Notice and Acknowledgement of Pay Rate and Payday, Exempt Employees, Spanish Version Notice and Acknowledgement of Pay Rate and Form

What is the notice and acknowledgement of pay rate and payday?

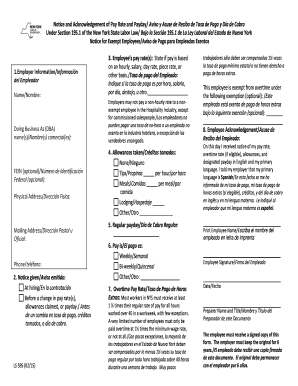

The notice and acknowledgement of pay rate and payday is a crucial document that informs employees about their wages and payment schedule. This form is particularly important for exempt employees in the United States, as it outlines the terms of their compensation, including the pay rate, pay period, and the date of payment. In the Spanish version, the content is tailored to meet the needs of Spanish-speaking employees, ensuring clarity and understanding. This form is essential for compliance with labor laws and helps protect both employers and employees by providing a clear record of payment terms.

Key elements of the notice and acknowledgement of pay rate and payday

Understanding the key elements of the notice and acknowledgement of pay rate and payday is vital for both employers and employees. The document typically includes:

- Employee's name and job title: Identifies the individual receiving the notice.

- Pay rate: Clearly states the hourly rate or salary.

- Pay period: Specifies the duration for which the pay is calculated.

- Payday: Indicates the date employees will receive their wages.

- Signature line: Provides space for the employee to acknowledge receipt of the notice.

These elements ensure that employees are fully informed about their compensation, which is essential for maintaining transparency and trust in the workplace.

Steps to complete the notice and acknowledgement of pay rate and payday

Completing the notice and acknowledgement of pay rate and payday involves several straightforward steps:

- Gather employee information: Collect the necessary details, including the employee's name, job title, and pay rate.

- Fill in pay period and payday: Clearly define the pay period and the specific payday.

- Provide a space for signature: Include a line for the employee to sign, indicating they have received and understood the notice.

- Review for accuracy: Ensure all information is correct before finalizing the document.

- Distribute the document: Provide a copy to the employee and retain a copy for your records.

Following these steps helps ensure that the document is completed correctly and serves its legal purpose.

Legal use of the notice and acknowledgement of pay rate and payday

The legal use of the notice and acknowledgement of pay rate and payday is governed by various labor laws in the United States. This document serves as proof that the employer has informed the employee about their pay structure. In case of disputes regarding wages, this notice can be presented as evidence in legal proceedings. It is essential for employers to comply with state-specific regulations to avoid penalties. Maintaining accurate records of these documents protects both parties and fosters a fair working environment.

How to obtain the notice and acknowledgement of pay rate and payday

Obtaining the notice and acknowledgement of pay rate and payday is a straightforward process. Employers can create a customized version of the form tailored to their specific needs. Many online resources offer templates that can be easily adapted. Additionally, consulting with a legal professional can ensure compliance with state laws. Once the form is ready, it can be distributed to employees in both digital and printed formats, ensuring accessibility for all staff members.

State-specific rules for the notice and acknowledgement of pay rate and payday

Each state in the U.S. may have specific rules regarding the notice and acknowledgement of pay rate and payday. For instance, some states require additional information to be included in the notice, such as overtime rates or benefits. Employers should familiarize themselves with local labor laws to ensure compliance. Non-compliance can result in legal repercussions, including fines and penalties. Staying informed about state-specific regulations helps maintain a lawful and equitable workplace.

Quick guide on how to complete notice and acknowledgement of pay rate and payday exempt employees spanish version notice and acknowledgement of pay rate and

Effortlessly Complete Notice And Acknowledgement Of Pay Rate And Payday, Exempt Employees, Spanish Version Notice And Acknowledgement Of Pay Rate And on Any Device

Managing documents online has gained popularity among organizations and individuals alike. It serves as an ideal green alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly and efficiently. Handle Notice And Acknowledgement Of Pay Rate And Payday, Exempt Employees, Spanish Version Notice And Acknowledgement Of Pay Rate And on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Notice And Acknowledgement Of Pay Rate And Payday, Exempt Employees, Spanish Version Notice And Acknowledgement Of Pay Rate And effortlessly

- Locate Notice And Acknowledgement Of Pay Rate And Payday, Exempt Employees, Spanish Version Notice And Acknowledgement Of Pay Rate And and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive details with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Notice And Acknowledgement Of Pay Rate And Payday, Exempt Employees, Spanish Version Notice And Acknowledgement Of Pay Rate And and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the notice and acknowledgement of pay rate and payday exempt employees spanish version notice and acknowledgement of pay rate and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'notice and acknowledgement of pay rate and payday Spanish' document?

The 'notice and acknowledgement of pay rate and payday Spanish' document is a form that notifies employees of their pay rate and paydays in Spanish. It ensures clarity and compliance, particularly for Spanish-speaking employees. Using airSlate SignNow, you can easily create, send, and eSign this document.

-

How can airSlate SignNow help with the 'notice and acknowledgement of pay rate and payday Spanish'?

airSlate SignNow streamlines the process of creating and managing the 'notice and acknowledgement of pay rate and payday Spanish.' The platform allows you to customize templates, collect signatures, and track document statuses in real-time, improving efficiency and compliance.

-

Is there a cost associated with using airSlate SignNow for 'notice and acknowledgement of pay rate and payday Spanish'?

Yes, airSlate SignNow offers various pricing plans that are cost-effective for businesses of all sizes. The cost varies depending on the features you need and the number of users. You can find a plan that suits your organization's budget while ensuring you can manage the 'notice and acknowledgement of pay rate and payday Spanish' documents efficiently.

-

Can I integrate airSlate SignNow with other software for the 'notice and acknowledgement of pay rate and payday Spanish'?

Absolutely! airSlate SignNow offers seamless integrations with popular HR and payroll software, making it easy to manage the 'notice and acknowledgement of pay rate and payday Spanish' alongside your existing systems. This integration helps streamline workflows and enhances data accuracy across platforms.

-

What benefits does electronic signing provide for the 'notice and acknowledgement of pay rate and payday Spanish'?

Using electronic signing for the 'notice and acknowledgement of pay rate and payday Spanish' enhances security, expedites the signing process, and improves record-keeping. It eliminates the need for paper, reducing environmental impact and storage needs. Plus, signed documents are easily accessible in the cloud.

-

How can I ensure compliance when using airSlate SignNow for the 'notice and acknowledgement of pay rate and payday Spanish'?

airSlate SignNow is designed to keep your documents compliant with legal standards. By utilizing templates specifically for the 'notice and acknowledgement of pay rate and payday Spanish,' you can be confident that each document meets regulatory requirements. The platform also provides audit trails and timestamps to support compliance audits.

-

Can I customize the 'notice and acknowledgement of pay rate and payday Spanish' template?

Yes, airSlate SignNow allows you to fully customize the template for the 'notice and acknowledgement of pay rate and payday Spanish' to fit your company’s branding and specific needs. You can add your logo, adjust the text, and include required fields to ensure it meets all necessary criteria.

Get more for Notice And Acknowledgement Of Pay Rate And Payday, Exempt Employees, Spanish Version Notice And Acknowledgement Of Pay Rate And

- Oakland rental agreement form

- Richland county child support form

- Statutory declaration 83126560 form

- Payroll receipt template word form

- Uob 2fa registration online form

- Agricultural inputs form

- Official oklahoma traffic collision report actar form

- Boklahomab dps 0192 01 crash report revised 012007 nhtsa nhtsa form

Find out other Notice And Acknowledgement Of Pay Rate And Payday, Exempt Employees, Spanish Version Notice And Acknowledgement Of Pay Rate And

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast