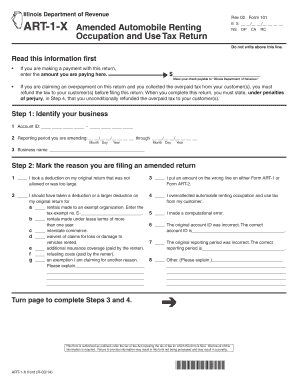

Form ART 1 X Illinois Department of Revenue

What is the Form ART 1 X Illinois Department Of Revenue

The Form ART 1 X is a specific document issued by the Illinois Department of Revenue. This form is primarily used for reporting and documenting various tax-related information. It is essential for individuals and businesses operating within Illinois to understand the purpose of this form, as it plays a critical role in compliance with state tax regulations. The form may be required for specific tax filings, adjustments, or claims, depending on the taxpayer's situation.

How to use the Form ART 1 X Illinois Department Of Revenue

Using the Form ART 1 X involves a few straightforward steps. First, gather all necessary information related to your tax situation, such as income, deductions, and any relevant financial documents. Next, carefully fill out the form, ensuring that all fields are completed accurately. Once the form is filled out, review it for any errors or omissions. Finally, submit the completed form according to the instructions provided, which may include filing online, by mail, or in person.

Steps to complete the Form ART 1 X Illinois Department Of Revenue

Completing the Form ART 1 X requires attention to detail. Follow these steps for a successful submission:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Download or obtain a physical copy of the Form ART 1 X from the Illinois Department of Revenue.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Complete the sections related to your specific tax situation, providing accurate figures and data.

- Review the form thoroughly to ensure all information is correct and complete.

- Submit the form as directed, ensuring you meet any applicable deadlines.

Legal use of the Form ART 1 X Illinois Department Of Revenue

The Form ART 1 X must be used in accordance with Illinois tax laws and regulations. It is crucial for taxpayers to understand the legal implications of submitting this form. Incorrect or fraudulent information can lead to penalties, including fines or additional tax liabilities. Therefore, it is advisable to consult with a tax professional if there are uncertainties regarding the completion or submission of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form ART 1 X can vary based on the type of tax being reported and the specific circumstances of the taxpayer. Generally, it is essential to submit the form by the designated due date to avoid penalties. Taxpayers should check the Illinois Department of Revenue’s official website or consult a tax professional for the most current deadlines and any important dates related to their tax obligations.

Form Submission Methods (Online / Mail / In-Person)

The Form ART 1 X can be submitted through various methods, providing flexibility for taxpayers. Options typically include:

- Online Submission: Many taxpayers prefer to file electronically through the Illinois Department of Revenue's online portal, which may streamline the process.

- Mail: Completed forms can be sent via postal mail to the appropriate address specified in the form instructions.

- In-Person: Taxpayers may also have the option to submit the form in person at designated Illinois Department of Revenue offices.

Quick guide on how to complete form art 1 x illinois department of revenue

Complete [SKS] effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without any hold-ups. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The most effective method to edit and electronically sign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight pertinent sections of your documents or conceal sensitive data with the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information, then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form ART 1 X Illinois Department Of Revenue

Create this form in 5 minutes!

How to create an eSignature for the form art 1 x illinois department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form ART 1 X Illinois Department Of Revenue?

Form ART 1 X Illinois Department Of Revenue is a specific form that businesses in Illinois must complete to report certain tax information. Understanding this form is essential for compliance with state tax regulations. Using airSlate SignNow can streamline this process by allowing you to securely eSign and submit the form electronically.

-

How can airSlate SignNow help with Form ART 1 X Illinois Department Of Revenue?

With airSlate SignNow, you can easily create, send, and eSign Form ART 1 X Illinois Department Of Revenue without the hassle of paperwork. Our platform ensures that all signatures are legally binding and securely stored, helping you maintain compliance. Simplifying the signing process can save you time and reduce the likelihood of errors.

-

Is there a cost to use airSlate SignNow for Form ART 1 X Illinois Department Of Revenue?

Yes, there are pricing plans available for airSlate SignNow that cater to different business needs. These plans are designed to be cost-effective while offering features that enhance your experience with Form ART 1 X Illinois Department Of Revenue. You can choose a plan that suits your volume of documents and required features.

-

What features does airSlate SignNow offer for signing Form ART 1 X Illinois Department Of Revenue?

airSlate SignNow includes features such as customizable templates, document tracking, and secure cloud storage for Form ART 1 X Illinois Department Of Revenue. Moreover, you can automate reminders and notifications to ensure timely submissions. This powerful combination enhances productivity and keeps your team organized.

-

Can I integrate airSlate SignNow with other tools for Form ART 1 X Illinois Department Of Revenue?

Absolutely! airSlate SignNow offers integrations with various popular tools and applications that can help manage your Form ART 1 X Illinois Department Of Revenue and other documents seamlessly. These integrations facilitate a smoother workflow and can enhance your overall productivity. You can connect with CRMs, cloud storage, and communication tools with ease.

-

What are the benefits of using airSlate SignNow for Form ART 1 X Illinois Department Of Revenue?

Using airSlate SignNow for Form ART 1 X Illinois Department Of Revenue provides numerous benefits, including faster turnaround times and reduced processing costs. You’ll also enjoy enhanced security features to protect sensitive information. Overall, airSlate SignNow helps you stay organized and compliant in your business operations.

-

How secure is airSlate SignNow for handling Form ART 1 X Illinois Department Of Revenue?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption protocols to protect your Form ART 1 X Illinois Department Of Revenue and other sensitive documents. Rest assured knowing that your data is protected, allowing you to focus on completing your business tasks without worry.

Get more for Form ART 1 X Illinois Department Of Revenue

- Louisiana workforce commission benefit analysis team phone number form

- Old mutual medical examination request form

- Hodges university transcript request form

- Intention to employa1 in gov form

- City of cocoa beach permit application form

- Data capture format

- Printable personal physical activity log usd 501 personal physical actvity log documents topekapublicschools form

- Mkopo wa dharura online form

Find out other Form ART 1 X Illinois Department Of Revenue

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself