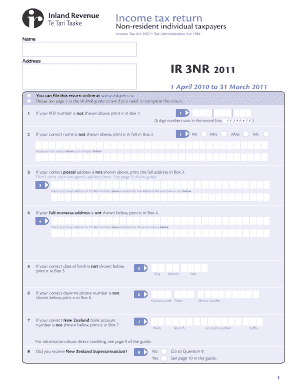

IR 3NR Form

What is the IR 3NR

The IR 3NR is a tax form used by non-resident individuals in the United States to report their income and calculate their tax liabilities. This form is specifically designed for those who do not meet the residency requirements set by the Internal Revenue Service (IRS) but still have U.S. source income. Non-residents must file this form to ensure compliance with federal tax regulations and to accurately report any income earned within the U.S. The IR 3NR is crucial for maintaining transparency with the IRS and avoiding potential penalties for underreporting income.

Steps to complete the IR 3NR

Completing the IR 3NR involves several key steps. First, gather all necessary documentation, including income statements, any applicable tax treaties, and personal identification information. Next, accurately fill out the form, ensuring that all income sources are reported. Pay close attention to the sections that pertain to deductions and credits, as these can significantly affect your overall tax liability. After completing the form, review it for accuracy and completeness before submitting it to the IRS. It is important to keep a copy of the submitted form for your records.

Filing Deadlines / Important Dates

Filing deadlines for the IR 3NR are crucial for compliance. Generally, non-residents must file their tax returns by April 15 of the following year for income earned in the previous year. However, if the individual is outside the U.S. on this date, they may qualify for an automatic extension until June 15. It is essential to check for any specific state requirements, as some states may have different deadlines or additional forms to submit. Missing these deadlines can result in penalties and interest on unpaid taxes.

Required Documents

To complete the IR 3NR, several documents are typically required. These include:

- Income statements such as W-2s or 1099s

- Passport or other identification to verify non-resident status

- Tax treaty documentation, if applicable

- Records of any deductions or credits claimed

Having these documents ready will streamline the filing process and help ensure that all income is accurately reported.

IRS Guidelines

The IRS provides specific guidelines for completing the IR 3NR, which are essential for ensuring compliance. These guidelines include instructions on how to report different types of income, eligibility for deductions, and the proper way to claim tax treaty benefits. It is advisable to refer to the IRS website or the instructions provided with the form for the most current information. Following these guidelines helps prevent errors and reduces the risk of audits or penalties.

Penalties for Non-Compliance

Failure to file the IR 3NR or inaccuracies in reporting can lead to significant penalties. The IRS may impose fines for late filings, which can accumulate over time. Additionally, underreporting income can result in further penalties and interest on unpaid taxes. Non-compliance can also affect future immigration status and eligibility for certain benefits. It is important for non-residents to understand these risks and to file their tax returns accurately and on time.

Quick guide on how to complete ir 3nr

Effortlessly manage [SKS] on any device

Digital document management has gained immense popularity among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to get started.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then hit the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from whichever device you prefer. Revise and eSign [SKS] to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IR 3NR

Create this form in 5 minutes!

How to create an eSignature for the ir 3nr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IR 3NR feature in airSlate SignNow?

The IR 3NR feature in airSlate SignNow allows users to create and manage three non-reusable documents simultaneously. This is particularly useful for businesses that require efficiency in handling multiple contracts or agreements without compromising document security.

-

How does the pricing for the IR 3NR feature work?

Pricing for the IR 3NR feature is competitively structured to provide cost-effective solutions for businesses of all sizes. Users can choose from various subscription plans, ensuring they only pay for what they need while gaining full access to the benefits of the IR 3NR feature.

-

What are the key benefits of using IR 3NR in airSlate SignNow?

The IR 3NR feature enhances document handling efficiency, reduces turnaround times, and simplifies collaboration. Businesses can leverage this feature to streamline workflows, enhance productivity, and ensure legal compliance for their e-signature processes.

-

Can IR 3NR integrate with other applications?

Yes, the IR 3NR feature in airSlate SignNow can seamlessly integrate with various applications, including CRM and project management tools. This allows businesses to automate workflows and manage documents more effectively across different platforms.

-

Is the IR 3NR feature secure for sensitive documents?

Absolutely, the IR 3NR feature in airSlate SignNow utilizes advanced encryption and security protocols to ensure that sensitive documents are protected. This commitment to security helps businesses maintain trust with clients and comply with regulatory requirements.

-

How do I get started with the IR 3NR feature?

To get started with the IR 3NR feature, simply sign up for an airSlate SignNow account. After choosing a suitable plan, you can easily access the feature and begin creating and managing your documents efficiently.

-

Are there any limitations with the IR 3NR feature?

While the IR 3NR feature is powerful, it does come with a limit on the number of non-reusable documents that can be managed at once. However, this is designed to enhance efficiency rather than hinder functionality, allowing businesses to operate within a structured framework.

Get more for IR 3NR

Find out other IR 3NR

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed