About Form 1040 ES NR, U S Estimated Tax for

Understanding the IT-2658 NYS Form

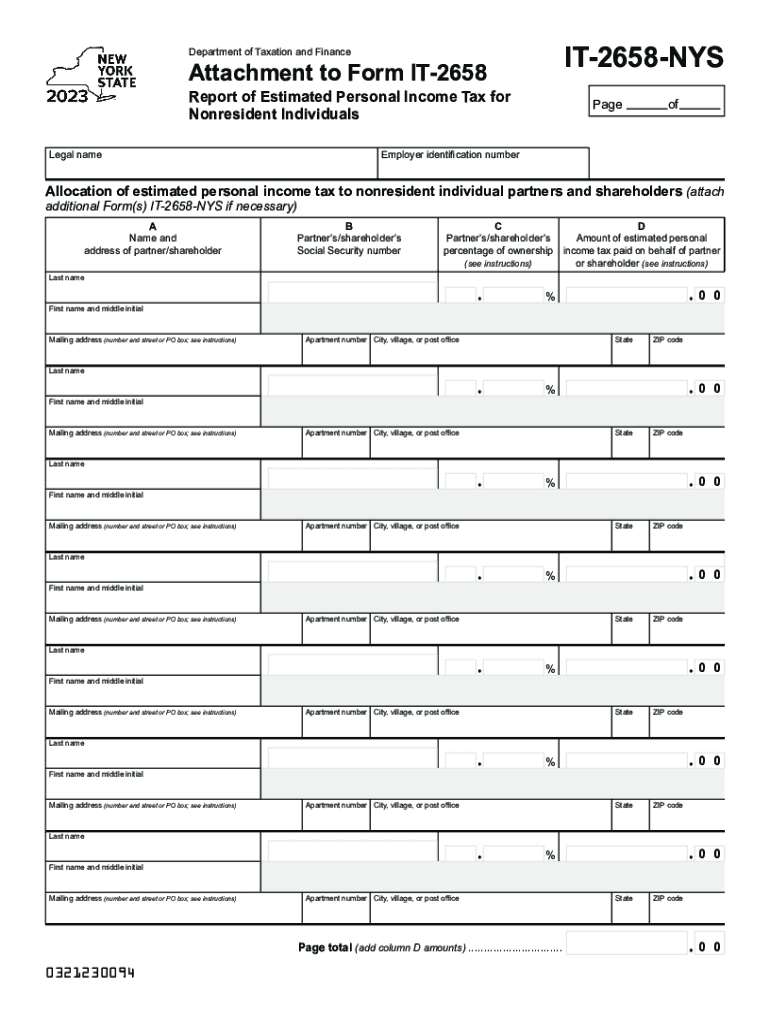

The IT-2658 NYS form is a crucial document for individuals who need to report their New York State income tax. This form is specifically designed for non-residents and part-year residents who have income sourced from New York State. It allows these individuals to calculate their tax liability accurately and ensure compliance with state tax regulations. The form captures essential information regarding income earned, deductions applicable, and the overall tax owed to the state.

Steps to Complete the IT-2658 NYS Form

Completing the IT-2658 NYS form involves several steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms, 1099 forms, and any other income statements. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report your total income from New York sources, followed by applicable deductions. After calculating your tax liability, review the form for accuracy before submission.

Filing Deadlines for the IT-2658 NYS Form

It is essential to be aware of the filing deadlines associated with the IT-2658 NYS form to avoid penalties. Typically, the form is due on or before the 15th day of the fourth month following the end of the tax year. For most taxpayers, this means the form must be filed by April 15. However, if you are unable to meet this deadline, you may request an extension, but it is crucial to pay any taxes owed by the original deadline to avoid interest and penalties.

Required Documents for the IT-2658 NYS Form

When preparing to file the IT-2658 NYS form, several documents are required to support your income claims and deductions. These include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any other income received

- Documentation for deductions, such as receipts or tax statements

Having these documents organized will facilitate a smoother filing process and help ensure that you accurately report your income and deductions.

Penalties for Non-Compliance with the IT-2658 NYS Form

Failing to file the IT-2658 NYS form or inaccurately reporting information can result in significant penalties. The New York State Department of Taxation and Finance may impose fines for late filings, which can accumulate over time. Additionally, if taxes owed are not paid, interest will accrue on the outstanding balance. It is advisable to file the form accurately and on time to avoid these financial repercussions.

Quick guide on how to complete about form 1040 es nr u s estimated tax for

Easily Prepare About Form 1040 ES NR, U S Estimated Tax For on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents rapidly without any hold-ups. Manage About Form 1040 ES NR, U S Estimated Tax For on any platform with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The Easiest Way to Modify and eSign About Form 1040 ES NR, U S Estimated Tax For Effortlessly

- Find About Form 1040 ES NR, U S Estimated Tax For and click on Obtain Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the specialized tools airSlate SignNow provides for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all details and click on the Finish button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign About Form 1040 ES NR, U S Estimated Tax For to ensure smooth communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 1040 es nr u s estimated tax for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 2658 nys form and how does it relate to airSlate SignNow?

The it 2658 nys form is used for New York State tax purposes. airSlate SignNow provides a solution that allows you to easily prepare, send, and eSign the it 2658 nys form, streamlining your document management and compliance processes.

-

How does airSlate SignNow ensure the security of the it 2658 nys documents?

airSlate SignNow employs industry-leading security measures, including encryption and secure data storage, to protect your it 2658 nys documents. Our platform is designed to ensure that all your sensitive information remains confidential and secure throughout the signing process.

-

Can I integrate airSlate SignNow with my existing accounting software for processing it 2658 nys forms?

Yes, airSlate SignNow offers seamless integrations with popular accounting software, making it easy to process your it 2658 nys forms. This feature helps you streamline your workflow, ensuring that your tax documentation is handled efficiently.

-

What are the pricing options for using airSlate SignNow for the it 2658 nys form?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a larger organization, you can select a plan that suits your needs for managing it 2658 nys forms effectively.

-

What are the main features of airSlate SignNow for eSigning the it 2658 nys?

Key features of airSlate SignNow include user-friendly eSigning capabilities, document tracking, and customizable templates specifically for the it 2658 nys form. These tools enhance your efficiency and ensure that you can manage your documents easily.

-

How can using airSlate SignNow benefit my business when handling it 2658 nys forms?

Using airSlate SignNow for it 2658 nys forms can signNowly reduce turnaround times and enhance productivity. The ability to eSign and manage documents online removes the hassle of physical paperwork, allowing your team to focus on more valuable tasks.

-

Is there a mobile app for airSlate SignNow to manage it 2658 nys forms?

Yes, airSlate SignNow offers a mobile app that allows you to manage and eSign it 2658 nys forms on the go. The app is designed for ease of use, ensuring that you can access and complete your documents anytime, anywhere.

Get more for About Form 1040 ES NR, U S Estimated Tax For

Find out other About Form 1040 ES NR, U S Estimated Tax For

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document