Ryder Financing Form

What is Ryder Financing?

Ryder financing refers to the various financial solutions offered by Ryder to assist businesses in acquiring trucks and other vehicles. This financing can take the form of leases, loans, or other financial products tailored to meet the specific needs of companies. Ryder's financing options aim to provide flexibility and affordability, allowing businesses to manage their transportation needs without the burden of significant upfront costs.

Eligibility Criteria for Ryder Financing

To qualify for Ryder financing, applicants typically need to meet certain criteria, which may include:

- Proof of business ownership or operation, such as a business license.

- A minimum credit score, which varies depending on the specific financing option.

- Demonstration of stable revenue or income to ensure the ability to meet payment obligations.

- Submission of financial statements or tax returns for the previous year.

Understanding these eligibility criteria can help streamline the application process and increase the chances of approval.

Steps to Complete the Ryder Financing Application

Completing the Ryder financing application involves several key steps:

- Gather necessary documentation, including financial statements and business licenses.

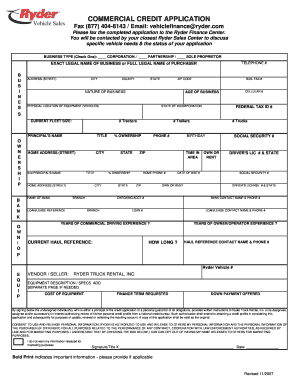

- Fill out the Ryder credit application, providing accurate information about your business and financial status.

- Submit the application through the designated method, either online or in person.

- Await approval, during which Ryder may conduct a credit check and review your financial history.

- Once approved, review the financing terms and sign the necessary documents to finalize the agreement.

Following these steps can facilitate a smoother application process.

Required Documents for Ryder Financing

When applying for Ryder financing, you will need to provide several important documents, including:

- A completed Ryder credit application form.

- Business financial statements for the past year.

- Tax returns to verify income and business operations.

- Proof of business registration or licensing.

- Identification documents of the business owner or authorized signers.

Having these documents ready can expedite the approval process and ensure compliance with Ryder's requirements.

Legal Use of Ryder Financing

Ryder financing is governed by various legal frameworks that ensure the validity and enforceability of the financing agreements. Compliance with federal and state regulations is crucial. This includes adhering to laws regarding fair lending practices and ensuring that all terms are clearly outlined in the financing documents. Understanding these legal aspects helps protect both the lender and the borrower during the financing process.

Key Elements of Ryder Financing

Several key elements define Ryder financing, including:

- Flexible payment options tailored to the business's cash flow.

- Competitive interest rates based on the applicant's creditworthiness.

- Variety of financing products, including leases and loans, to suit different needs.

- Support from Ryder's financial experts to guide businesses through the process.

These elements contribute to making Ryder financing an appealing option for businesses seeking transportation solutions.

Quick guide on how to complete ryder financing

Complete Ryder Financing seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the appropriate form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without any hold-ups. Manage Ryder Financing on any platform with the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to edit and eSign Ryder Financing effortlessly

- Locate Ryder Financing and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details thoroughly and hit the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and eSign Ryder Financing and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ryder financing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the basic Ryder financing requirements?

The basic Ryder financing requirements typically include a good credit score, proof of income, and possibly a down payment depending on the vehicle type. Additionally, applicants may need to provide personal and business information to assess eligibility. Understanding these requirements can help streamline your financing process.

-

How does airSlate SignNow assist with Ryder financing documentation?

AirSlate SignNow provides a seamless way to eSign and manage all Ryder financing documentation electronically. Our platform allows you to upload, send, and securely sign all necessary forms, minimizing paperwork and reducing processing time. This efficiency can help you meet Ryder financing requirements faster.

-

What features does airSlate SignNow offer for managing Ryder contracts?

AirSlate SignNow offers a user-friendly interface for managing Ryder contracts, including easy document uploads, customizable templates, and real-time tracking of signatures. Additionally, our solution integrates with various CRM systems, making it easier to manage customer relationships while ensuring compliance with Ryder financing requirements.

-

Are there any specific benefits of using airSlate SignNow for Ryder financing?

Using airSlate SignNow for Ryder financing offers numerous benefits, including time savings, enhanced security, and improved accuracy in document handling. Our platform simplifies the signing process, allowing you to focus on what matters most—running your business while ensuring you meet Ryder financing requirements.

-

What pricing plans are available for airSlate SignNow users?

AirSlate SignNow offers various pricing plans tailored to meet business needs, from small startups to large corporations. Each plan provides essential features for eSigning documents, including those related to Ryder financing requirements. Contact us for detailed pricing and feature comparisons to find the right plan for you.

-

Does airSlate SignNow integrate with other financial tools for Ryder financing?

Yes, airSlate SignNow integrates seamlessly with various financial tools and platforms, enhancing your workflow for Ryder financing. This integration allows for better data sharing and document management, helping you easily comply with Ryder financing requirements. Check our integrations page for more details.

-

How can airSlate SignNow improve the Ryder financing process?

AirSlate SignNow streamlines the Ryder financing process by automating document workflows and reducing the turnaround time for signatures. Our solution ensures all documents meet Ryder financing requirements and keeps your team organized with reminders and tracking features. This optimization can lead to quicker approvals and transactions.

Get more for Ryder Financing

Find out other Ryder Financing

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad