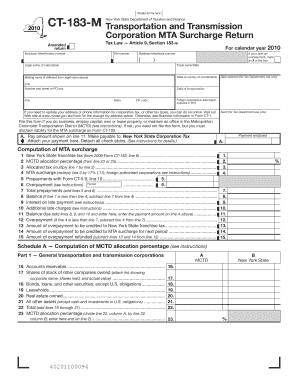

Form CT 183 M Tax Ny

What is the Form CT 183 M Tax Ny

The Form CT 183 M Tax Ny is a tax form used by businesses and individuals in New York to report certain types of income and calculate the associated taxes. This form is particularly relevant for non-residents or part-year residents who earn income in New York State. The information provided on this form helps the New York State Department of Taxation and Finance assess the correct tax liability based on the reported income.

How to use the Form CT 183 M Tax Ny

Using the Form CT 183 M Tax Ny involves a clear process. First, gather all necessary financial documents, including income statements and any relevant tax documents. Next, accurately fill out the form with your personal information, income details, and any deductions or credits you may qualify for. After completing the form, review it for accuracy before submitting it to ensure compliance with state tax regulations.

Steps to complete the Form CT 183 M Tax Ny

Completing the Form CT 183 M Tax Ny requires careful attention to detail. Follow these steps:

- Download the form from the New York State Department of Taxation and Finance website or obtain a physical copy.

- Fill in your name, address, and Social Security number at the top of the form.

- Report your income from all sources, including wages, dividends, and interest.

- Calculate any deductions or credits you are eligible for, and subtract these from your total income.

- Determine your tax liability based on the calculated income and applicable tax rates.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form CT 183 M Tax Ny. Typically, the form must be submitted by April fifteenth of the year following the tax year in question. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Keeping track of these important dates ensures timely compliance and helps avoid penalties.

Required Documents

When preparing to complete the Form CT 183 M Tax Ny, certain documents are necessary to provide accurate information. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits claimed

- Previous year’s tax return for reference

Having these documents on hand will facilitate a smoother and more accurate filing process.

Penalties for Non-Compliance

Failure to file the Form CT 183 M Tax Ny by the deadline can result in penalties. The New York State Department of Taxation and Finance may impose fines based on the amount of tax owed and the length of the delay. Additionally, interest may accrue on any unpaid taxes, further increasing the total amount due. It is essential to file the form on time to avoid these financial repercussions.

Quick guide on how to complete form ct 183 m tax ny

Finalize [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed materials, as you can access the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to edit and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you choose. Edit and eSign [SKS] and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form CT 183 M Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the form ct 183 m tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 183 M Tax NY?

Form CT 183 M Tax NY is a specific tax form used for certain tax processes in New York. It is crucial for businesses to understand its requirements and how it integrates into their overall tax filing strategies to ensure compliance with state regulations.

-

How can airSlate SignNow help with Form CT 183 M Tax NY?

airSlate SignNow streamlines the process of completing and signing Form CT 183 M Tax NY by providing an intuitive interface for eSigning documents. This helps users save time and ensures that important tax documents are processed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for Form CT 183 M Tax NY?

Yes, airSlate SignNow offers various pricing plans that are cost-effective for businesses of all sizes. Each plan provides full access to features that facilitate the eSigning of essential forms like Form CT 183 M Tax NY.

-

What features does airSlate SignNow offer for handling tax forms?

airSlate SignNow provides features such as customizable templates, automated reminders, and secure storage. These tools enhance the efficiency of managing forms like Form CT 183 M Tax NY and ensure that all documents are signed and stored safely.

-

Can airSlate SignNow integrate with accounting software for Form CT 183 M Tax NY compliance?

Yes, airSlate SignNow offers integrations with various accounting software solutions, enabling seamless workflow management. This means that users can easily handle Form CT 183 M Tax NY and other documents right from their preferred accounting platforms.

-

What are the benefits of using airSlate SignNow for Form CT 183 M Tax NY?

The benefits include reduced turnaround time, lower operational costs, and enhanced accuracy. By using airSlate SignNow to manage Form CT 183 M Tax NY, businesses can minimize errors and ensure timely compliance with tax regulations.

-

Is airSlate SignNow user-friendly for completing Form CT 183 M Tax NY?

Absolutely! airSlate SignNow is designed for ease of use, allowing users to quickly complete Form CT 183 M Tax NY without extensive training. Its user-friendly interface ensures that anyone can efficiently manage their eSigning needs.

Get more for Form CT 183 M Tax Ny

Find out other Form CT 183 M Tax Ny

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online