Fillable PTAX 324 Application for Senior Citizens Homestead Exemption Form

What is the Fillable PTAX 324 Application For Senior Citizens Homestead Exemption

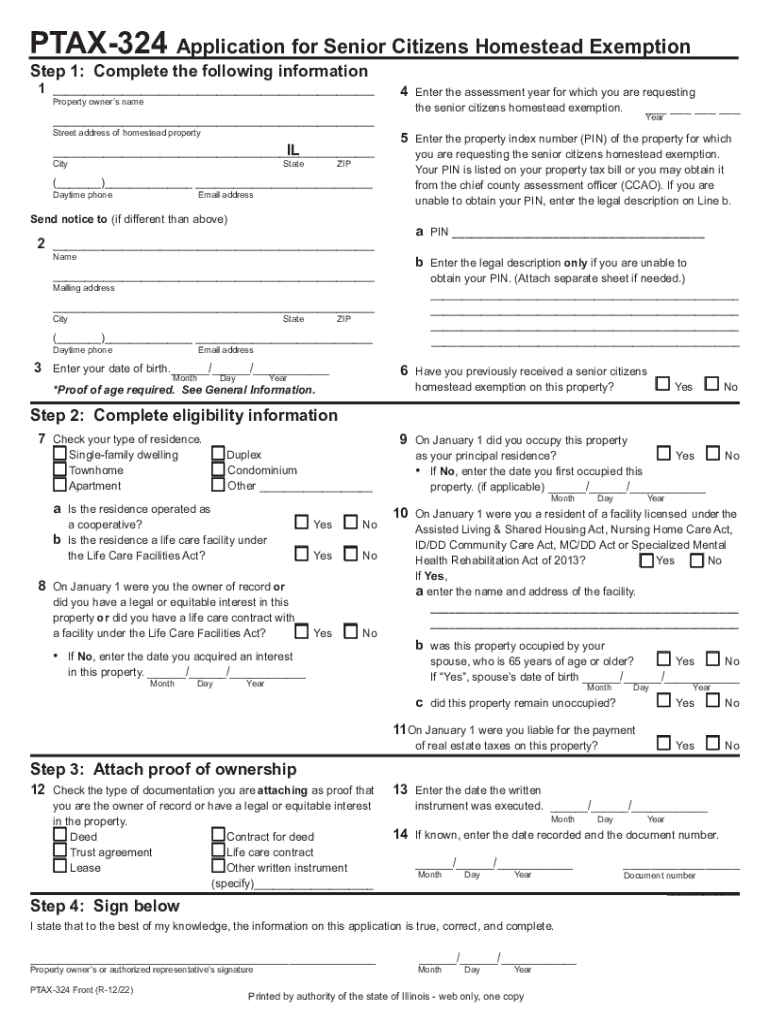

The Fillable PTAX 324 Application for Senior Citizens Homestead Exemption is a crucial document for eligible seniors in Illinois seeking tax relief on their property taxes. This application allows qualifying individuals aged sixty-five or older to receive a reduction in their property tax bill, making homeownership more affordable. The exemption can significantly lower the assessed value of a home, resulting in decreased property taxes owed.

Eligibility Criteria

To qualify for the PTAX 324 exemption, applicants must meet specific requirements:

- Applicants must be at least sixty-five years old by the end of the tax year.

- The property must be the applicant's primary residence.

- Applicants must own the property or have a legal interest in it.

- Income limits may apply, depending on the local jurisdiction.

Steps to Complete the Fillable PTAX 324 Application For Senior Citizens Homestead Exemption

Completing the PTAX 324 application involves several straightforward steps:

- Download the Fillable PTAX 324 form from the official website or obtain a physical copy from your local assessor's office.

- Fill out the required personal information, including your name, address, and date of birth.

- Provide details about the property, including its location and ownership status.

- Review the income requirements and include any necessary income documentation.

- Sign and date the application to certify the information is accurate.

How to Obtain the Fillable PTAX 324 Application For Senior Citizens Homestead Exemption

The PTAX 324 application can be obtained in multiple ways:

- Download the form directly from the Illinois Department of Revenue website.

- Visit your local county assessor's office to request a physical copy.

- Contact local government offices for assistance in acquiring the form.

Form Submission Methods

Once the PTAX 324 application is completed, it can be submitted through various methods:

- Mail the application to your local assessor's office.

- Submit the application in person at the local office.

- Some jurisdictions may offer online submission options, so check with your local office for availability.

Required Documents

When submitting the PTAX 324 application, certain documents may be required to verify eligibility:

- Proof of age, such as a driver's license or birth certificate.

- Documentation of property ownership, like a deed or tax bill.

- Income verification, which may include tax returns or pay stubs.

Quick guide on how to complete fillable ptax 324 application for senior citizens homestead exemption

Accomplish Fillable PTAX 324 Application For Senior Citizens Homestead Exemption seamlessly on any device

Digital document administration has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as it allows you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents quickly and efficiently. Manage Fillable PTAX 324 Application For Senior Citizens Homestead Exemption on any device using the airSlate SignNow applications for Android or iOS and enhance any document-oriented procedure today.

The simplest method to modify and eSign Fillable PTAX 324 Application For Senior Citizens Homestead Exemption effortlessly

- Obtain Fillable PTAX 324 Application For Senior Citizens Homestead Exemption and then click Obtain Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize crucial sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional ink signature.

- Review the details and then click the Complete button to preserve your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing additional document copies. airSlate SignNow fulfils your document management needs with just a few clicks from any device you choose. Modify and eSign Fillable PTAX 324 Application For Senior Citizens Homestead Exemption and ensure superb communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable ptax 324 application for senior citizens homestead exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ptax senior exemption and who qualifies for it?

The ptax senior exemption is a property tax exemption designed to provide financial relief to senior citizens who meet certain eligibility criteria. Typically, applicants must be over the age of 65 and meet income limits set by their local government. This exemption can signNowly reduce property tax liabilities, making it easier for seniors to afford housing.

-

How can airSlate SignNow assist with ptax senior exemption applications?

airSlate SignNow streamlines the application process for the ptax senior exemption by allowing seniors to eSign and submit necessary documents electronically. This reduces the time and effort involved in filling out paper forms and ensures that submissions are secure and compliant. Users can manage their documentation easily, facilitating a smooth application process.

-

Is there a cost associated with using airSlate SignNow for ptax senior exemption applications?

Yes, there is a pricing structure associated with using airSlate SignNow, but it is designed to be cost-effective for users. The platform offers various subscription plans tailored to different business needs, ensuring that seniors and organizations assisting them can find an affordable solution. Investing in airSlate SignNow can save time and streamline the ptax senior exemption process.

-

What features does airSlate SignNow offer to support ptax senior exemption applications?

airSlate SignNow offers a range of features designed to support the ptax senior exemption application process. These include electronic signatures, document templates, secure storage, and audit trails, ensuring that all documents are handled efficiently and securely. The platform is user-friendly, making it accessible even for seniors who may not be tech-savvy.

-

How does airSlate SignNow ensure the security of ptax senior exemption documents?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like those related to the ptax senior exemption. The platform uses industry-standard encryption protocols and secure cloud storage to protect users' data. Additionally, users can track document access and ensure confidentiality throughout the signing process.

-

Can airSlate SignNow integrate with other tools to help with ptax senior exemption management?

Yes, airSlate SignNow offers integrations with a variety of tools and platforms that can assist in managing ptax senior exemption applications and related documentation. These integrations enhance the user experience by allowing seamless data transfer and improved workflow efficiency. Whether it's CRM systems or document management software, airSlate SignNow can work alongside your existing tools.

-

What are the benefits of using airSlate SignNow for ptax senior exemption over traditional methods?

Using airSlate SignNow for the ptax senior exemption offers numerous benefits compared to traditional paper-based methods. The platform saves time with electronic signatures and simplifies the application process, reducing paperwork. Moreover, it enhances accessibility for seniors, ensuring they can manage their exemption applications from the comfort of their home.

Get more for Fillable PTAX 324 Application For Senior Citizens Homestead Exemption

Find out other Fillable PTAX 324 Application For Senior Citizens Homestead Exemption

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile