First Capital Equipment Leasing Corp Form

What is the First Capital Equipment Leasing Corp

The First Capital Equipment Leasing Corp specializes in providing financing solutions for businesses seeking to acquire equipment without the burden of upfront costs. This corporation offers leasing options that allow companies to use essential machinery and technology while preserving cash flow. By leasing equipment, businesses can maintain operational flexibility and access the latest tools without significant capital investment.

How to use the First Capital Equipment Leasing Corp

Utilizing the First Capital Equipment Leasing Corp involves a straightforward process. First, businesses identify the equipment they need and assess their financial requirements. Next, they can reach out to the corporation to discuss leasing options tailored to their specific needs. After reviewing the terms, businesses can proceed with the application, which typically includes providing financial information and details about the equipment. Once approved, the leasing agreement is finalized, allowing the business to begin using the equipment.

Steps to complete the First Capital Equipment Leasing Corp

Completing the leasing process with the First Capital Equipment Leasing Corp includes several key steps:

- Identify the equipment required for your business operations.

- Assess your budget and determine how much you can allocate for leasing.

- Contact the First Capital Equipment Leasing Corp to discuss available leasing options.

- Submit an application that includes your business information and financial details.

- Review the leasing agreement, ensuring all terms are clear and acceptable.

- Sign the agreement and take possession of the equipment.

Key elements of the First Capital Equipment Leasing Corp

Several key elements define the offerings of the First Capital Equipment Leasing Corp. These include:

- Flexible Terms: Leasing agreements can be tailored to meet the specific needs of businesses, including varying lease lengths and payment structures.

- Tax Benefits: Leasing may provide tax advantages, as payments can often be deducted as business expenses.

- Equipment Upgrades: Leasing allows businesses to upgrade to newer equipment more frequently, ensuring they remain competitive.

- Preserved Capital: By leasing, businesses can conserve cash flow for other operational needs.

Legal use of the First Capital Equipment Leasing Corp

The legal use of the First Capital Equipment Leasing Corp involves adhering to the terms outlined in the leasing agreement. Businesses must ensure compliance with all applicable laws and regulations regarding equipment leasing. This includes understanding the rights and responsibilities of both the lessor and lessee, as well as any state-specific regulations that may apply. It is essential for businesses to maintain accurate records of their leasing agreements and payments to avoid potential disputes.

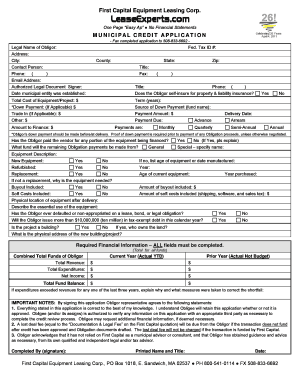

Required Documents

When applying for a lease with the First Capital Equipment Leasing Corp, businesses typically need to provide several documents, including:

- Business financial statements, such as balance sheets and income statements.

- Tax returns for the previous two years.

- Proof of business registration and ownership.

- Details about the equipment being leased, including specifications and pricing.

Quick guide on how to complete first capital equipment leasing corp

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to edit and electronically sign [SKS] without stress

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing out new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to First Capital Equipment Leasing Corp

Create this form in 5 minutes!

How to create an eSignature for the first capital equipment leasing corp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does First Capital Equipment Leasing Corp. offer?

First Capital Equipment Leasing Corp. specializes in providing flexible leasing solutions for businesses looking to acquire essential equipment. Their services include tailored leasing options, financing plans, and consultation to align with your business needs. With their experience, they help streamline the acquisition process without heavy upfront costs.

-

How can First Capital Equipment Leasing Corp. benefit my business?

First Capital Equipment Leasing Corp. allows businesses to maintain cash flow by avoiding large upfront payments for equipment. Leasing can also provide tax benefits and keep your equipment updated with the latest technology. This flexibility helps businesses respond to market changes more effectively.

-

What types of equipment can I lease through First Capital Equipment Leasing Corp.?

First Capital Equipment Leasing Corp. offers a wide range of equipment leasing options, including office equipment, industrial machinery, and vehicles. This diverse offering ensures that businesses across different sectors can find leasing solutions that fit their operational needs. Their focus is on meeting the specific requirements of various industries.

-

Are there any hidden fees with First Capital Equipment Leasing Corp.?

First Capital Equipment Leasing Corp. prides itself on transparency and does not impose hidden fees on its leasing agreements. Clients can expect clear communication regarding all terms, including monthly payments and any potential charges. This commitment to transparency builds trust and helps businesses budget effectively.

-

How does the application process work with First Capital Equipment Leasing Corp.?

The application process with First Capital Equipment Leasing Corp. is straightforward and efficient. Businesses can complete an online application quickly, providing necessary details about their leasing needs and financial information. Once submitted, their team reviews the application promptly to get you started on your equipment leasing journey.

-

Can I upgrade my leased equipment with First Capital Equipment Leasing Corp.?

Yes, First Capital Equipment Leasing Corp. allows businesses to upgrade leased equipment during or at the end of the lease term. This flexibility is crucial for companies looking to keep up with technological advancements or changing operational needs. Their team will assist you in finding the best upgrade options tailored to your business.

-

What financing options does First Capital Equipment Leasing Corp. provide?

First Capital Equipment Leasing Corp. provides multiple financing options, including fair market value leases, $1 buyout leases, and operating leases. Each option caters to different business strategies and financial situations, allowing you to choose one that best suits your cash flow and equipment needs. Their experts are also available to guide you through the best choice for your situation.

Get more for First Capital Equipment Leasing Corp

Find out other First Capital Equipment Leasing Corp

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe