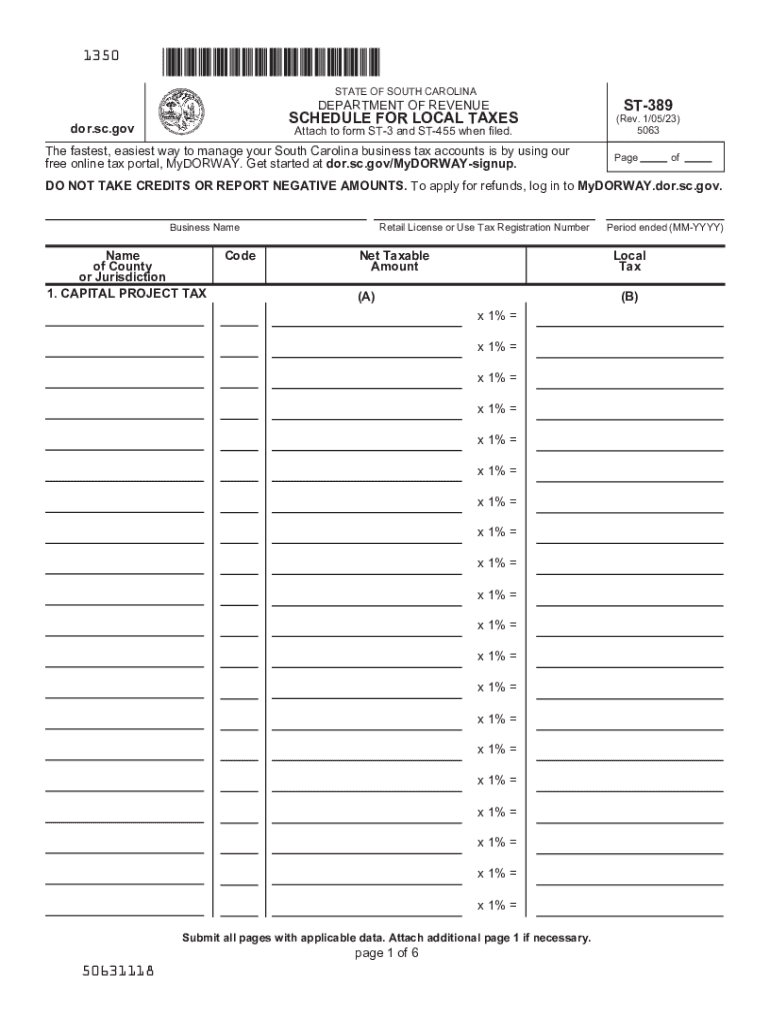

St 389 Form

What is the SC ST 389?

The SC ST 389 is a sales tax exemption certificate used in South Carolina. This form allows certain purchasers to claim exemption from sales tax on qualifying purchases. It is primarily utilized by organizations that are exempt from sales tax, such as non-profit entities, government agencies, and educational institutions. By presenting this form to vendors, exempt organizations can avoid paying sales tax on eligible items, which can significantly reduce their operational costs.

How to Obtain the SC ST 389

To obtain the SC ST 389, individuals or organizations must visit the South Carolina Department of Revenue's official website. The form is available for download in PDF format, making it easy to access and print. Additionally, organizations may need to provide proof of their tax-exempt status, such as a letter from the IRS or a state-issued exemption certificate. It is essential to ensure that the form is filled out accurately to avoid any issues during transactions.

Steps to Complete the SC ST 389

Completing the SC ST 389 involves several straightforward steps:

- Begin by entering the name and address of the purchaser at the top of the form.

- Specify the type of exemption being claimed, such as a non-profit or governmental exemption.

- Include the sales tax exemption number, if applicable, to validate the claim.

- List the items being purchased that qualify for the exemption.

- Sign and date the form to certify that the information provided is accurate.

It is advisable to keep a copy of the completed form for your records, as it may be required for future reference or audits.

Legal Use of the SC ST 389

The SC ST 389 must be used in compliance with South Carolina sales tax laws. It is crucial that only eligible organizations utilize this form to claim tax exemptions. Misuse of the form can lead to penalties, including back taxes owed and potential fines. Vendors are required to retain a copy of the completed form for their records as proof of the exemption claimed during the sale.

Key Elements of the SC ST 389

Several key elements make up the SC ST 389, which include:

- Purchaser Information: Name and address of the entity claiming the exemption.

- Exemption Type: Classification of the exemption, such as non-profit or governmental.

- Exemption Number: The official number assigned to the exempt organization.

- Item Description: Detailed list of items being purchased under the exemption.

- Signature: The authorized representative must sign and date the form to validate it.

Form Submission Methods

The SC ST 389 can be submitted to vendors in various ways, depending on the vendor's acceptance policies. Typically, the form can be presented in person at the time of purchase, or it can be sent via email or fax if the vendor allows for electronic submissions. It is important to check with the vendor beforehand to ensure they accept the SC ST 389 in the desired format.

Quick guide on how to complete st 389 701722395

Complete St 389 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly without delays. Manage St 389 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-based task today.

How to edit and eSign St 389 with ease

- Find St 389 and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, the frustration of searching for forms, or the need to print new copies due to errors. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign St 389 to ensure superior communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 389 701722395

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is sc st 389 and how does it relate to airSlate SignNow?

SC ST 389 is a designation that often refers to specialized government forms relevant in document management. With airSlate SignNow, you can efficiently send and eSign these documents, ensuring compliance and simplifying your workflow.

-

What features does airSlate SignNow offer for handling sc st 389 documents?

airSlate SignNow provides powerful features such as easy document uploading, customizable templates, and secure eSignature options specifically for documents like sc st 389. This ensures you can manage your forms quickly and securely.

-

Is there a free trial available for using airSlate SignNow for sc st 389?

Yes, airSlate SignNow offers a free trial that allows you to explore its functionalities, including the handling of sc st 389 documents. This gives prospective customers a risk-free opportunity to assess how airSlate SignNow can meet their needs.

-

How does pricing work for airSlate SignNow when dealing with sc st 389?

Pricing for airSlate SignNow varies based on the features you need, but it remains cost-effective, especially for processing sc st 389 forms. Organizations can choose a plan that fits their budget while efficiently managing their document signing processes.

-

Can airSlate SignNow integrate with my existing systems for sc st 389?

Absolutely! airSlate SignNow offers a range of integrations with popular applications, allowing you to seamlessly incorporate it into your existing workflows for processes involving sc st 389 documents. This means you can enhance your productivity without disrupting your current systems.

-

What are the benefits of using airSlate SignNow for sc st 389 eSignatures?

Using airSlate SignNow for sc st 389 eSignatures offers numerous benefits including time savings, improved accuracy, and enhanced security. It simplifies the signing process while ensuring that all documents are legally compliant and easily accessible.

-

Are there mobile options available for managing sc st 389 with airSlate SignNow?

Yes, airSlate SignNow offers a mobile-friendly platform that allows users to manage sc st 389 documents on the go. This feature ensures that signers can complete their documentation anytime, anywhere, enhancing convenience and efficiency.

Get more for St 389

Find out other St 389

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors