Loan Application Form Corporate Borrowers Neogrowth

What is the Loan Application Form Corporate Borrowers Neogrowth

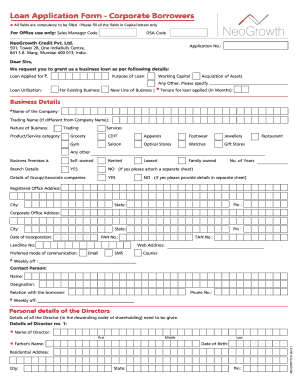

The Loan Application Form for Corporate Borrowers Neogrowth is a specialized document designed for businesses seeking financial assistance. This form captures essential information about the borrowing entity, including its financial status, business structure, and purpose for the loan. By providing detailed insights into the company's operations and financial health, it helps lenders assess the risk and viability of granting the requested funds.

Key Elements of the Loan Application Form Corporate Borrowers Neogrowth

Understanding the key elements of the Loan Application Form is crucial for a successful submission. The form typically includes:

- Business Information: Name, address, and contact details of the borrowing entity.

- Financial Statements: Recent balance sheets, income statements, and cash flow statements to demonstrate financial health.

- Loan Purpose: A clear explanation of how the funds will be used, whether for expansion, equipment purchase, or operational costs.

- Ownership Structure: Details about the business owners and their respective ownership percentages.

- Credit History: Information regarding the company's creditworthiness and any existing debts.

Steps to Complete the Loan Application Form Corporate Borrowers Neogrowth

Completing the Loan Application Form requires careful attention to detail. Here are the steps to follow:

- Gather Required Documents: Collect all necessary financial statements and business documents.

- Fill Out the Form: Provide accurate and comprehensive information in each section of the form.

- Review for Accuracy: Double-check all entries to ensure there are no errors or omissions.

- Submit the Form: Follow the submission guidelines, whether online or via mail.

- Follow Up: Contact the lender to confirm receipt and inquire about the next steps in the approval process.

Legal Use of the Loan Application Form Corporate Borrowers Neogrowth

The Loan Application Form is legally binding when completed and signed according to specific regulations. It is essential to ensure compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws validate electronic signatures and documents, making them enforceable in a court of law. Using a reputable eSignature platform can help ensure that the form meets all legal requirements.

Application Process & Approval Time

The application process for the Loan Application Form involves several stages, starting with the submission of the completed form and required documents. After submission, lenders typically review the application, which may take anywhere from a few days to several weeks, depending on the lender's policies and the complexity of the application. Factors influencing approval time include the completeness of the application, the lender's workload, and the need for additional information or documentation.

Eligibility Criteria

Eligibility for the Loan Application Form Corporate Borrowers Neogrowth varies by lender but generally includes criteria such as:

- Business Type: Must be a registered business entity, such as an LLC, corporation, or partnership.

- Time in Business: Many lenders require a minimum operational period, often two years or more.

- Creditworthiness: A satisfactory credit history is essential for approval.

- Financial Stability: Demonstrating a positive cash flow and profitability can enhance eligibility.

Quick guide on how to complete loan application form corporate borrowers neogrowth

Accomplish Loan Application Form Corporate Borrowers Neogrowth effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It provides an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your files quickly and without interruption. Handle Loan Application Form Corporate Borrowers Neogrowth on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and eSign Loan Application Form Corporate Borrowers Neogrowth with ease

- Obtain Loan Application Form Corporate Borrowers Neogrowth and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to secure your changes.

- Choose your preferred method to send your form, whether by email, SMS, or sharing a link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your preference. Edit and eSign Loan Application Form Corporate Borrowers Neogrowth and guarantee excellent communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan application form corporate borrowers neogrowth

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Loan Application Form for Corporate Borrowers Neogrowth?

The Loan Application Form for Corporate Borrowers Neogrowth is a streamlined document designed to simplify the application process for businesses seeking financing. It collects essential information needed by lenders to assess the borrower's creditworthiness and funding requirements, ensuring a comprehensive application that meets Neogrowth's standards.

-

How does airSlate SignNow enhance the Loan Application Form for Corporate Borrowers Neogrowth?

airSlate SignNow enhances the Loan Application Form for Corporate Borrowers Neogrowth by providing an intuitive platform that allows users to fill out, sign, and send documents electronically. This reduces the time and effort involved in completing applications while ensuring all documents are securely stored and easily accessible.

-

What are the pricing options for using the Loan Application Form for Corporate Borrowers Neogrowth?

Pricing for using the Loan Application Form for Corporate Borrowers Neogrowth through airSlate SignNow is designed to be cost-effective. Users can choose from various subscription plans that fit different business sizes and needs, with features tailored to help corporate borrowers streamline their application workflow efficiently.

-

What features are included in the Loan Application Form for Corporate Borrowers Neogrowth?

The Loan Application Form for Corporate Borrowers Neogrowth includes features such as customizable templates, electronic signatures, automated reminders, and integration capabilities with various business applications. These features help businesses manage their loan applications smoothly and effectively.

-

How can airSlate SignNow help speed up the approval process for loan applications?

airSlate SignNow can signNowly speed up the approval process for loan applications by enabling faster document handling and signing. The platform allows corporate borrowers to complete the Loan Application Form for Corporate Borrowers Neogrowth electronically, ensuring that all necessary information is submitted in a timely manner.

-

Are there integrations available for the Loan Application Form for Corporate Borrowers Neogrowth?

Yes, airSlate SignNow offers several integrations that enhance the functionality of the Loan Application Form for Corporate Borrowers Neogrowth. These integrations allow borrowers to connect with popular CRMs, project management tools, and other productivity apps, streamlining the workflow and data management process.

-

What are the benefits of using airSlate SignNow for corporate borrowers?

Using airSlate SignNow for corporate borrowers brings numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for sensitive documents. The Loan Application Form for Corporate Borrowers Neogrowth can be filled out and signed from anywhere, making it easier for businesses to stay organized and compliant.

Get more for Loan Application Form Corporate Borrowers Neogrowth

- Lead based paint disclosure for sales transaction mississippi form

- Lead based paint disclosure for rental transaction mississippi form

- Notice of lease for recording mississippi form

- Sample cover letter for filing of llc articles or certificate with secretary of state mississippi form

- Supplemental residential lease forms package mississippi

- Ms landlord 497315634 form

- Subpoena duces form

- Name change form 497315638

Find out other Loan Application Form Corporate Borrowers Neogrowth

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free