H Probateforms Forms Form No 021 Instructions to Fiduciary for

What is the H Probateforms Forms Form No 021 Instructions To Fiduciary For

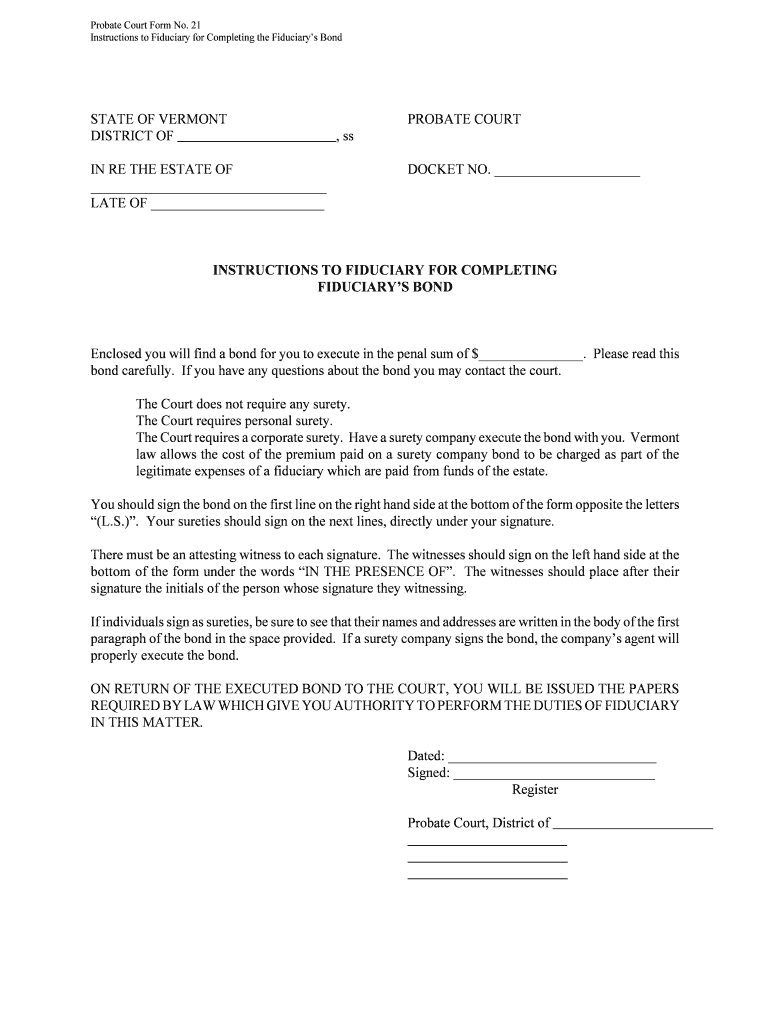

The H Probateforms Forms Form No 021, commonly referred to as Instructions To Fiduciary For, is a legal document utilized in the probate process. This form provides essential guidance to fiduciaries, such as executors or administrators, on their responsibilities and duties when managing the estate of a deceased individual. It outlines the steps necessary for the proper administration of the estate, ensuring that the fiduciary understands their obligations under state law.

How to use the H Probateforms Forms Form No 021 Instructions To Fiduciary For

Using the H Probateforms Forms Form No 021 involves several key steps. First, the fiduciary must carefully read the instructions provided within the form to understand their roles and responsibilities. Next, the fiduciary should gather all relevant documents related to the estate, including wills, asset lists, and debts. After reviewing the instructions, the fiduciary can proceed to complete any required tasks, such as notifying beneficiaries and settling debts, in accordance with the guidelines outlined in the form.

Steps to complete the H Probateforms Forms Form No 021 Instructions To Fiduciary For

Completing the H Probateforms Forms Form No 021 involves a systematic approach:

- Review the form thoroughly to understand the fiduciary's obligations.

- Gather necessary documentation, including the will and estate inventory.

- Notify all beneficiaries and interested parties as required.

- Settle any outstanding debts and expenses related to the estate.

- Distribute the remaining assets to the beneficiaries according to the will.

- Maintain accurate records of all transactions and communications.

Key elements of the H Probateforms Forms Form No 021 Instructions To Fiduciary For

The key elements of the H Probateforms Forms Form No 021 include detailed instructions on the fiduciary's duties, a checklist of tasks to complete, and legal requirements that must be adhered to during the probate process. The form also highlights the importance of transparency with beneficiaries and provides guidelines for maintaining accurate records throughout the administration of the estate.

Legal use of the H Probateforms Forms Form No 021 Instructions To Fiduciary For

The legal use of the H Probateforms Forms Form No 021 is crucial for ensuring compliance with state probate laws. The fiduciary must follow the instructions outlined in the form to avoid potential legal issues, such as mismanagement of the estate or disputes among beneficiaries. Proper use of the form helps protect the fiduciary from liability and ensures that the estate is administered in accordance with the deceased's wishes.

Required Documents

When using the H Probateforms Forms Form No 021, several documents are typically required to facilitate the probate process. These may include:

- The original will of the deceased.

- A list of all assets and liabilities of the estate.

- Death certificate of the deceased.

- Identification documents for the fiduciary.

- Any prior court orders related to the estate.

Who Issues the Form

The H Probateforms Forms Form No 021 is typically issued by state probate courts or relevant state agencies responsible for overseeing the probate process. Each state may have its own specific guidelines and requirements for the form, so it is essential for fiduciaries to obtain the correct version applicable to their jurisdiction.

Quick guide on how to complete h probateforms forms form no 021 instructions to fiduciary for

Effortlessly prepare [SKS] on any device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools provided by airSlate SignNow designed for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require the printing of new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to H Probateforms Forms Form No 021 Instructions To Fiduciary For

Create this form in 5 minutes!

How to create an eSignature for the h probateforms forms form no 021 instructions to fiduciary for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is H Probateforms Forms Form No 021 Instructions To Fiduciary For?

H Probateforms Forms Form No 021 Instructions To Fiduciary For is a legal document that details guidelines for fiduciaries managing estates. This form ensures that fiduciaries understand their duties and responsibilities, promoting transparency and compliance with the law.

-

How can airSlate SignNow help with H Probateforms Forms Form No 021 Instructions To Fiduciary For?

airSlate SignNow provides a simple and efficient platform for completing H Probateforms Forms Form No 021 Instructions To Fiduciary For electronically. By using our eSigning feature, you can securely sign, store, and manage your documents, ensuring a streamlined process.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to individual needs and business requirements. You can choose from a monthly or annual subscription, which provides you with access to features such as completing H Probateforms Forms Form No 021 Instructions To Fiduciary For at a competitive price.

-

Is it easy to integrate airSlate SignNow with other software?

Yes, airSlate SignNow is designed for easy integration with various third-party applications and platforms. This compatibility allows users to seamlessly incorporate features for H Probateforms Forms Form No 021 Instructions To Fiduciary For into their existing workflows.

-

What are the benefits of using airSlate SignNow for H Probateforms Forms Form No 021 Instructions To Fiduciary For?

Using airSlate SignNow for H Probateforms Forms Form No 021 Instructions To Fiduciary For offers multiple benefits, including enhanced security, time savings, and easy document management. Users can quickly send and receive signed forms while ensuring compliance with legal standards.

-

Can I access H Probateforms Forms Form No 021 Instructions To Fiduciary For on mobile devices?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to access and manage H Probateforms Forms Form No 021 Instructions To Fiduciary For from any device. This feature ensures that you can stay productive anytime and anywhere.

-

Are there customer support options available for airSlate SignNow users?

Yes, airSlate SignNow provides comprehensive customer support to help users with any inquiries related to H Probateforms Forms Form No 021 Instructions To Fiduciary For. Our support team is available via multiple channels to ensure you receive prompt assistance.

Get more for H Probateforms Forms Form No 021 Instructions To Fiduciary For

Find out other H Probateforms Forms Form No 021 Instructions To Fiduciary For

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate