4596, MICHIGAN Business Tax Miscellaneous Credits for Insurance Companies 4596, MICHIGAN Business Tax Miscellaneous Credits for Form

Understanding the 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies

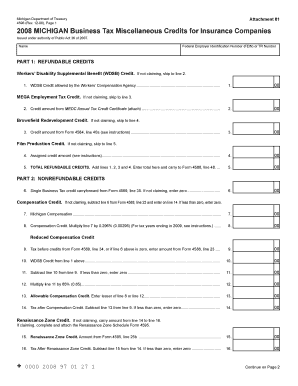

The 4596 form is specifically designed for insurance companies operating in Michigan to claim miscellaneous tax credits under the Michigan Business Tax (MBT). These credits are intended to reduce the overall tax liability of insurance companies, encouraging business growth and stability within the state. The form requires detailed information regarding the company's financial activities, including premium taxes paid and any applicable deductions. Understanding the specific credits available can help insurance companies maximize their tax benefits and ensure compliance with state regulations.

Steps to Complete the 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies

Completing the 4596 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and tax records. Next, accurately fill out the form by providing the required information about your business operations, including the total premium taxes paid. It is essential to review the instructions carefully to ensure that all sections of the form are completed correctly. After completing the form, double-check for any errors before submitting it to the appropriate state tax authority.

Eligibility Criteria for the 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies

To be eligible for the credits claimed on the 4596 form, insurance companies must meet specific criteria set forth by the Michigan Department of Treasury. These criteria typically include being a licensed insurance provider in Michigan, having a minimum amount of premium taxes paid, and complying with all state regulations regarding business operations. It is crucial for companies to verify their eligibility before filing to avoid potential penalties or disallowance of credits.

Required Documents for the 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies

When preparing to file the 4596 form, insurance companies must compile several key documents to support their claims for miscellaneous credits. Required documents often include detailed financial statements, proof of premium taxes paid, and any relevant correspondence with the Michigan Department of Treasury. Additionally, companies may need to provide documentation that demonstrates compliance with state regulations. Having these documents ready can streamline the filing process and enhance the credibility of the submitted information.

Filing Deadlines for the 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies

Timely filing of the 4596 form is crucial for insurance companies to ensure they receive the applicable tax credits. The filing deadline generally aligns with the due date for the Michigan Business Tax return. Companies should be aware of any specific deadlines set by the Michigan Department of Treasury and plan accordingly to avoid late fees or penalties. Staying informed about these deadlines helps companies maintain compliance and optimize their tax positions.

Examples of Using the 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies

Utilizing the 4596 form can significantly impact an insurance company's financial health. For instance, a company that has paid substantial premium taxes may use this form to claim credits that offset its tax liability, resulting in significant savings. Another example includes a company that has invested in community programs or initiatives that qualify for additional credits. By effectively leveraging the 4596 form, insurance companies can enhance their financial standing and contribute positively to the Michigan economy.

Quick guide on how to complete 4596 michigan business tax miscellaneous credits for insurance companies 4596 michigan business tax miscellaneous credits for

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed papers, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to swiftly create, modify, and eSign your documents without delays. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

How to Modify and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize our tools to complete your form.

- Emphasize important sections of your documents or conceal sensitive information using the specialized tools that airSlate SignNow offers for this purpose.

- Create your eSignature with the Sign feature, which takes only seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form: by email, text message (SMS), or via an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4596 michigan business tax miscellaneous credits for insurance companies 4596 michigan business tax miscellaneous credits for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies?

The 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies are specific tax credits available to insurance companies operating within Michigan. These credits can help businesses reduce their tax liability signNowly, encouraging investment in the state. By taking advantage of these credits, companies can enhance their financial performance and better manage their tax obligations.

-

How can I apply for the 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies?

To apply for the 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies, you need to fill out the appropriate state tax forms and provide supporting documentation that qualifies your business for the credits. It's advisable to consult with a tax professional to ensure accuracy in your application. Once submitted, the state will review your claims before awarding any credits.

-

What are the benefits of the 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies?

The main benefits of the 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies include signNow tax savings, improved cash flow, and enhanced competitive positioning within the state. These credits can serve as a financial incentive for insurance companies to invest further in Michigan's economy. Additionally, utilizing these credits fosters sustainable growth and development for the insurance sector.

-

Are all insurance companies eligible for the 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies?

Not all insurance companies may qualify for the 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies. Eligibility typically depends on specific factors such as the type of insurance offered, total gross premiums, and the company's tax standing within Michigan. It's crucial to review the eligibility criteria provided by the Michigan Department of Treasury to understand your company's status.

-

What documentation is required to claim the 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies?

To claim the 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies, businesses typically need to provide forms detailing their operations, revenue, and prior tax payments. Supporting documents may include financial statements, proof of insurance premiums collected, and any correspondence with state tax authorities. Ensuring all documents are accurate and complete will facilitate the claims process.

-

How does airSlate SignNow help in the process of applying for these tax credits?

airSlate SignNow streamlines the application process by allowing insurance companies to send and eSign necessary documentation quickly and securely. This ease of use ensures that all required forms for the 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies are transmitted efficiently. By integrating SignNow into your workflow, you can improve productivity and process compliance effectively.

-

What are the costs associated with applying for the 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies?

While applying for the 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies may not have direct application fees, businesses should consider costs associated with tax preparation and consulting services. These costs may vary based on the complexity of your application and your business structure. Using efficient tools like airSlate SignNow can reduce some operational costs during the documentation process.

Get more for 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies 4596, MICHIGAN Business Tax Miscellaneous Credits For

- Title money makes the fair go round nsa form

- J23 ct dmv form

- Family court adoption decree case number first circuit by hawaii form

- 2f p 217 form

- Adoption decree by other than stepparent or by stepparent form

- Alere inratio2 recall letter fda final version w id info form

- Bfi real estate form

- Bacb grades form

Find out other 4596, MICHIGAN Business Tax Miscellaneous Credits For Insurance Companies 4596, MICHIGAN Business Tax Miscellaneous Credits For

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free