LLC Filing as a Corporation or Partnership Form

Understanding LLC Filing As A Corporation Or Partnership

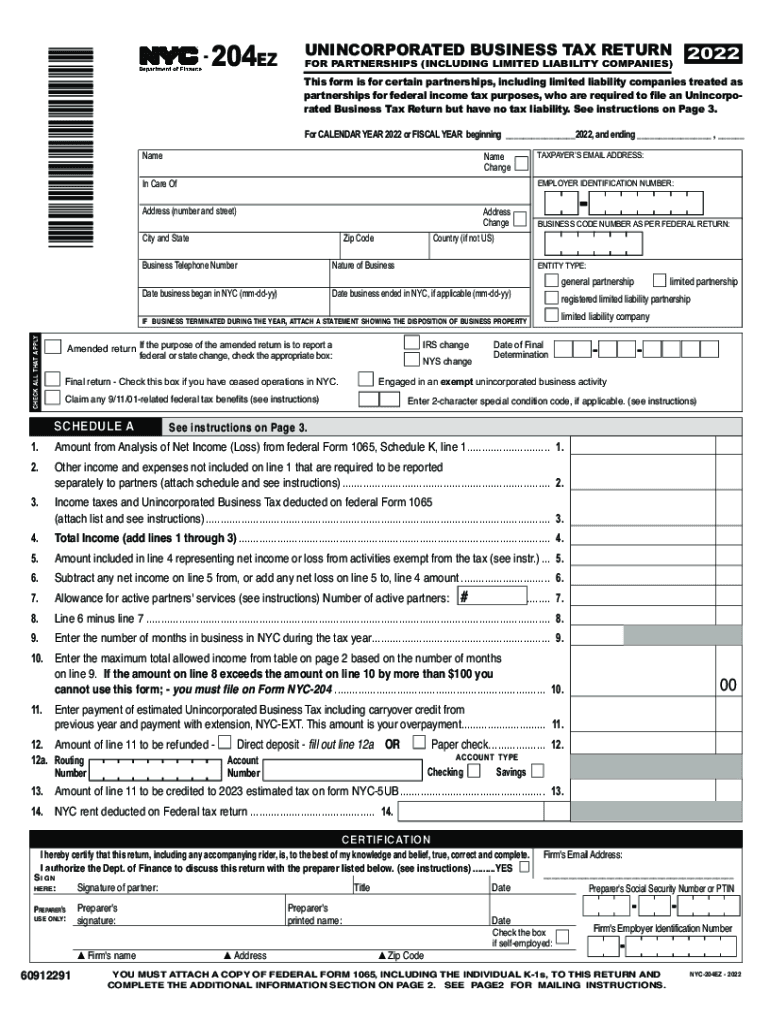

The LLC filing as a corporation or partnership involves selecting a specific business structure that can impact taxation, liability, and management. An LLC, or Limited Liability Company, offers flexibility in how it can be taxed. By default, an LLC is treated as a pass-through entity, meaning profits and losses pass through to the owners’ personal tax returns. However, LLCs can elect to be taxed as a corporation, which may provide benefits like lower tax rates on retained earnings. Understanding these distinctions is crucial for business owners when deciding how to structure their entity.

Steps to Complete the LLC Filing As A Corporation Or Partnership

Completing the LLC filing as a corporation or partnership involves several key steps:

- Choose a business name that complies with state regulations.

- File Articles of Organization with the state, including information about the business structure.

- Decide on the tax classification by submitting IRS Form 8832 if electing to be taxed as a corporation.

- Obtain any necessary business licenses and permits.

- Draft an operating agreement outlining the management structure and operational procedures.

Each state may have specific requirements, so it is important to check with local regulations.

Required Documents for LLC Filing

To successfully file an LLC as a corporation or partnership, several documents are typically required:

- Articles of Organization: This document officially establishes the LLC.

- Operating Agreement: While not always required, this document outlines the management structure and member responsibilities.

- IRS Form 8832: Required if electing to be taxed as a corporation.

- State-specific forms: Some states may require additional forms or documentation.

Ensuring all necessary documents are prepared and submitted correctly can help avoid delays in the filing process.

Legal Use of LLC Filing As A Corporation Or Partnership

The legal use of LLC filing as a corporation or partnership is essential for protecting personal assets and ensuring compliance with state laws. An LLC provides limited liability protection, meaning that personal assets are generally shielded from business debts and lawsuits. When an LLC chooses to file as a corporation, it can also benefit from corporate tax structures, which may lead to tax advantages depending on the business’s income levels. It is important to adhere to all legal requirements, including maintaining proper records and filing annual reports as required by the state.

State-Specific Rules for LLC Filing

Each state has its own rules and regulations governing the LLC filing process. These can include:

- Filing fees: Costs can vary significantly from state to state.

- Publication requirements: Some states require new LLCs to publish their formation in local newspapers.

- Annual report submissions: Many states require LLCs to file annual reports and pay associated fees.

Business owners should consult their state’s Secretary of State website or a legal professional to ensure compliance with local laws.

IRS Guidelines for LLC Taxation

The IRS provides specific guidelines for LLCs regarding taxation. By default, single-member LLCs are treated as sole proprietorships, while multi-member LLCs are treated as partnerships. However, LLCs can elect to be taxed as S corporations or C corporations by filing the appropriate forms with the IRS. This election can impact how profits are taxed and how self-employment taxes are calculated. Understanding these guidelines is crucial for maximizing tax efficiency and ensuring compliance with federal tax obligations.

Quick guide on how to complete llc filing as a corporation or partnership

Accomplish LLC Filing As A Corporation Or Partnership seamlessly on any device

Digital document management has become widely accepted among businesses and individuals. It offers an ideal sustainable alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools you require to create, alter, and electronically sign your documents rapidly without delays. Handle LLC Filing As A Corporation Or Partnership on any device using airSlate SignNow Android or iOS applications and simplify any document-based process now.

How to alter and electronically sign LLC Filing As A Corporation Or Partnership effortlessly

- Locate LLC Filing As A Corporation Or Partnership and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your needs in document management within a few clicks from any device of your choosing. Alter and electronically sign LLC Filing As A Corporation Or Partnership and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the llc filing as a corporation or partnership

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for LLC Filing As A Corporation Or Partnership?

The process for LLC Filing As A Corporation Or Partnership typically involves selecting a suitable business name, designating a registered agent, and filing the necessary documents with your state. It's crucial to understand that the requirements may vary by state, so reviewing local regulations is essential. AirSlate SignNow simplifies this process by providing templates and eSigning capabilities, ensuring you can complete your filing efficiently.

-

What are the benefits of choosing LLC Filing As A Corporation Or Partnership?

Choosing LLC Filing As A Corporation Or Partnership provides several benefits, including personal liability protection for owners and flexibility in management structures. Additionally, this option allows for pass-through taxation, which can lead to tax savings. Utilizing AirSlate SignNow ensures a smooth document eSigning experience for these filings, making it an attractive choice for budding entrepreneurs.

-

What features does airSlate SignNow offer for LLC Filing As A Corporation Or Partnership?

AirSlate SignNow offers a variety of features tailored for LLC Filing As A Corporation Or Partnership, including document templates, automated workflows, and secure eSigning. Users can quickly send, receive, and store important documents, enhancing overall efficiency. Additionally, our intuitive interface makes the filing process straightforward for all users.

-

How does pricing work for LLC Filing As A Corporation Or Partnership services?

Pricing for LLC Filing As A Corporation Or Partnership services can vary based on the complexity of the filing and the additional features you may require. AirSlate SignNow offers competitive pricing plans that cater to various business sizes and needs. It's advisable to review our plans to find the one that best fits your requirements.

-

Can I customize documents for LLC Filing As A Corporation Or Partnership?

Yes, you can customize documents for LLC Filing As A Corporation Or Partnership using AirSlate SignNow. Our platform allows you to edit templates and add necessary information tailored to your specific business requirements. This flexibility ensures that your documents meet all legal and regulatory standards.

-

Is it easy to collaborate with others on my LLC Filing As A Corporation Or Partnership paperwork?

Absolutely! AirSlate SignNow provides seamless collaboration tools for all users involved in LLC Filing As A Corporation Or Partnership. You can easily invite team members to review or sign documents, track changes, and maintain clear communication throughout the process.

-

What integrations does airSlate SignNow support for LLC Filing As A Corporation Or Partnership?

AirSlate SignNow supports a variety of integrations that enhance the LLC Filing As A Corporation Or Partnership process. You can seamlessly connect with popular platforms like Google Drive, Dropbox, and sales CRM systems to streamline document management. These integrations simplify your workflow and ensure that your filings are well-organized.

Get more for LLC Filing As A Corporation Or Partnership

- Hzi employment application houston zoo form

- Acg atlanta attendee list 2016 form

- Allegations report the tennessee department of health health state tn form

- How to send money from navy federal western union form

- Direct deposit authorization form to initiate direct deposit to your

- Oba disclosure form 2012 keystone capital yorkcastcom

- Creditdebit card transaction dispute form patelco credit union patelco

Find out other LLC Filing As A Corporation Or Partnership

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe