate [SKS] and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight signNow sections of the documents or conceal sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your device of choice. Modify and eSign [SKS] to ensure smooth communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to BORROWER APPLICATION FOR CREDIT

Create this form in 5 minutes!

How to create an eSignature for the borrower application for credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the BORROWER APPLICATION FOR CREDIT form used for?

The BORROWER APPLICATION FOR CREDIT form is designed to help businesses streamline their loan application process. By using this form, companies can easily collect essential information from borrowers, making it simpler to evaluate creditworthiness and expedite approvals.

-

How does airSlate SignNow simplify the BORROWER APPLICATION FOR CREDIT process?

airSlate SignNow simplifies the BORROWER APPLICATION FOR CREDIT process by allowing you to send documents for eSignature easily. This efficiency reduces the time spent on paperwork, enhances collaboration among stakeholders, and helps businesses close deals faster.

-

What features does airSlate SignNow offer for the BORROWER APPLICATION FOR CREDIT?

AirSlate SignNow offers features such as customizable templates, secure document storage, and real-time tracking to support the BORROWER APPLICATION FOR CREDIT. These tools ensure that you maintain compliance while providing a seamless experience for borrowers.

-

Is airSlate SignNow cost-effective for handling the BORROWER APPLICATION FOR CREDIT?

Yes, airSlate SignNow is a cost-effective solution for managing the BORROWER APPLICATION FOR CREDIT. With competitive pricing plans and no hidden fees, businesses can save on operational costs while still enjoying a high-quality eSigning experience.

-

Can I integrate the BORROWER APPLICATION FOR CREDIT with other software?

Absolutely! airSlate SignNow offers various integrations with popular tools such as CRM systems, accounting software, and cloud storage services. This allows you to easily incorporate the BORROWER APPLICATION FOR CREDIT into your existing workflows.

-

What benefits do I get when using airSlate SignNow for the BORROWER APPLICATION FOR CREDIT?

Using airSlate SignNow for the BORROWER APPLICATION FOR CREDIT offers numerous benefits, including enhanced efficiency, reduced processing times, and improved document security. Additionally, it helps ensure a seamless experience for both lenders and borrowers, promoting trust and satisfaction.

-

How secure is the BORROWER APPLICATION FOR CREDIT process with airSlate SignNow?

The BORROWER APPLICATION FOR CREDIT process with airSlate SignNow is highly secure. The platform adheres to industry standards for data protection, utilizing encryption and compliance measures to safeguard sensitive information throughout the signing process.

Get more for BORROWER APPLICATION FOR CREDIT

Find out other BORROWER APPLICATION FOR CREDIT

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple