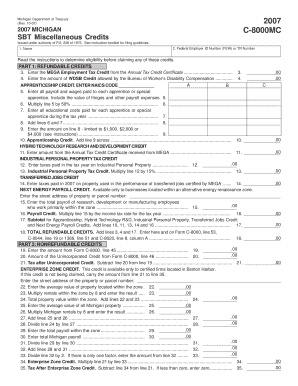

SBT Miscellaneous Credits Form

What is the SBT Miscellaneous Credits

The SBT Miscellaneous Credits form is designed to help taxpayers claim various credits that may not fall under standard categories. These credits can include those for specific expenses, activities, or circumstances that the IRS recognizes as eligible for tax relief. Understanding this form is essential for maximizing potential tax benefits and ensuring compliance with federal regulations.

How to use the SBT Miscellaneous Credits

Using the SBT Miscellaneous Credits form involves identifying the specific credits applicable to your situation. Taxpayers should gather all relevant documentation that supports their claim for these credits. This may include receipts, invoices, or other proof of expenses incurred. Once you have compiled the necessary information, complete the form accurately, ensuring all details align with the supporting documents.

Steps to complete the SBT Miscellaneous Credits

Completing the SBT Miscellaneous Credits form requires a systematic approach:

- Gather all necessary documentation related to the credits you wish to claim.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the form according to the guidelines specified, whether online, by mail, or in person.

Eligibility Criteria

To qualify for the SBT Miscellaneous Credits, taxpayers must meet specific eligibility criteria set forth by the IRS. This may include income thresholds, types of expenses incurred, or particular circumstances that justify the claim for credits. It is important to review these criteria carefully to ensure that you qualify before submitting your form.

Required Documents

When filing the SBT Miscellaneous Credits form, certain documents are essential to support your claim. These may include:

- Receipts for expenses related to the credits claimed.

- Invoices or statements from service providers.

- Any relevant tax documents that may provide context for your claim.

Having these documents ready will streamline the filing process and help substantiate your claims.

Filing Deadlines / Important Dates

Being aware of filing deadlines is crucial for successfully submitting the SBT Miscellaneous Credits form. Generally, the form should be filed by the same deadlines as annual tax returns. However, specific credits may have unique deadlines. It is advisable to check the IRS calendar for the most accurate and current dates to avoid penalties or missed opportunities for claiming credits.

Penalties for Non-Compliance

Failing to comply with the requirements of the SBT Miscellaneous Credits form can result in penalties. These may include fines, interest on unpaid taxes, or disallowance of the claimed credits. It is essential to ensure that all information is accurate and that the form is submitted on time to avoid these potential consequences.

Quick guide on how to complete sbt miscellaneous credits

Accomplish [SKS] with ease on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, enabling you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly and efficiently. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance your document-centered workflows today.

Steps to modify and electronically sign [SKS] effortlessly

- Access [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Identify pertinent sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to finalize your edits.

- Choose your preferred method to share your form, whether via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to missing or disorganized files, frustrating form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Alter and electronically sign [SKS] and ensure top-notch communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sbt miscellaneous credits

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are SBT Miscellaneous Credits?

SBT Miscellaneous Credits are a type of credit used to offset various tax obligations or enhance financial flexibility. They can be particularly beneficial for businesses looking to manage their expenses more efficiently. Understanding how to apply these credits can lead to signNow savings.

-

How can airSlate SignNow assist with managing SBT Miscellaneous Credits?

airSlate SignNow offers a streamlined document management solution that simplifies the process of applying for and tracking SBT Miscellaneous Credits. Our platform allows for easy collaboration and sharing of required documents, ensuring your credit applications are handled efficiently. This feature ultimately saves time and enhances productivity.

-

What features does airSlate SignNow provide for SBT Miscellaneous Credits?

The platform includes features like electronic signatures, document templates, and automated workflows, all designed to facilitate the management of SBT Miscellaneous Credits. These tools help users ensure compliance and eliminate errors that may arise during the documentation process. By leveraging these features, you can easily scale your operations.

-

Is there a cost associated with utilizing SBT Miscellaneous Credits on airSlate SignNow?

While accessing SBT Miscellaneous Credits through airSlate SignNow may involve some associated costs, the platform's pricing is designed to be cost-effective. The savings gained from effectively utilizing these credits can far outweigh the expenses of using our services. We offer various pricing plans to accommodate businesses of all sizes.

-

Can I integrate airSlate SignNow with my existing systems to manage SBT Miscellaneous Credits?

Yes, airSlate SignNow supports integration with a variety of third-party applications, allowing users to manage SBT Miscellaneous Credits seamlessly within their existing workflows. Integration capabilities enable real-time data synchronization and enhance the overall efficiency of credit management processes. This ensures that all parties have access to the latest information.

-

What are the benefits of using airSlate SignNow for SBT Miscellaneous Credits?

Using airSlate SignNow for managing SBT Miscellaneous Credits offers numerous benefits, including increased efficiency, reduced errors, and enhanced compliance. The ease of use and accessibility of our platform empower businesses to track and optimize their spending effectively. Consequently, you can focus on strategic initiatives while we handle the paperwork.

-

Is airSlate SignNow suitable for small businesses looking to utilize SBT Miscellaneous Credits?

Absolutely! airSlate SignNow is tailored to meet the needs of small businesses seeking to leverage SBT Miscellaneous Credits effectively. Our user-friendly platform, combined with affordable pricing, makes it accessible for smaller operations to optimize their financial management. This empowers small businesses to compete more effectively.

Get more for SBT Miscellaneous Credits

Find out other SBT Miscellaneous Credits

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement