Understanding Additional Taxes with IRS Form 1040 Schedule 2

Understanding Additional Taxes with IRS Form 1040 Schedule 2

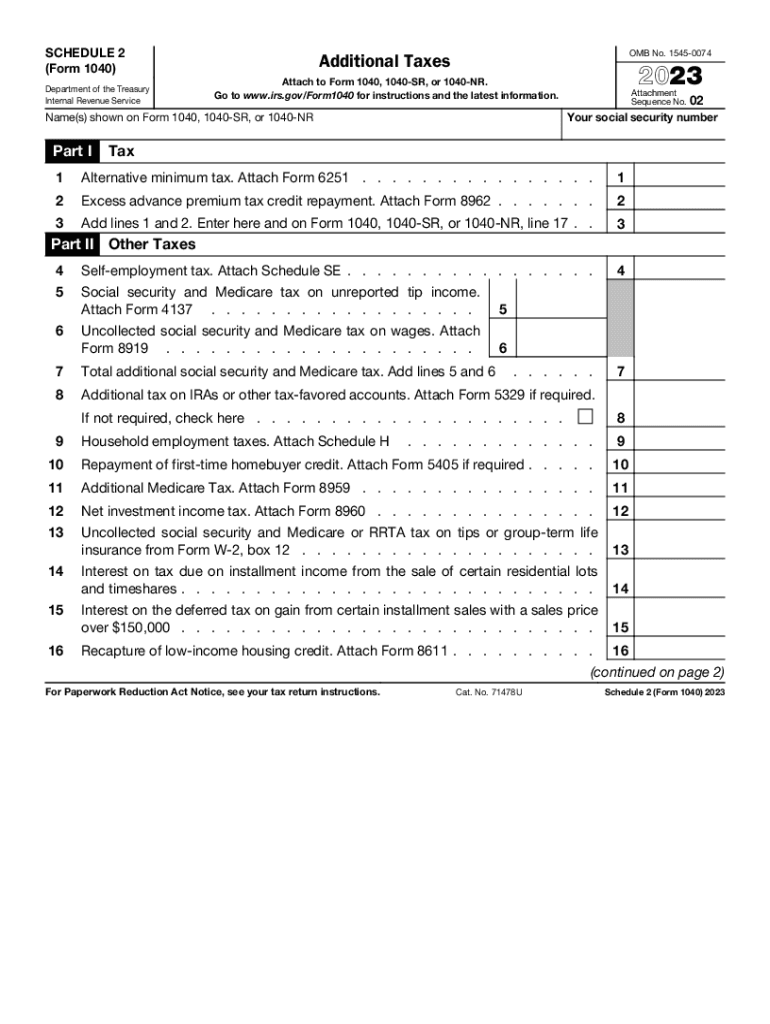

IRS Form 1040 Schedule 2 is used to report additional taxes that are not included on the main Form 1040. This form is essential for taxpayers who have specific tax liabilities, such as the alternative minimum tax, excess advance premium tax credit repayment, or certain other taxes. Understanding the purpose and requirements of Schedule 2 can help ensure accurate tax reporting and compliance with IRS regulations.

Steps to Complete IRS Form 1040 Schedule 2

Completing IRS Form 1040 Schedule 2 involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Identify the specific additional taxes applicable to your situation, such as the alternative minimum tax or the repayment of excess advance premium tax credits.

- Fill out the form accurately, ensuring all calculations are correct and all relevant information is included.

- Review the completed form for accuracy and completeness before submission.

Filing Deadlines and Important Dates for Schedule 2

Taxpayers must be aware of the filing deadlines associated with IRS Form 1040 Schedule 2. Typically, the deadline for submitting your federal tax return, including any additional forms, is April 15. If this date falls on a weekend or holiday, the deadline may be extended. It is important to check for any updates or changes to deadlines each tax year.

Required Documents for IRS Form 1040 Schedule 2

To accurately complete Schedule 2, you will need several documents:

- Your completed Form 1040

- Documentation of any additional taxes owed, such as records of the alternative minimum tax or other applicable taxes

- Any relevant forms that support the calculations on Schedule 2, such as Form 8862 for the repayment of advance premium tax credits

IRS Guidelines for Completing Schedule 2

The IRS provides specific guidelines for completing Schedule 2. Taxpayers should refer to the official IRS instructions for Schedule 2, which outline the requirements for reporting additional taxes, eligibility criteria, and any necessary calculations. Following these guidelines ensures compliance and minimizes the risk of errors that could lead to penalties.

Examples of Using IRS Form 1040 Schedule 2

There are various scenarios in which taxpayers may need to use Schedule 2. For instance, if you are subject to the alternative minimum tax due to high income, you must report this on Schedule 2. Additionally, if you received advance premium tax credits for health insurance but earned more than anticipated, you may need to repay some of these credits using this form. Each situation requires careful consideration of the applicable taxes and accurate reporting.

Quick guide on how to complete understanding additional taxes with irs form 1040 schedule 2

Effortlessly prepare Understanding Additional Taxes With IRS Form 1040 Schedule 2 on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to locate the right form and securely retain it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Understanding Additional Taxes With IRS Form 1040 Schedule 2 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to modify and electronically sign Understanding Additional Taxes With IRS Form 1040 Schedule 2 without hassle

- Obtain Understanding Additional Taxes With IRS Form 1040 Schedule 2 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark pertinent sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to preserve your modifications.

- Choose your method of delivering your form, by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Understanding Additional Taxes With IRS Form 1040 Schedule 2 and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the understanding additional taxes with irs form 1040 schedule 2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the schedule 2 feature in airSlate SignNow?

The schedule 2 feature in airSlate SignNow allows users to set specific times for document signing and approvals. This scheduling capability enhances workflow efficiency by ensuring that all necessary parties can review and sign documents at their convenience.

-

How does pricing work for the schedule 2 feature?

airSlate SignNow offers flexible pricing plans that include the schedule 2 feature at various tiers. Users can choose a plan that best fits their needs, ensuring they have access to all essential features while staying within their budget.

-

What are the primary benefits of using the schedule 2 feature?

The schedule 2 feature in airSlate SignNow streamlines the signing process and reduces turnaround time. By allowing users to schedule document signings, it helps improve collaboration and ensures that all stakeholders are on the same page.

-

Can I integrate schedule 2 with my existing tools?

Yes, airSlate SignNow offers robust integrations with various third-party applications, making it easy to incorporate the schedule 2 feature into your existing workflow. This interoperability helps maintain a seamless signing and document management experience.

-

Is the schedule 2 feature user-friendly?

Absolutely! The schedule 2 feature is designed with user experience in mind. Its intuitive interface allows users, regardless of technical expertise, to easily schedule and manage their document signing processes.

-

How can schedule 2 help my business improve compliance?

Implementing the schedule 2 feature can greatly enhance compliance by ensuring that all document signing occurs within set timeframes. airSlate SignNow provides tracking and notifications, which help you maintain proper records and adhere to regulatory requirements.

-

What types of businesses benefit most from the schedule 2 feature?

Any business that requires timely approvals and signature verifications can benefit from the schedule 2 feature. This includes industries like real estate, finance, and healthcare, where document timelines are critical for success.

Get more for Understanding Additional Taxes With IRS Form 1040 Schedule 2

Find out other Understanding Additional Taxes With IRS Form 1040 Schedule 2

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed