CMFT 1 X Amended County Motor Fuel Tax Return Illinois Form

What is the CMFT 1 X Amended County Motor Fuel Tax Return Illinois

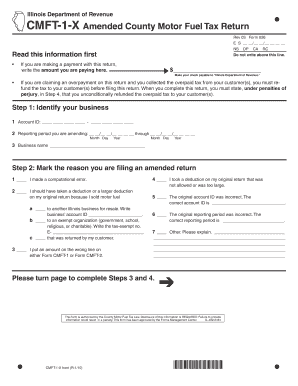

The CMFT 1 X Amended County Motor Fuel Tax Return is a tax form used in Illinois for reporting and amending motor fuel tax liabilities. This form is specifically designed for businesses that need to correct previously filed motor fuel tax returns. The amended return allows taxpayers to report changes in fuel purchases, sales, or any discrepancies that may have occurred in the original filing. It ensures compliance with state tax regulations and helps maintain accurate records for tax purposes.

How to use the CMFT 1 X Amended County Motor Fuel Tax Return Illinois

Using the CMFT 1 X Amended County Motor Fuel Tax Return involves several steps. First, obtain the form from the appropriate state tax authority or download it from a reliable source. Next, carefully fill out the required fields, ensuring that all information is accurate and reflects the necessary amendments. After completing the form, review it for any errors before submitting it. This form can be filed electronically or mailed to the designated tax office, depending on the submission methods available in your area.

Steps to complete the CMFT 1 X Amended County Motor Fuel Tax Return Illinois

Completing the CMFT 1 X Amended County Motor Fuel Tax Return requires attention to detail. Follow these steps:

- Gather all relevant documentation related to your original motor fuel tax return.

- Access the CMFT 1 X form and begin filling out your business information.

- Indicate the tax period for which you are amending the return.

- Provide the corrected figures for fuel purchases and sales.

- Sign and date the form to certify its accuracy.

- Submit the completed form as per the guidelines provided by the state tax authority.

Key elements of the CMFT 1 X Amended County Motor Fuel Tax Return Illinois

The CMFT 1 X Amended County Motor Fuel Tax Return includes several key elements that are essential for accurate reporting. These elements typically consist of:

- Taxpayer identification information, including name and address.

- Tax period for which the amendment is being filed.

- Details of the original return, including previously reported figures.

- Corrected amounts for fuel purchases and sales.

- Reason for the amendment, which should be clearly stated.

Filing Deadlines / Important Dates

Filing deadlines for the CMFT 1 X Amended County Motor Fuel Tax Return are crucial to avoid penalties. Generally, the amended return must be filed within a specific timeframe following the original return's due date. It is important to check with the Illinois Department of Revenue for the exact deadlines applicable to your situation, as these dates can vary based on the tax period and any changes in state regulations.

Penalties for Non-Compliance

Failing to file the CMFT 1 X Amended County Motor Fuel Tax Return or submitting it late can result in penalties. These penalties may include fines or interest on any unpaid taxes. It is essential to adhere to filing requirements and deadlines to avoid these consequences. Understanding the specific penalties associated with non-compliance can help businesses maintain their tax obligations and avoid unnecessary financial burdens.

Quick guide on how to complete cmft 1 x amended county motor fuel tax return illinois

Effortlessly Prepare CMFT 1 X Amended County Motor Fuel Tax Return Illinois on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional paper forms by enabling you to obtain the necessary document and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage CMFT 1 X Amended County Motor Fuel Tax Return Illinois on any device using the airSlate SignNow applications for Android or iOS and enhance any document-driven workflow today.

How to Edit and Electronically Sign CMFT 1 X Amended County Motor Fuel Tax Return Illinois with Ease

- Find CMFT 1 X Amended County Motor Fuel Tax Return Illinois and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you want to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign CMFT 1 X Amended County Motor Fuel Tax Return Illinois and guarantee seamless communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cmft 1 x amended county motor fuel tax return illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CMFT 1 X Amended County Motor Fuel Tax Return Illinois?

The CMFT 1 X Amended County Motor Fuel Tax Return Illinois is a form required by the state of Illinois for taxpayers to amend their previous submissions related to county motor fuel taxes. This document ensures that any corrections or updates to previous tax filings are formally recognized and processed by the state government.

-

How can airSlate SignNow help with the CMFT 1 X Amended County Motor Fuel Tax Return Illinois?

airSlate SignNow provides a user-friendly platform that allows businesses to easily send and eSign the CMFT 1 X Amended County Motor Fuel Tax Return Illinois. With its streamlined interface, you can quickly fill out and submit your amended tax return, ensuring compliance with state regulations.

-

Is there a cost associated with using airSlate SignNow for the CMFT 1 X Amended County Motor Fuel Tax Return Illinois?

Yes, there is a cost associated with using airSlate SignNow, but it offers a cost-effective solution for managing your documents, including the CMFT 1 X Amended County Motor Fuel Tax Return Illinois. Pricing plans are available to cater to various business needs, providing excellent value for efficiency and compliance.

-

What features does airSlate SignNow offer for handling the CMFT 1 X Amended County Motor Fuel Tax Return Illinois?

AirSlate SignNow offers several features that facilitate the process of submitting the CMFT 1 X Amended County Motor Fuel Tax Return Illinois, including document templates, eSignature capabilities, and cloud storage for easy access. These features streamline the workflow, allowing for quicker submission and tracking of your amended returns.

-

Can airSlate SignNow integrate with accounting software for the CMFT 1 X Amended County Motor Fuel Tax Return Illinois?

Yes, airSlate SignNow can integrate with various accounting and tax software solutions, making it easier to manage the CMFT 1 X Amended County Motor Fuel Tax Return Illinois alongside your financial records. These integrations help ensure that your data is consistent and up-to-date, improving accuracy in your tax filings.

-

What are the benefits of using airSlate SignNow for tax documents like the CMFT 1 X Amended County Motor Fuel Tax Return Illinois?

Using airSlate SignNow to manage your tax documents, such as the CMFT 1 X Amended County Motor Fuel Tax Return Illinois, offers several benefits, including time savings, improved accuracy, and enhanced compliance. The intuitive platform reduces the risk of errors and offers tracking capabilities to ensure your returns are submitted on time.

-

How secure is airSlate SignNow when submitting the CMFT 1 X Amended County Motor Fuel Tax Return Illinois?

AirSlate SignNow prioritizes the security of your documents, including the CMFT 1 X Amended County Motor Fuel Tax Return Illinois. With advanced encryption and compliance with industry standards, you can trust that your sensitive information is protected during the eSigning and submission processes.

Get more for CMFT 1 X Amended County Motor Fuel Tax Return Illinois

- Object intention circumstances worksheet form

- Family clinic new patient information sheet english

- Us customs forms

- Belotero balance treatment informed consent beauty by design beauty by design

- Aarto 04 form

- Dlc4030 officer shareholder disclosure form com ohio

- Instructions for form 6220 alaska underpayment of

- Irs form 8862 walkthrough information to claim youtube

Find out other CMFT 1 X Amended County Motor Fuel Tax Return Illinois

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy