Form 3260

What is the Form 3260

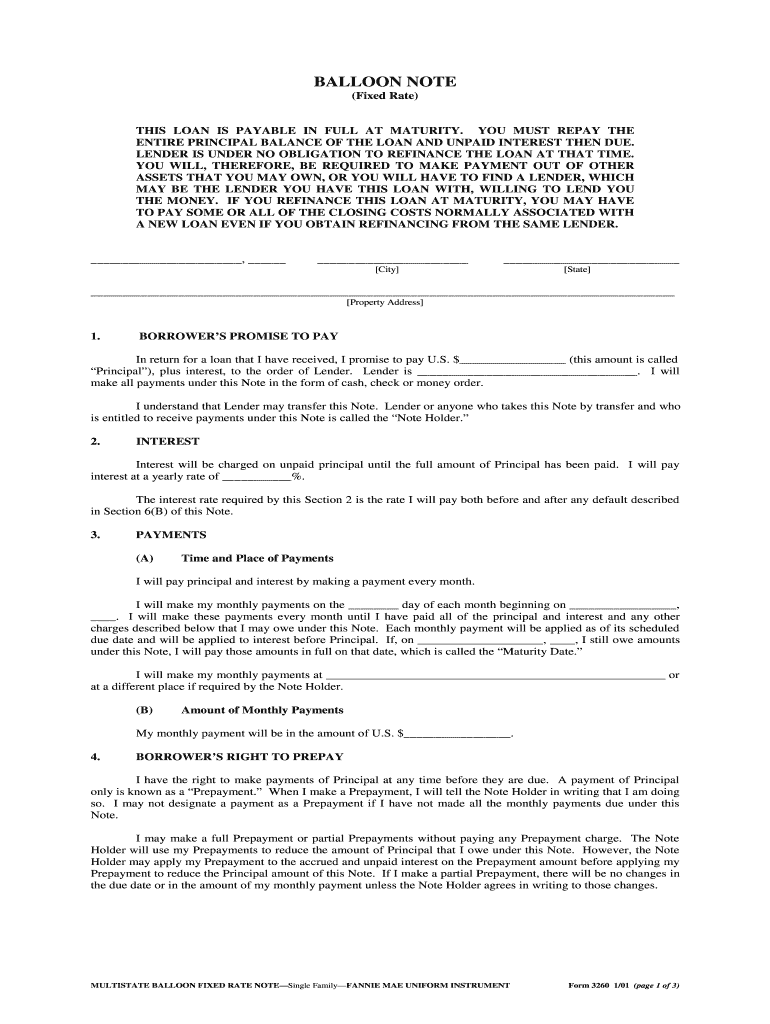

The Form 3260, also known as the Fannie Mae Balloon Mortgage Note, is a legal document used in the United States for securing a loan with a balloon payment structure. This form outlines the terms of the mortgage, including the loan amount, interest rate, payment schedule, and the final balloon payment due at the end of the loan term. It is essential for both lenders and borrowers to understand the implications of this form, as it establishes the legal framework for the mortgage agreement.

Key elements of the Form 3260

The Form 3260 includes several critical components that define the mortgage agreement. These elements typically consist of:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The percentage charged on the borrowed amount.

- Payment Schedule: Details on how often payments are made, such as monthly or quarterly.

- Balloon Payment: The final large payment due at the end of the loan term, which is significantly larger than previous payments.

- Borrower and Lender Information: Names and contact details of both parties involved in the agreement.

Understanding these key elements is crucial for ensuring compliance and making informed decisions about the mortgage.

Steps to complete the Form 3260

Completing the Form 3260 involves several straightforward steps to ensure accuracy and compliance with legal requirements:

- Gather Information: Collect all necessary details, including personal information, loan specifics, and property details.

- Fill Out the Form: Carefully input the gathered information into the form, ensuring all fields are completed accurately.

- Review for Accuracy: Double-check all entries for errors or omissions to avoid complications later.

- Sign the Document: Both the borrower and lender must sign the form to validate the agreement.

- Submit the Form: Follow the appropriate submission method, whether online, by mail, or in person, as required.

By following these steps, users can confidently complete the Form 3260, ensuring that all necessary information is accurately documented.

Legal use of the Form 3260

The Form 3260 is legally binding when executed correctly, meaning it must comply with federal and state laws governing mortgage agreements. To ensure its legal validity, the following conditions must be met:

- Proper Signatures: All parties involved must sign the document, which may include electronic signatures if compliant with eSignature laws.

- Clear Terms: The terms of the mortgage must be clearly stated to avoid ambiguity.

- Compliance with Regulations: The form must adhere to applicable laws, such as the Truth in Lending Act and other relevant regulations.

Understanding these legal requirements helps protect both parties and ensures that the mortgage agreement is enforceable in a court of law.

How to obtain the Form 3260

The Form 3260 can typically be obtained through several channels, ensuring that borrowers and lenders have access to the necessary documentation for their mortgage agreements. Options include:

- Official Fannie Mae Website: Download the form directly from the Fannie Mae website, where it is available in PDF format.

- Financial Institutions: Many banks and mortgage lenders provide copies of the form upon request.

- Legal Professionals: Attorneys specializing in real estate may also provide the form and assist with its completion.

Accessing the Form 3260 through these sources ensures that users have the most current and compliant version available.

Examples of using the Form 3260

The Form 3260 is commonly used in various scenarios involving balloon mortgages. Some typical examples include:

- Home Purchases: When a buyer secures a mortgage to purchase a home with a balloon payment structure.

- Refinancing Existing Mortgages: Borrowers may use the form to refinance an existing mortgage into a new balloon mortgage.

- Investment Properties: Investors may utilize the form when financing rental properties with balloon payments.

These examples illustrate the versatility of the Form 3260 in different real estate transactions, highlighting its importance in the mortgage process.

Quick guide on how to complete form 3260

Complete Form 3260 easily on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can find the correct template and securely store it online. airSlate SignNow provides all the tools you need to generate, modify, and eSign your documents swiftly without hindrances. Handle Form 3260 on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to alter and eSign Form 3260 effortlessly

- Find Form 3260 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 3260 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3260

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a ballon note form?

A ballon note form is a financial document that outlines a loan agreement where the borrower must pay a large final installment at the end of the term. With airSlate SignNow, creating and managing your ballon note form becomes straightforward and efficient, helping you stay organized throughout the loan process.

-

How can I create a ballon note form using airSlate SignNow?

Creating a ballon note form in airSlate SignNow is simple. Just log in to your account, select the option to create a new document, and choose from our customizable templates. You can easily input the necessary details and send the form for eSignature within minutes.

-

What features does airSlate SignNow offer for managing ballon note forms?

airSlate SignNow provides several features designed for ballon note forms, including customizable templates, secure eSignature options, and real-time document tracking. Additionally, you can set reminders for important due dates and ensure all parties are notified promptly.

-

Are there any costs associated with using airSlate SignNow for balloon note forms?

airSlate SignNow offers various pricing plans to suit different business needs. Our plans are cost-effective, and you can use a free trial to explore all features related to creating and managing your ballon note forms. Choose a plan that best aligns with your volume and functionality requirements.

-

Can I integrate airSlate SignNow with other tools for my ballon note forms?

Yes, airSlate SignNow seamlessly integrates with various platforms, including CRM systems, document management tools, and cloud storage services. This allows you to enhance your workflow and efficiently manage your ballon note forms alongside other business processes.

-

What are the benefits of using airSlate SignNow for creating ballon note forms?

Using airSlate SignNow for your ballon note forms offers numerous benefits, including increased efficiency, reduced paperwork, and a secure method for obtaining signatures. Furthermore, our platform facilitates faster transaction times, helping you close deals more promptly.

-

Is it safe to use airSlate SignNow for my ballon note forms?

Absolutely. airSlate SignNow prioritizes the security of your documents, including ballon note forms, by employing encryption and other advanced security measures. You can trust that your sensitive information is protected at all times while using our service.

Get more for Form 3260

Find out other Form 3260

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease