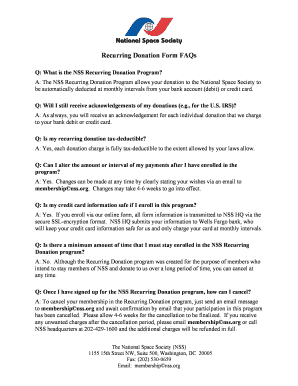

Recurring Donation Form FAQs Nss

Understanding the Recurring Donation Form FAQs Nss

The Recurring Donation Form FAQs Nss is designed to help organizations manage ongoing contributions from donors. This form allows donors to set up automatic donations on a regular basis, simplifying the giving process. It is especially useful for nonprofits looking to secure steady funding while providing donors with a convenient way to support their causes.

This form typically includes sections for donor information, donation amounts, frequency of donations, and payment details. Understanding how to properly fill out this form is essential for both organizations and donors to ensure smooth transactions and compliance with any applicable regulations.

Steps to Complete the Recurring Donation Form FAQs Nss

Completing the Recurring Donation Form FAQs Nss involves several key steps:

- Gather necessary information: Collect personal details such as name, address, and contact information. You will also need your payment method details, such as credit card or bank account information.

- Choose donation amount: Decide how much you wish to donate on a recurring basis. This could be a fixed amount or a percentage of your income, depending on your preference.

- Select donation frequency: Indicate how often you want the donations to occur, whether it be weekly, monthly, or annually.

- Review and sign: Carefully review all the information provided to ensure accuracy. Once confirmed, sign the form to authorize the recurring donations.

Legal Use of the Recurring Donation Form FAQs Nss

The use of the Recurring Donation Form FAQs Nss is governed by various legal guidelines to protect both donors and organizations. It is essential for organizations to comply with federal and state laws regarding charitable contributions. This includes providing clear information about how donations will be used and ensuring that donors have the right to cancel their recurring donations at any time.

Organizations should also maintain accurate records of all transactions for tax purposes and ensure that they adhere to any disclosure requirements set forth by the IRS. This transparency helps build trust with donors and ensures compliance with legal standards.

Key Elements of the Recurring Donation Form FAQs Nss

Several key elements are essential to the Recurring Donation Form FAQs Nss:

- Donor Information: This section collects the donor's personal details, including name, address, and contact information.

- Donation Amount: Donors specify how much they wish to contribute on a recurring basis.

- Frequency of Donations: This allows donors to choose how often their contributions will be made.

- Payment Information: Details about the payment method, such as credit card or bank account information, are included here.

- Authorization Signature: Donors must sign the form to authorize the recurring transaction.

Examples of Using the Recurring Donation Form FAQs Nss

The Recurring Donation Form FAQs Nss can be utilized in various scenarios:

- Nonprofit Organizations: Many charities use this form to facilitate ongoing donations from supporters, ensuring a stable funding source.

- Religious Institutions: Churches and other religious organizations often encourage members to set up recurring donations to support their missions.

- Community Projects: Local initiatives may use this form to gather consistent financial support from community members.

These examples illustrate the versatility of the Recurring Donation Form FAQs Nss in fostering long-term financial relationships between donors and organizations.

IRS Guidelines for Recurring Donations

The IRS has specific guidelines regarding charitable contributions, including those made through recurring donations. Donors should be aware that contributions may be tax-deductible, provided that the organization is recognized as tax-exempt under IRS regulations. It is advisable for donors to keep records of their donations, including receipts or confirmations from the organization.

Organizations, in turn, must provide donors with a written acknowledgment of contributions, especially for donations exceeding a certain amount. This acknowledgment serves as proof for tax purposes and helps ensure compliance with IRS requirements.

Quick guide on how to complete recurring donation form faqs nss

Effortlessly Prepare [SKS] on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources essential for creating, editing, and electronically signing your documents quickly and efficiently. Handle [SKS] on any device with the airSlate SignNow applications for Android or iOS and enhance your document-oriented tasks today.

How to Edit and eSign [SKS] with Ease

- Obtain [SKS] and click Get Form to commence.

- Use the tools available to fill out your form.

- Highlight important sections of your documents or obscure sensitive data with the specialized tools provided by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form—either via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, and mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the recurring donation form faqs nss

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Recurring Donation Form?

A Recurring Donation Form is a digital tool that allows organizations to collect ongoing contributions from donors easily. It streamlines the donation process, ensuring that giving can happen on a schedule that suits both the donor and the organization. For more details, check our Recurring Donation Form FAQs Nss.

-

How does airSlate SignNow support Recurring Donation Forms?

airSlate SignNow provides a user-friendly platform for creating and managing Recurring Donation Forms. This solution helps organizations automate the donation process through e-signatures and secure transactions. Explore our Recurring Donation Form FAQs Nss for more insights on features.

-

What are the pricing options for creating Recurring Donation Forms?

airSlate SignNow offers several pricing plans to accommodate different organizational needs for Recurring Donation Forms. Our competitive pricing ensures that organizations of all sizes can manage donations effectively. Visit the Recurring Donation Form FAQs Nss for specific details on our pricing structure.

-

Are there integration options for the Recurring Donation Form?

Yes, airSlate SignNow supports integrations with various CRM and payment processing platforms, enhancing the functionality of your Recurring Donation Form. This allows seamless data collection and transaction management. Find more about integrations in our Recurring Donation Form FAQs Nss.

-

What features come with the Recurring Donation Form?

The Recurring Donation Form includes features like customizable templates, automated reminders, and secure payment processing. These features are designed to simplify the donor experience and increase retention. For a complete list of features, explore our Recurring Donation Form FAQs Nss.

-

How can Recurring Donation Forms benefit my organization?

Recurring Donation Forms can signNowly boost fundraising efforts by providing a consistent revenue stream. They help foster donor loyalty through easy, automated giving options. Check our Recurring Donation Form FAQs Nss for more information on the benefits.

-

Is support available for users of the Recurring Donation Form?

Yes, airSlate SignNow offers comprehensive support for users of the Recurring Donation Form, including tutorials, user guides, and customer service assistance. Our team is dedicated to helping you maximize the platform’s potential. For more on support, refer to our Recurring Donation Form FAQs Nss.

Get more for Recurring Donation Form FAQs Nss

- Macc gift shop consignment bapplicationb city of marquette mqtcty form

- Visionworks com contactlensrebates form

- Delaware residential lease agreement form

- 1040es me form

- Informal observation examples

- Tb 43 180 pdf form

- The trial of cardigan jones full story pdf form

- Where do i feel stress in my body form

Find out other Recurring Donation Form FAQs Nss

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement