Application to Convert from a State to a Federal Credit Union NCUA Form

Understanding the Application To Convert From A State To A Federal Credit Union NCUA

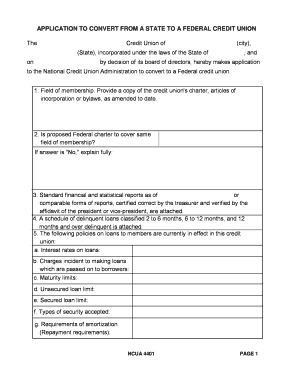

The Application To Convert From A State To A Federal Credit Union, governed by the National Credit Union Administration (NCUA), is a formal request that allows a state-chartered credit union to transition to a federal charter. This process is significant as it can provide the credit union with enhanced regulatory oversight and access to federal resources. The application must be completed accurately to ensure compliance with federal regulations and to facilitate a smooth transition.

How to Obtain the Application To Convert From A State To A Federal Credit Union NCUA

The application form can typically be obtained directly from the NCUA's official website or through your state credit union regulatory authority. It is essential to ensure that you are using the most current version of the application to avoid any delays in processing. Additionally, some credit unions may provide guidance or resources to assist in completing the application.

Steps to Complete the Application To Convert From A State To A Federal Credit Union NCUA

Completing the application involves several key steps:

- Gather necessary documentation, including the credit union's charter, bylaws, and financial statements.

- Complete all sections of the application form, ensuring that all information is accurate and up-to-date.

- Obtain approval from the credit union's board of directors before submission.

- Submit the application along with any required fees to the NCUA.

- Await confirmation of receipt and any follow-up requests for additional information.

Key Elements of the Application To Convert From A State To A Federal Credit Union NCUA

Several critical components must be included in the application:

- Credit Union Information: Basic details about the credit union, including its name, location, and charter number.

- Board Resolution: A resolution from the board of directors supporting the conversion.

- Membership Information: Details about the current membership and how it will be affected by the conversion.

- Financial Statements: Recent financial statements to demonstrate the credit union's fiscal health.

Legal Use of the Application To Convert From A State To A Federal Credit Union NCUA

The legal framework for the conversion process is outlined in federal regulations. The application must comply with the NCUA's rules and procedures, as well as any applicable state laws. This ensures that the conversion is valid and that the credit union operates within the legal parameters set forth by regulatory authorities.

Eligibility Criteria for Conversion

To be eligible for conversion from a state to a federal credit union, certain criteria must be met:

- The credit union must be in good standing with its state regulatory authority.

- There must be a demonstrated need for federal chartering, such as the desire for expanded services or regulatory benefits.

- Approval from the membership may be required, often through a vote.

Quick guide on how to complete application to convert from a state to a federal credit union ncua

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed materials, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly and without issues. Handle [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method to share your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Application To Convert From A State To A Federal Credit Union NCUA

Create this form in 5 minutes!

How to create an eSignature for the application to convert from a state to a federal credit union ncua

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for submitting an Application To Convert From A State To A Federal Credit Union NCUA?

The process involves several steps, including preparation of documents, completion of the application form, and submission to the NCUA. You'll need to gather relevant details about your state credit union and adhere to NCUA guidelines. Consulting with a compliance expert can streamline this process and ensure all requirements are met efficiently.

-

What are the benefits of converting from a state to a federal credit union?

Converting to a federal credit union can provide access to a broader market, improved regulatory advantages, and more opportunities for member benefits. The Application To Convert From A State To A Federal Credit Union NCUA is designed to facilitate this transition smoothly, allowing for increased membership and more financial offerings.

-

What costs are associated with the Application To Convert From A State To A Federal Credit Union NCUA?

Costs can vary, but typically include application fees, legal expenses, and possible operational changes needed to meet federal standards. It's crucial to budget accordingly and understand the full financial implications before initiating the Application To Convert From A State To A Federal Credit Union NCUA.

-

How long does the application process take?

The duration of the Application To Convert From A State To A Federal Credit Union NCUA can vary widely based on the complexity of your credit union's operations and the completeness of the submitted documentation. On average, it may take several months to receive approval, so it's important to plan ahead.

-

Can I use eSignatures for my Application To Convert From A State To A Federal Credit Union NCUA?

Yes, eSignatures can be used for many documents associated with the Application To Convert From A State To A Federal Credit Union NCUA. Utilizing an eSigning solution like airSlate SignNow can simplify workflows and expedite the submission process, ensuring quicker turnaround times.

-

What features should I look for in an eSigning solution for this application process?

When choosing an eSigning solution for the Application To Convert From A State To A Federal Credit Union NCUA, look for features such as compliance with federal regulations, user-friendliness, and robust security measures. These features ensure that your application is submitted correctly and securely.

-

What happens after I submit my application?

After submitting your Application To Convert From A State To A Federal Credit Union NCUA, it will be reviewed by NCUA officials. They may request additional information or clarification during their review. Be prepared to respond promptly to any inquiries to keep the process moving forward.

Get more for Application To Convert From A State To A Federal Credit Union NCUA

- Hyundai azera repair manual pdf form

- Loan application form corporate borrowers neogrowth

- Fillable month to month rental agreement form

- Cpcs a73 questions and answers form

- Barangay clearance quezon city form

- Fidelity bank deposit slip form

- Mock interview critique form elon

- Madang teachers college application form pdf download

Find out other Application To Convert From A State To A Federal Credit Union NCUA

- How Can I Sign California Residential lease agreement form

- How To Sign Georgia Residential lease agreement form

- Sign Nebraska Residential lease agreement form Online

- Sign New Hampshire Residential lease agreement form Safe

- Help Me With Sign Tennessee Residential lease agreement

- Sign Vermont Residential lease agreement Safe

- Sign Rhode Island Residential lease agreement form Simple

- Can I Sign Pennsylvania Residential lease agreement form

- Can I Sign Wyoming Residential lease agreement form

- How Can I Sign Wyoming Room lease agreement

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe