Ny Form

What is the NY Form IT-2663?

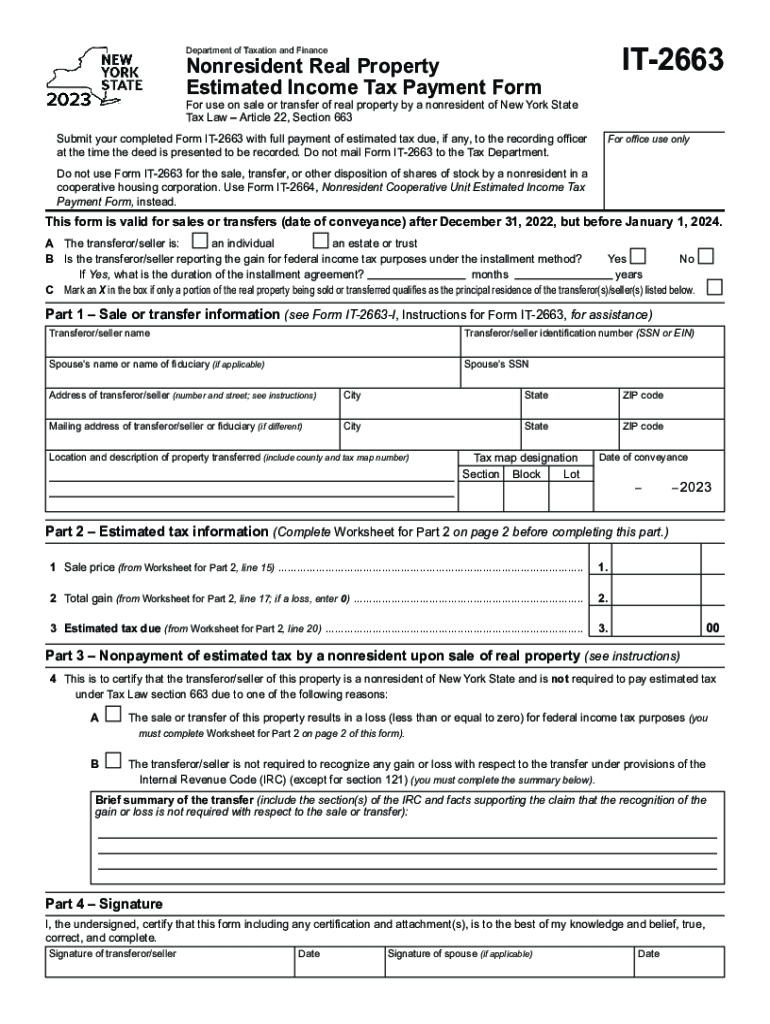

The NY Form IT-2663 is a state tax form used in New York for reporting the transfer of real property by nonresidents. This form is essential for ensuring compliance with state tax laws when a nonresident sells or transfers property located in New York. It helps calculate any potential tax liabilities associated with the gain from the property transfer. The form is part of New York's efforts to collect taxes on income generated from real estate transactions within the state.

How to Obtain the NY Form IT-2663

The NY Form IT-2663 can be obtained directly from the New York State Department of Taxation and Finance website. It is available in PDF format, allowing users to download and print the form for completion. Additionally, physical copies may be available at local tax offices or through authorized tax professionals. Ensuring you have the correct version of the form is crucial, as updates may occur periodically.

Steps to Complete the NY Form IT-2663

Completing the NY Form IT-2663 involves several key steps:

- Begin by providing your personal information, including your name, address, and taxpayer identification number.

- Detail the property being transferred, including its address and the date of transfer.

- Calculate the gain from the property transfer, which is the difference between the selling price and your adjusted basis in the property.

- Determine the appropriate tax amount based on the gain calculated, following the guidelines provided in the form instructions.

- Sign and date the form before submitting it to the appropriate tax authority.

Legal Use of the NY Form IT-2663

The NY Form IT-2663 serves a legal purpose in the context of real estate transactions involving nonresidents. It ensures that the state can assess and collect taxes on any gains realized from property transfers. Noncompliance with the filing requirements can lead to penalties and interest on unpaid taxes. Therefore, it is vital for nonresidents engaging in real estate transactions in New York to understand their obligations under state law.

Filing Deadlines / Important Dates

Filing deadlines for the NY Form IT-2663 typically coincide with the date of the property transfer. Nonresidents must file the form within a specific timeframe, usually within fifteen days of the transfer. It is essential to be aware of these deadlines to avoid late fees and potential legal consequences. Keeping track of important dates related to your real estate transaction can help ensure timely compliance.

Form Submission Methods

The NY Form IT-2663 can be submitted in various ways, accommodating different preferences. Nonresidents may choose to file the form online through the New York State Department of Taxation and Finance website, ensuring a quick and efficient process. Alternatively, the form can be mailed to the designated address provided in the instructions or submitted in person at local tax offices. Each submission method has its own processing times, so it is advisable to choose the method that best suits your needs.

Quick guide on how to complete ny form

Complete Ny Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Manage Ny Form on any platform with airSlate SignNow's Android or iOS applications and streamline any document-focused process today.

How to modify and electronically sign Ny Form seamlessly

- Locate Ny Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight signNow sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Ny Form and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ny form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to IT 2663?

airSlate SignNow is an innovative platform designed to allow businesses to send and eSign documents efficiently. Specifically, IT 2663 is one of the key tools within the airSlate SignNow ecosystem that enhances document management workflows. By leveraging IT 2663, users can streamline their processes, ensuring compliance and security in document handling.

-

How much does airSlate SignNow cost for businesses utilizing IT 2663?

airSlate SignNow offers a variety of pricing plans to cater to different business needs, including those utilizing IT 2663. Pricing typically depends on features and the number of users, ensuring flexibility for small businesses to large enterprises. It's advisable to review their pricing page for the most accurate and up-to-date information.

-

What are the key features of airSlate SignNow's IT 2663?

The key features of airSlate SignNow’s IT 2663 include electronic signatures, document templates, and personalized workflows. These features are designed to enhance productivity and ensure secure and compliant document transactions. Users can also enjoy robust tracking and reporting capabilities to monitor their document's status.

-

How can IT 2663 benefit my business?

Implementing IT 2663 through airSlate SignNow can signNowly streamline your document signing process, reducing turnaround time and improving efficiency. This not only saves time but also enhances customer satisfaction with quicker transactions. Businesses can leverage IT 2663 for better compliance and security in document management.

-

Can I integrate IT 2663 with other applications?

Yes, airSlate SignNow, including IT 2663, can seamlessly integrate with various applications such as Google Drive, Salesforce, and others. This interoperability allows businesses to maintain their existing workflows while enhancing them with advanced eSigning capabilities. Check the integration options available to ensure it aligns with your current tools.

-

Is there a mobile version of IT 2663 for airSlate SignNow?

Absolutely! airSlate SignNow, featuring IT 2663, offers a fully functional mobile application. This allows users to send, sign, and manage documents on the go, ensuring that your business operations remain efficient and responsive regardless of location.

-

What support options are available for IT 2663 users?

airSlate SignNow provides comprehensive support for users of IT 2663, including a dedicated help center, live chat, and email support. Additionally, users can access a range of tutorials and documentation to help them maximize their use of the platform. This ensures that all users can effectively utilize the features of IT 2663.

Get more for Ny Form

- Energy management and control systems emcs design manual form

- Dhs 4315 dme mobility devices kepro mhcp form

- Owwa online application form

- Download annual verification certificate form

- Cidb green card renewal form

- Lagos state health service commission form

- Cha3u american history markville secondary school form

- Resource guide for the deaf hard of hearing and late form

Find out other Ny Form

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document