5870A Form California Franchise Tax Board Yumpu

Understanding California Form 541

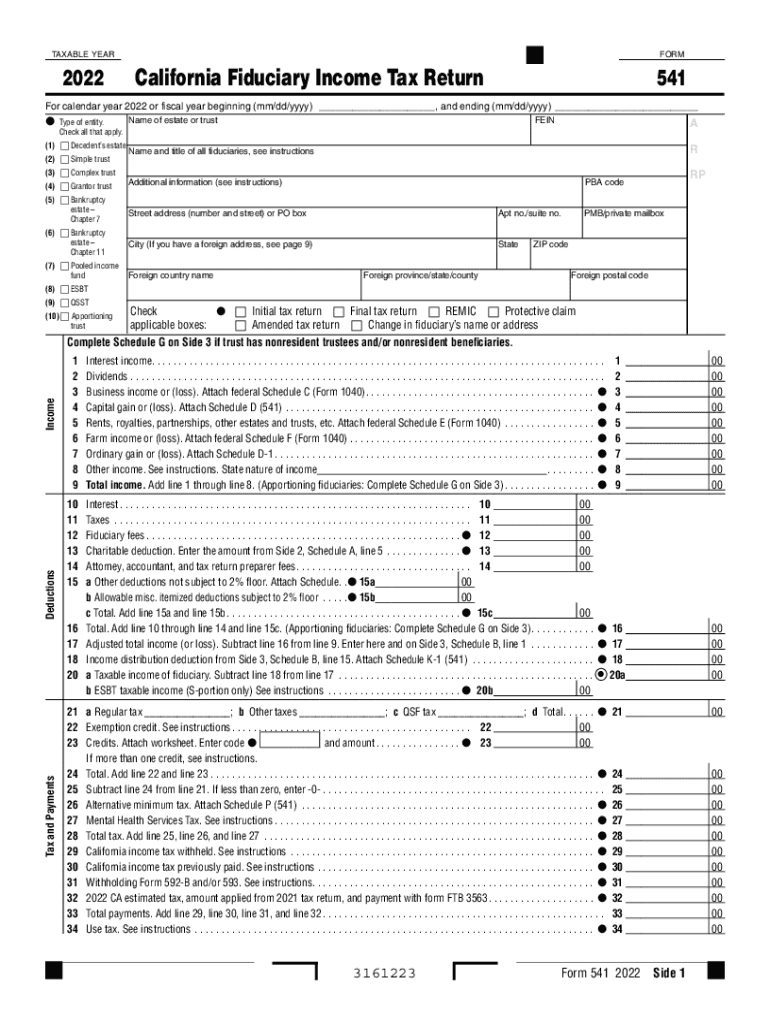

California Form 541 is the state's fiduciary income tax return, specifically designed for estates and trusts. This form is essential for reporting income, deductions, and credits for these entities. The California Franchise Tax Board (FTB) requires the completion of Form 541 to ensure compliance with state tax laws. It is important for fiduciaries to accurately report all income generated by the estate or trust to avoid penalties and ensure proper tax treatment.

Steps to Complete California Form 541

Completing California Form 541 involves several key steps:

- Gather necessary documentation, including income statements, deduction records, and any previous tax returns related to the estate or trust.

- Begin filling out the form by entering basic information about the estate or trust, including its name, address, and federal employer identification number (EIN).

- Report all sources of income, such as interest, dividends, and capital gains, in the appropriate sections of the form.

- Detail any deductions that may apply, including administrative expenses, distributions to beneficiaries, and other allowable deductions.

- Calculate the total tax liability based on the reported income and applicable tax rates.

- Review the completed form for accuracy before submitting it to the FTB.

Filing Deadlines for California Form 541

Filing deadlines for California Form 541 are crucial for compliance. Typically, the form is due on the 15th day of the fourth month following the close of the tax year. For most estates and trusts that operate on a calendar year, this means the form is due by April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is advisable to file on time to avoid penalties and interest on any unpaid taxes.

Required Documents for Filing Form 541

Before filing California Form 541, ensure that you have the following documents ready:

- Income statements, including Forms 1099 and K-1, that report income received by the estate or trust.

- Records of any deductions claimed, such as receipts for expenses related to the administration of the estate or trust.

- Prior year tax returns, if applicable, to provide context for the current filing.

- Any relevant documentation regarding distributions made to beneficiaries during the tax year.

Who Must File California Form 541

California Form 541 must be filed by fiduciaries of estates and trusts that have taxable income. This includes any estate or trust that has gross income of more than $1,000 during the tax year. Additionally, if the estate or trust has any beneficiaries who are California residents, the form must be filed regardless of the income amount. Understanding these requirements is essential for compliance and to avoid potential penalties.

Penalties for Non-Compliance with Form 541

Failure to file California Form 541 on time can result in significant penalties. The FTB imposes a late filing penalty, which is typically five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. Additionally, interest accrues on any unpaid taxes from the original due date until payment is made. It is important to adhere to filing deadlines and ensure all information is accurate to mitigate these risks.

Quick guide on how to complete 5870a form california franchise tax board yumpu

Effortlessly Complete 5870A Form California Franchise Tax Board Yumpu on Any Device

Managing documents online has gained traction among organizations and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed forms, since you can locate the appropriate document and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents quickly without delays. Manage 5870A Form California Franchise Tax Board Yumpu on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to Modify and Electronically Sign 5870A Form California Franchise Tax Board Yumpu with Ease

- Locate 5870A Form California Franchise Tax Board Yumpu and then click Get Form to begin.

- Utilize the provided tools to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose your preferred method of delivering your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate reprinting new copies. airSlate SignNow effortlessly addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 5870A Form California Franchise Tax Board Yumpu to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 5870a form california franchise tax board yumpu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the CA Form 541 instructions for filing?

The CA Form 541 instructions provide detailed guidance on how to complete and submit the California Partnership Return of Income. It includes essential steps for reporting income, deductions, and credits. By following the CA Form 541 instructions accurately, you can ensure compliance and avoid penalties.

-

How can airSlate SignNow assist with CA Form 541 instructions?

airSlate SignNow simplifies the process of filling out your CA Form 541 instructions by allowing you to digitally sign and send documents quickly and securely. Our easy-to-use interface helps you manage your tax documents efficiently. With airSlate SignNow, you can streamline your workflow while ensuring compliance with CA Form 541 instructions.

-

What pricing plans does airSlate SignNow offer for businesses?

airSlate SignNow provides several pricing plans tailored to fit various business needs, starting from a basic plan to more advanced options. Each plan includes features that help streamline document processes, helping you manage your CA Form 541 instructions effortlessly. You can choose a plan that suits your volume of eSigning and document management.

-

Are there any features specific to handling tax documents like CA Form 541?

Yes, airSlate SignNow includes features like customizable templates and audit trails that are especially useful for managing tax documents such as the CA Form 541 instructions. These features enhance your efficiency and help ensure all necessary compliance measures are met. Additionally, you can store and organize your documents securely.

-

Can I integrate airSlate SignNow with other software tools?

Absolutely! airSlate SignNow offers seamless integration capabilities with various software tools, including popular accounting and tax preparation applications. Integrating with these tools allows you to easily access and apply your CA Form 541 instructions within your existing workflows, making the process more efficient.

-

Is airSlate SignNow suitable for individuals as well as businesses?

Yes, airSlate SignNow is designed to serve both individuals and businesses effectively. Whether you need to manage personal tax documents or business-related forms, our platform helps you navigate CA Form 541 instructions with ease. Our flexible solutions cater to users at all levels, ensuring everyone can use the service to its full potential.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow prioritizes the security of your documents by employing advanced encryption and rigorous compliance standards. This ensures that all your sensitive information, including data related to your CA Form 541 instructions, is protected. Our platform adheres to industry best practices to keep your documents safe from unauthorized access.

Get more for 5870A Form California Franchise Tax Board Yumpu

Find out other 5870A Form California Franchise Tax Board Yumpu

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile