St 556 Form

What is the St 556 Form

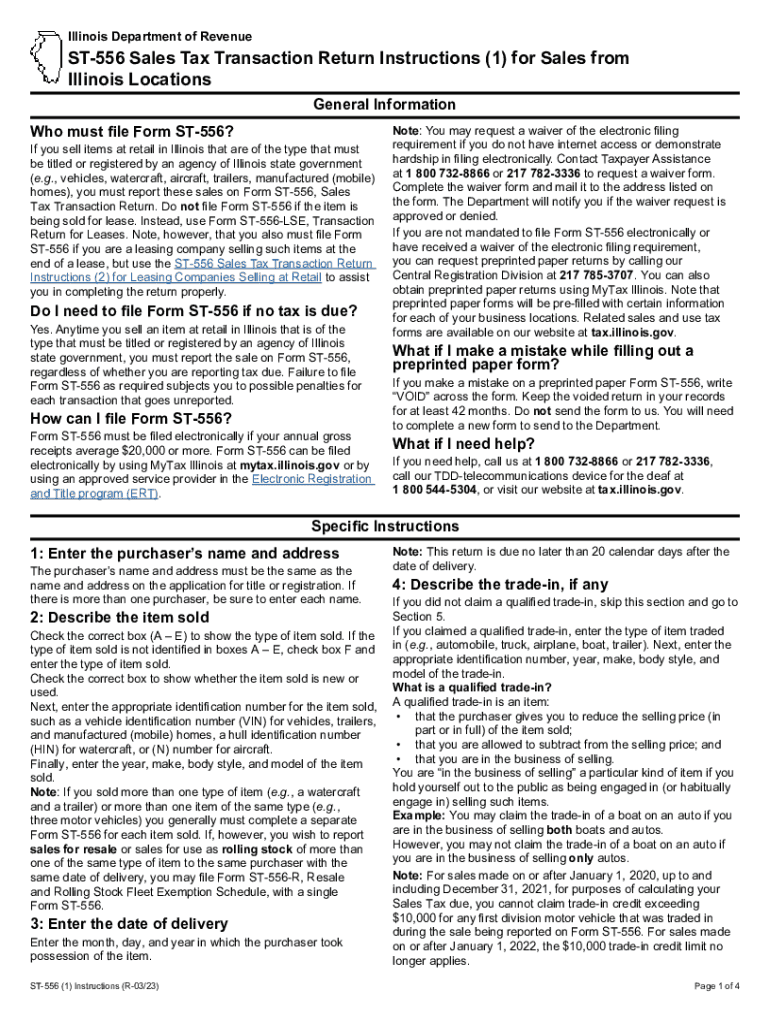

The St 556 form is an official document issued by the Illinois Department of Revenue. It is primarily used for sales tax exemption purposes. This form allows eligible purchasers to claim an exemption from sales tax when buying certain goods or services in the state of Illinois. The St 556 form is essential for businesses and individuals who qualify for tax exemptions under specific circumstances, ensuring compliance with state tax regulations.

How to use the St 556 Form

To use the St 556 form, individuals or businesses must first determine their eligibility for a sales tax exemption. This involves understanding the specific criteria set by the Illinois Department of Revenue. Once eligibility is confirmed, the form should be filled out accurately, providing all required information, including the purchaser's details and the nature of the exemption. After completing the form, it must be presented to the seller at the time of purchase to validate the exemption and avoid sales tax charges.

Steps to complete the St 556 Form

Completing the St 556 form involves several key steps:

- Obtain the St 556 form from the Illinois Department of Revenue website or other authorized sources.

- Fill in the required fields, including the purchaser's name, address, and the reason for the exemption.

- Ensure all information is accurate and complete to avoid delays or issues.

- Sign and date the form to certify its accuracy.

- Present the completed form to the seller when making a purchase.

Key elements of the St 556 Form

The St 556 form contains several key elements that are crucial for its validity:

- Purchaser Information: This includes the name, address, and contact details of the individual or business claiming the exemption.

- Exemption Reason: A clear explanation of why the exemption is being claimed, such as for resale or specific use.

- Signature: The form must be signed by the purchaser or an authorized representative to confirm the information provided.

- Date: The date of completion is necessary for record-keeping and compliance purposes.

Legal use of the St 556 Form

The legal use of the St 556 form is governed by Illinois state tax laws. It is important for users to understand that this form should only be used for legitimate sales tax exemption claims. Misuse of the form, such as falsifying information or claiming exemptions without proper eligibility, can lead to penalties, including fines and back taxes owed. Therefore, it is essential to adhere to all legal requirements when using the St 556 form.

Form Submission Methods

The St 556 form can be submitted in various ways, depending on the seller's preferences and the nature of the transaction:

- In-Person: Present the completed form directly to the seller at the time of purchase.

- Mail: Some sellers may accept the form via mail, although this is less common.

- Digital Submission: While not universally accepted, some sellers may allow digital copies of the St 556 form for electronic transactions.

Quick guide on how to complete st 556 form

Complete St 556 Form seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can easily locate the necessary template and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents swiftly without delays. Manage St 556 Form on any platform using airSlate SignNow Android or iOS applications and simplify any document-focused task today.

The simplest way to modify and eSign St 556 Form effortlessly

- Obtain St 556 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the information and click the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign St 556 Form and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 556 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ST 556 form and why is it important?

The ST 556 form is a tax form used for filing sales and use taxes in certain states. It's essential for businesses to ensure compliance with tax regulations and avoid penalties. Correctly filling out the ST 556 form helps streamline the tax reporting process and can also enhance your overall financial management.

-

How can airSlate SignNow help me with the ST 556 form?

airSlate SignNow simplifies the process of completing and eSigning the ST 556 form by providing an intuitive interface. Users can easily upload, fill out, and send this form electronically, ensuring quick turnaround times. Moreover, it enhances collaboration by allowing multiple stakeholders to sign the ST 556 form seamlessly.

-

Is there a fee for using airSlate SignNow to manage the ST 556 form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan provides the necessary features to manage documents like the ST 556 form efficiently. For a clear understanding of costs, it’s best to check our pricing page to find a solution that fits your budget.

-

What features does airSlate SignNow offer for eSigning the ST 556 form?

airSlate SignNow includes features like secure eSigning, document templates, and real-time tracking for the ST 556 form. You can also customize your signing workflows, ensuring that the process is both efficient and legally binding. These features make signing the ST 556 form easy and secure.

-

Can I integrate airSlate SignNow with other software for managing the ST 556 form?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, allowing you to manage the ST 556 form alongside your existing workflows. Integrations with CRM, accounting software, and more help streamline the process of document management and enhance productivity.

-

What are the benefits of using airSlate SignNow for the ST 556 form?

Using airSlate SignNow for the ST 556 form offers benefits such as increased efficiency, reduced paperwork, and improved compliance. The platform enhances collaboration among team members and provides secure storage for your documents. Ultimately, it saves time and reduces the risk of errors when submitting important tax forms.

-

Is airSlate SignNow legally compliant for signing the ST 556 form?

Yes, airSlate SignNow is legally compliant and follows the necessary regulations for eSigning documents like the ST 556 form. The platform utilizes advanced security measures and meets eSignature laws, ensuring that your signed documents are valid and enforceable. You can confidently use SignNow for your tax-related paperwork.

Get more for St 556 Form

Find out other St 556 Form

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy