Oklahoma Wage Withholding Tax Application Form

What is the Oklahoma Wage Withholding Tax Application

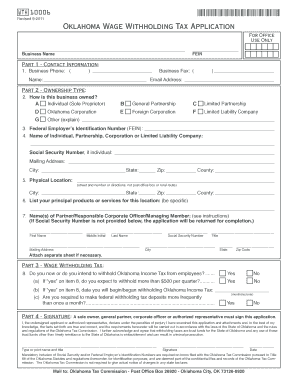

The Oklahoma Wage Withholding Tax Application is a crucial document for employers in Oklahoma who need to withhold state income tax from their employees' wages. This application ensures compliance with state tax laws and allows businesses to register for withholding tax accounts. By submitting this application, employers can obtain the necessary identification number to facilitate proper tax withholding and reporting.

Steps to complete the Oklahoma Wage Withholding Tax Application

Completing the Oklahoma Wage Withholding Tax Application involves several key steps to ensure accuracy and compliance. First, gather all relevant information about your business, including the legal name, address, and federal Employer Identification Number (EIN). Next, fill out the application form with details regarding the type of business entity and the anticipated number of employees. After completing the form, review it for any errors before submission. Finally, submit the application through the designated method, whether online, by mail, or in person, to ensure timely processing.

Legal use of the Oklahoma Wage Withholding Tax Application

The legal use of the Oklahoma Wage Withholding Tax Application is essential for employers to remain compliant with state tax regulations. This application must be filled out accurately and submitted to the Oklahoma Tax Commission to avoid penalties. The application serves as a formal request to establish a withholding tax account, which is necessary for employers to legally withhold state income tax from employee wages. Failure to properly complete and submit this application can result in legal repercussions and financial penalties.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Oklahoma Wage Withholding Tax Application. The application can be completed and submitted online through the Oklahoma Tax Commission's website, providing a quick and efficient method. Alternatively, businesses may choose to print the application and submit it by mail to the appropriate address specified by the tax authority. In-person submissions are also accepted at designated tax commission offices, allowing for direct interaction with tax officials if needed. Each method has its own processing times, so employers should choose the one that best fits their needs.

Required Documents

When completing the Oklahoma Wage Withholding Tax Application, certain documents may be required to support the information provided. Employers should have their federal Employer Identification Number (EIN) readily available, as it is essential for tax identification. Additionally, documentation regarding the business structure, such as articles of incorporation or partnership agreements, may be necessary to validate the entity type. Having these documents prepared in advance can streamline the application process and ensure compliance with state requirements.

Eligibility Criteria

To be eligible to submit the Oklahoma Wage Withholding Tax Application, a business must be operating within the state of Oklahoma and have employees from whom state income tax will be withheld. This includes various business entities such as sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). Employers must also ensure they are registered with the Internal Revenue Service (IRS) and have obtained a federal Employer Identification Number (EIN) prior to applying for state withholding tax accounts.

Quick guide on how to complete oklahoma wage withholding tax application

Easily Prepare Oklahoma Wage Withholding Tax Application on Any Gadget

Online document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to find the correct template and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Manage Oklahoma Wage Withholding Tax Application on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign Oklahoma Wage Withholding Tax Application effortlessly

- Find Oklahoma Wage Withholding Tax Application and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as an old-fashioned ink signature.

- Review all the details and click on the Done button to retain your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from your preferred gadget. Adjust and electronically sign Oklahoma Wage Withholding Tax Application and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oklahoma wage withholding tax application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oklahoma Wage Withholding Tax Application?

The Oklahoma Wage Withholding Tax Application is a tool designed to help businesses manage their tax withholding processes efficiently. By utilizing this application, employers can streamline their payroll operations and ensure compliance with state laws regarding wage withholding.

-

How does the Oklahoma Wage Withholding Tax Application benefit my business?

Using the Oklahoma Wage Withholding Tax Application can drastically reduce the time and effort spent on payroll processing. It helps businesses avoid common errors and ensures that tax calculations are accurate, leading to fewer penalties and a smoother operation overall.

-

Is there a cost associated with the Oklahoma Wage Withholding Tax Application?

The cost of the Oklahoma Wage Withholding Tax Application varies based on the features you choose. However, airSlate SignNow offers competitive pricing designed to be cost-effective, providing value for businesses looking to enhance their tax management process.

-

Can the Oklahoma Wage Withholding Tax Application integrate with other software?

Yes, the Oklahoma Wage Withholding Tax Application integrates seamlessly with various accounting and payroll software. This integration capability allows businesses to keep their financial data consistent and easily accessible across different platforms.

-

What features does the Oklahoma Wage Withholding Tax Application offer?

The Oklahoma Wage Withholding Tax Application offers features such as real-time tax calculations, automated reporting, and eSignature capabilities. These features simplify the tax withholding process, making it easier for businesses to manage their obligations efficiently.

-

How can I ensure compliance with the Oklahoma Wage Withholding Tax Application?

To ensure compliance with the Oklahoma Wage Withholding Tax Application, it's crucial to keep the application updated with the latest tax regulations. airSlate SignNow continually updates its software, helping businesses remain compliant with state laws and reducing the risk of audit issues.

-

Who can benefit from the Oklahoma Wage Withholding Tax Application?

Small to medium-sized businesses, as well as larger enterprises, can greatly benefit from the Oklahoma Wage Withholding Tax Application. It provides a streamlined approach to managing wage withholding, which is critical for any employer in Oklahoma.

Get more for Oklahoma Wage Withholding Tax Application

Find out other Oklahoma Wage Withholding Tax Application

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors