Taxable Calculation Form

What is the Taxable Calculation

The taxable calculation for the Vermont property tax return involves determining the amount of property transfer tax owed when real estate is sold or transferred. This calculation is based on the sale price of the property or the fair market value if the property is not sold. The taxable amount is crucial for ensuring compliance with Vermont's property transfer tax laws.

How to use the Taxable Calculation

To use the taxable calculation, begin by identifying the total sale price of the property or its fair market value. Next, apply the current Vermont property transfer tax rate to this amount. The result will give you the total tax owed. It is essential to accurately assess the property's value to avoid underpayment or overpayment of taxes.

Steps to complete the Taxable Calculation

Completing the taxable calculation involves several steps:

- Determine the sale price or fair market value of the property.

- Check the current Vermont property transfer tax rate.

- Multiply the sale price or fair market value by the tax rate.

- Document the calculation for your records and for submission with the property transfer tax return.

Filing Deadlines / Important Dates

It is important to be aware of filing deadlines for the Vermont property tax return. Typically, the property transfer tax return must be filed within 15 days of the property transfer. Missing this deadline may result in penalties or interest on the unpaid tax amount. Always check for any specific dates relevant to your transaction.

Required Documents

When filing the Vermont property tax return, you will need several documents, including:

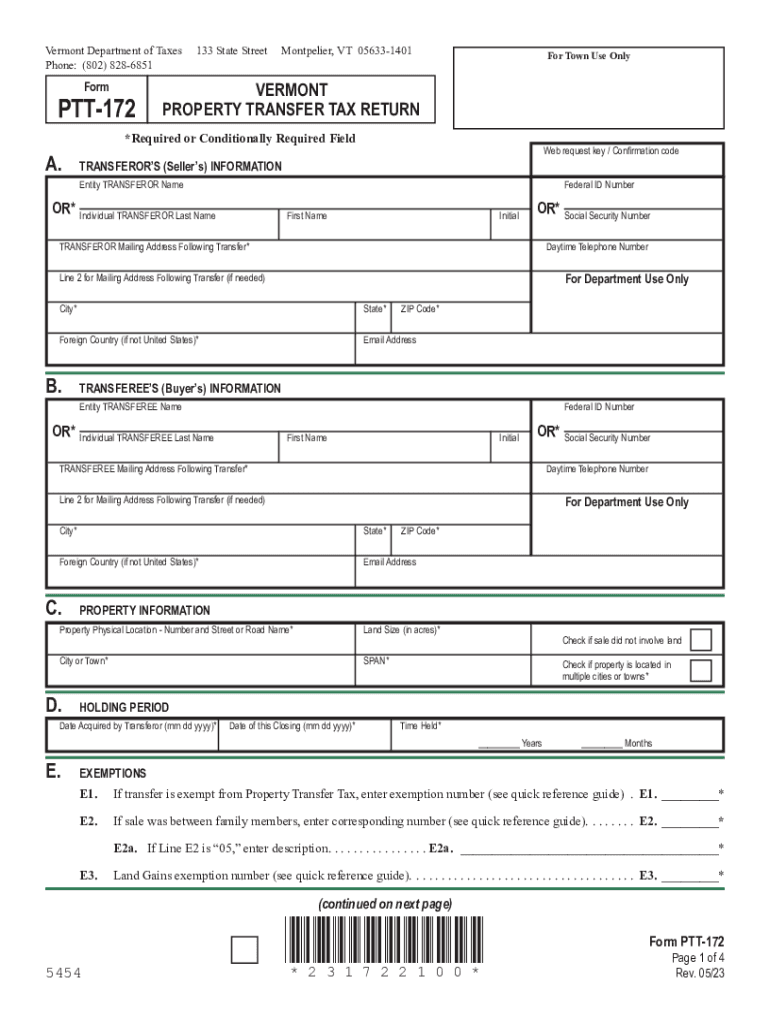

- The completed Vermont property transfer tax return form (PTT-172).

- Documentation supporting the sale price or fair market value of the property.

- Any additional forms required by the state, such as the property transfer tax return (PTTR) form.

Form Submission Methods (Online / Mail / In-Person)

The Vermont property tax return can be submitted through various methods. You can file online through the Vermont Department of Taxes website, mail the completed form to the appropriate tax office, or submit it in person at your local tax office. Each method has its own processing times, so choose the one that best fits your needs.

Penalties for Non-Compliance

Failure to comply with the Vermont property transfer tax requirements can lead to significant penalties. These may include fines, interest on unpaid taxes, and additional fees for late filing. It is crucial to ensure that all calculations and submissions are accurate and timely to avoid these consequences.

Quick guide on how to complete taxable calculation

Effortlessly Prepare Taxable Calculation on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed materials, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Handle Taxable Calculation on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Steps to Edit and Electronically Sign Taxable Calculation with Ease

- Locate Taxable Calculation and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Mark relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information carefully and click the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Taxable Calculation, ensuring effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxable calculation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is transfer tax vt and how does it affect my documents?

Transfer tax vt refers to the tax imposed on the transfer of real estate or property. Understanding this tax is essential as it can affect your overall costs when conducting property transactions. Using airSlate SignNow can help manage the documentation process efficiently, ensuring all relevant taxes are accurately accounted for.

-

How does airSlate SignNow help with transfer tax vt documentation?

airSlate SignNow streamlines the signing and sending of important documents related to transfer tax vt. Our platform allows users to securely manage and eSign documents, eliminating potential delays or errors in your filing process. This makes it easier to comply with local regulations.

-

Are there any costs associated with using airSlate SignNow for transfer tax vt documents?

Yes, while airSlate SignNow offers a range of pricing plans, the costs are generally competitive compared to traditional methods of document management. Users benefit from the efficiency and convenience provided by our platform, especially when dealing with important taxes like transfer tax vt.

-

What features of airSlate SignNow assist in managing transfer tax vt?

With airSlate SignNow, users can utilize features such as eSignature, document tracking, and cloud storage specifically designed for managing transfer tax vt documents. These features ensure that all necessary paperwork is easily accessible and securely signed, reducing the risk of missing vital information.

-

Can I integrate airSlate SignNow with other software for transfer tax vt processes?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage transfer tax vt and other related tasks. This integration capability allows for a more streamlined workflow, saving you time and ensuring accuracy in documentation.

-

What are the benefits of using airSlate SignNow for transfer tax vt paperwork?

Using airSlate SignNow for transfer tax vt paperwork offers numerous benefits, such as increased efficiency, reduced paperwork errors, and a secure signing process. Additionally, you can access your documents anytime and anywhere, making it easier to manage important transactions.

-

Is airSlate SignNow user-friendly for individuals unfamiliar with transfer tax vt?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with transfer tax vt processes. Our intuitive interface guides users through document preparation and signing, ensuring a smooth experience without requiring extensive technical knowledge.

Get more for Taxable Calculation

Find out other Taxable Calculation

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later