Form 14039 Rev 9

What is the Form 14039 Rev 9

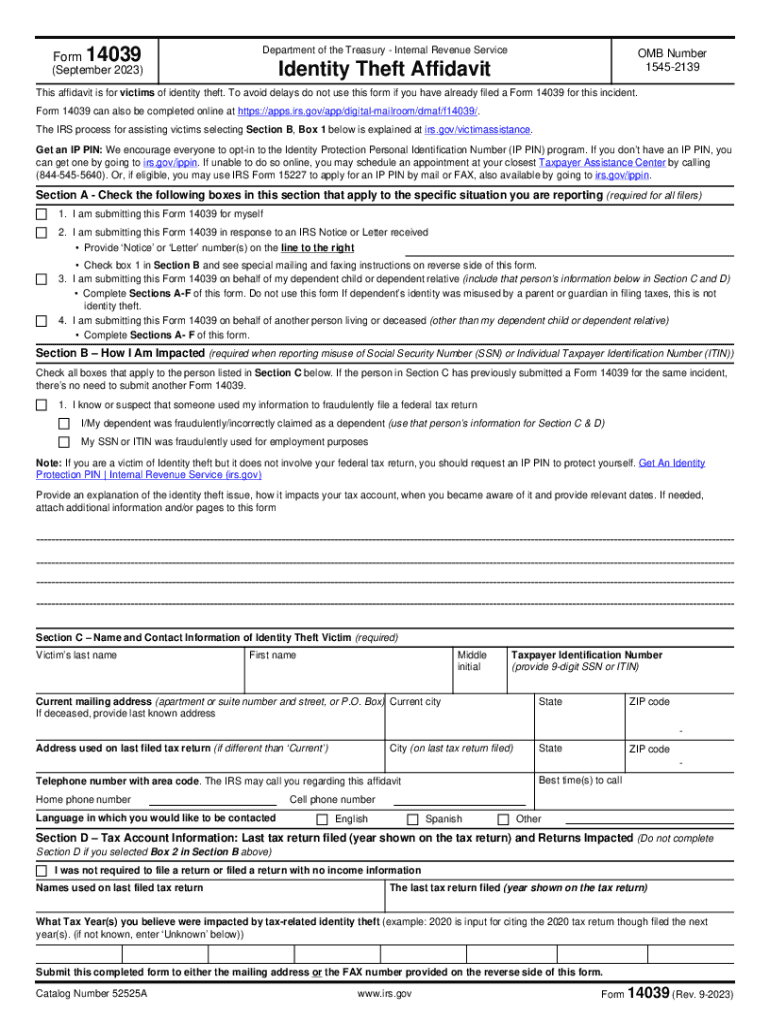

The Form 14039 Rev 9, also known as the Identity Theft Affidavit, is a document used by individuals who believe they have been victims of identity theft. This form is essential for reporting the misuse of personal information, particularly in relation to tax-related fraud. By submitting this affidavit, individuals can alert the IRS about the fraudulent use of their Social Security number and take steps to protect their financial identity.

How to use the Form 14039 Rev 9

To effectively use the Form 14039 Rev 9, individuals must complete the affidavit accurately. This involves providing personal details, including name, address, and Social Security number, as well as a description of the identity theft incident. Once completed, the form should be submitted to the IRS, either electronically or by mail, depending on the specific instructions provided by the IRS for reporting identity theft cases.

Steps to complete the Form 14039 Rev 9

Completing the Form 14039 Rev 9 involves several key steps:

- Gather necessary personal information, including your Social Security number and any relevant documentation regarding the identity theft.

- Fill out the form by providing accurate details about yourself and the nature of the identity theft.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS, following the specified submission methods outlined in the IRS guidelines.

Legal use of the Form 14039 Rev 9

The Form 14039 Rev 9 serves a legal purpose in protecting individuals from the repercussions of identity theft. By filing this affidavit, victims can establish a formal record of the identity theft incident, which may be necessary for legal proceedings or when dealing with creditors. It is crucial to ensure that the information provided is truthful and accurate to avoid potential legal complications.

Filing Deadlines / Important Dates

While there are no specific deadlines for submitting the Form 14039 Rev 9, it is advisable to file the affidavit as soon as identity theft is suspected. Prompt reporting can help mitigate further fraudulent activity and assist the IRS in addressing the issue more effectively. Keeping track of any correspondence from the IRS regarding the affidavit is also important for future reference.

Form Submission Methods (Online / Mail / In-Person)

The Form 14039 Rev 9 can be submitted to the IRS through various methods. Individuals have the option to file the form online using the IRS website or by mailing a completed paper form to the appropriate IRS address. In-person submissions are generally not recommended for this form, but individuals can seek assistance at local IRS offices if needed. Always refer to the IRS guidelines for the most current submission methods.

Quick guide on how to complete form 14039 rev 9

Effortlessly Prepare Form 14039 Rev 9 on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing for easy access to the necessary forms and secure online storage. airSlate SignNow equips you with all the tools required to swiftly create, modify, and electronically sign your documents without any delays. Manage Form 14039 Rev 9 on any device using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to Modify and Electronically Sign Form 14039 Rev 9 with Ease

- Locate Form 14039 Rev 9 and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to share your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 14039 Rev 9 to guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 14039 rev 9

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 14039?

IRS Form 14039 is a report used by taxpayers to alert the IRS about identity theft related to tax fraud. By using IRS Form 14039, affected individuals can report the situation and ensure that their identity is protected. This form is crucial for establishing that tax returns filed in your name may not have been initiated by you.

-

How can airSlate SignNow help with IRS Form 14039?

airSlate SignNow allows users to easily create, send, and eSign IRS Form 14039 quickly and securely. Our platform ensures that all documents are safely handled, which is especially important when dealing with sensitive information like identity theft. With airSlate SignNow, you can take control of your paperwork related to IRS Form 14039.

-

Is there a cost associated with using airSlate SignNow for IRS Form 14039?

Yes, there are pricing plans available for using airSlate SignNow, which are designed to be cost-effective for businesses. Our plans offer various features, including enhanced security for sensitive documents like IRS Form 14039. You can choose the plan that best fits your needs and budget.

-

What features are included in airSlate SignNow for IRS Form 14039?

airSlate SignNow includes features such as document templates, secure eSigning, workflow automation, and tracking capabilities, all essential for managing IRS Form 14039. With these tools, you can streamline the process of reporting identity theft and ensure all steps are completed efficiently. Plus, our platform is user-friendly, making it easy for anyone to navigate.

-

Can I integrate airSlate SignNow with other applications for IRS Form 14039?

Yes, airSlate SignNow offers integration with various applications and systems, allowing you to manage your IRS Form 14039 seamlessly. You can integrate with tools like CRM systems, cloud storage, and productivity applications, enhancing your workflow and efficiency. This flexibility ensures that you can use airSlate SignNow in conjunction with your existing systems.

-

What benefits does airSlate SignNow provide for handling IRS Form 14039?

The primary benefits of using airSlate SignNow for IRS Form 14039 include improved security for your documents, ease of use, and faster processing times. Our platform's secure eSigning feature helps safeguard your sensitive information, while our user-friendly interface allows anyone to complete forms quickly. This ultimately saves time and reduces stress when dealing with IRS-related documents.

-

How do I start using airSlate SignNow for IRS Form 14039?

Getting started with airSlate SignNow for IRS Form 14039 is simple. You can sign up for an account on our website and choose a plan that suits your needs. Once your account is set up, you can access our document templates and begin the process of eSigning your IRS Form 14039.

Get more for Form 14039 Rev 9

Find out other Form 14039 Rev 9

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online